USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today.

Long Trade 1

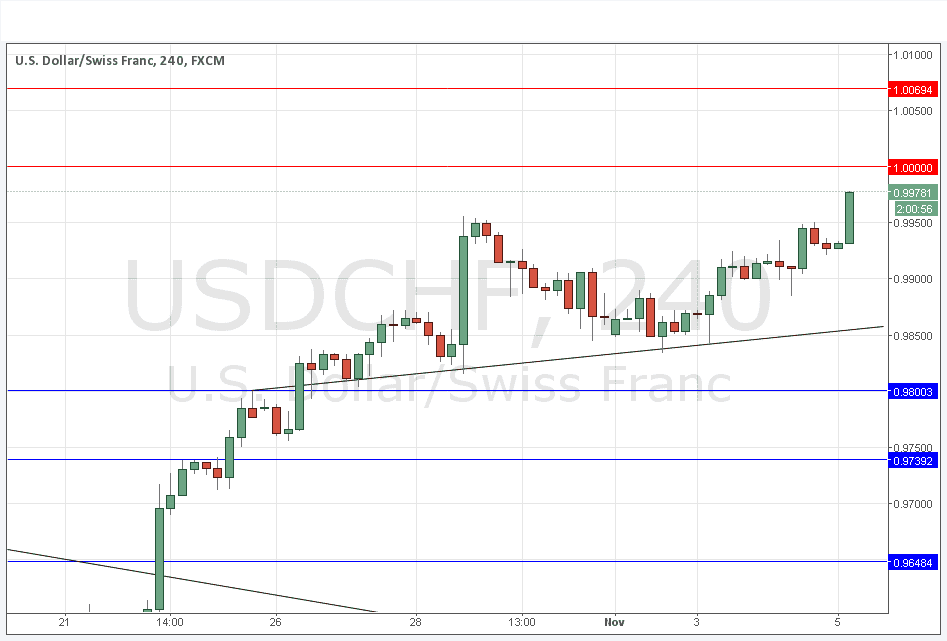

Go long after bullish price action on the H1 time frame following a touch of the supportive trend line currently sitting at around 0.9855.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long after bullish price action on the H1 time frame following a touch of 0.9800.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0000.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The technical picture remains the same as this pair remains strongly bullish and looks even more so now the Federal Reserve is signalling that the first rate rise in many years is probably going to happen in December.

The price continues to make new multi-month highs.

There may be strong resistance above at the key psychological level of 1.0000. There is a key previous high above that at 1.070.

There is nothing regarding the CHF. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.