USD/CHF Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be made before 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of the supportive trend line currently sitting at around 0.9855.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry after bullish price action on the H1 time frame following a touch of 0.9800.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0000.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

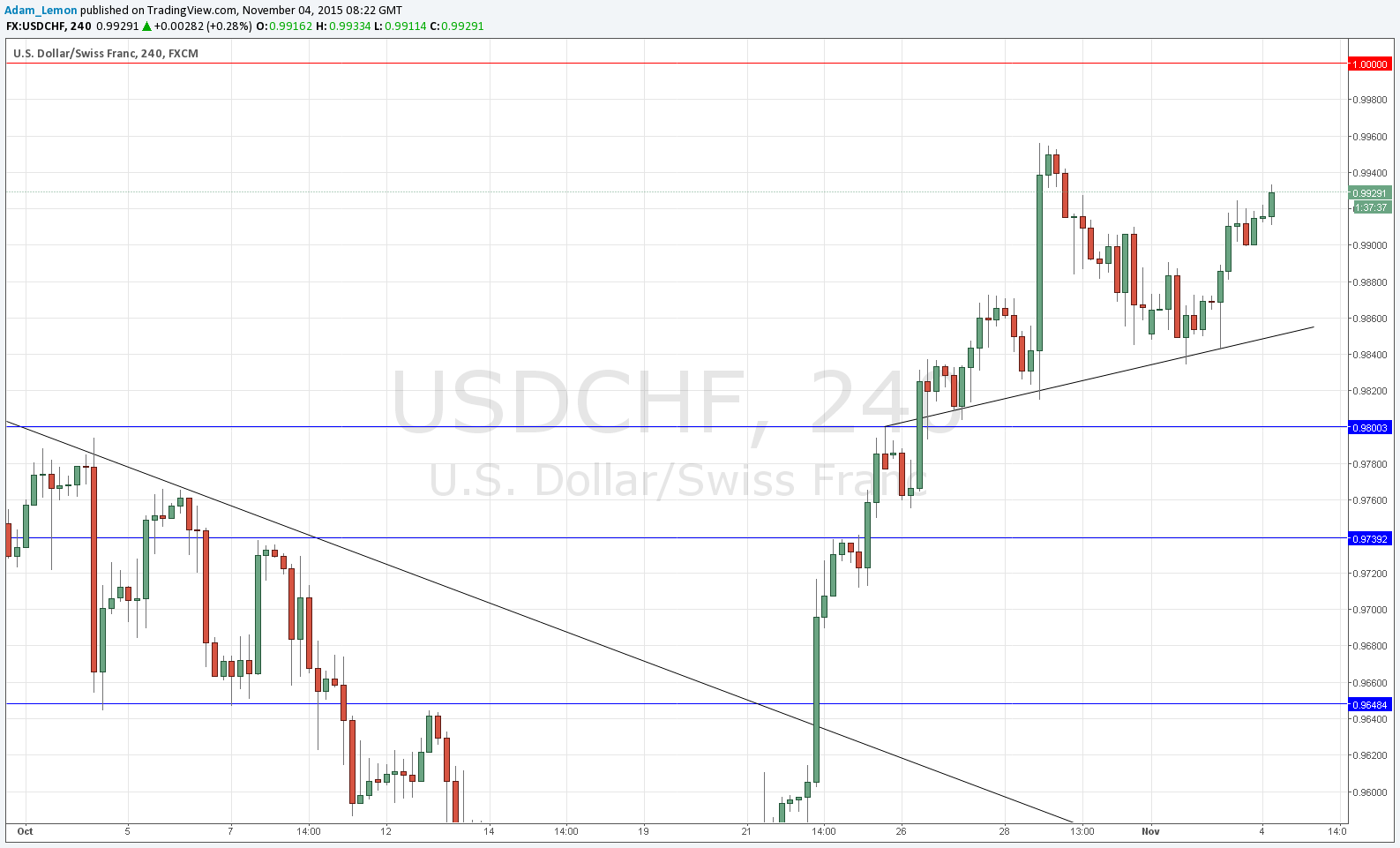

USD/CHF Analysis

I wrote yesterday that a breakout from this triangle might well be indicative of the next major move. This was exactly what happened as the lower trend line of that short-term consolidating triangle was used as a Launchpad for the push upwards that we got yesterday. The CHF is the weakest currency overall and as the USD has been gaining some strength lately this pair is becoming a market favourite to trade long. Obvious additional long entries are located at the supportive trend line and at the round number of 0.9800 below that.

Above, watch out for a possible double top at around 0.9950 and strong resistance at 1.0000.

There is nothing regarding the CHF. Concerning the USD, there will be a release of the ADP Non-Farm Employment Change Number at 1:15pm, followed by Trade Balance data at 1:30pm and then finally ISM Non-Manufacturing PMI and Fed Chair testimony at 3pm.