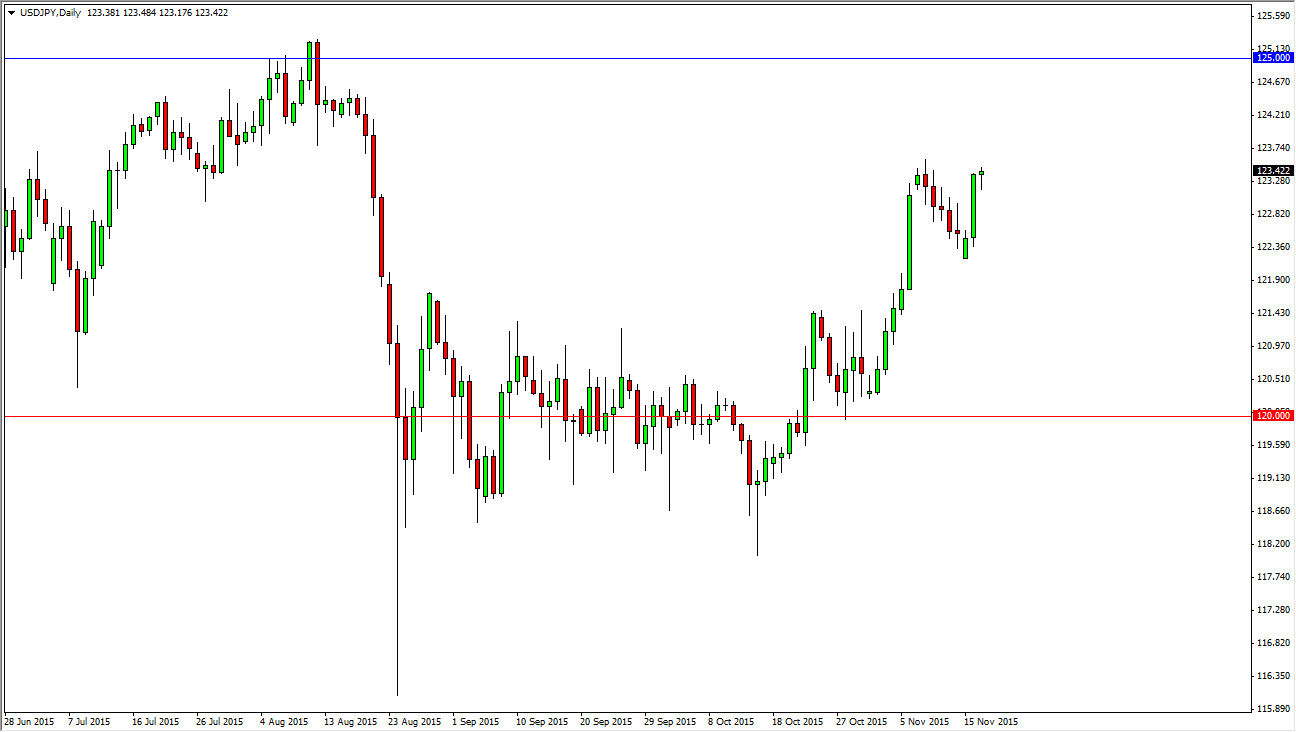

The USD/JPY pair initially fell during the day on Tuesday, but found enough support near the 123 handle the turn things around and form a nice-looking hammer. I think this shows that the market has proclivity to go higher, and with the Bank of Japan releasing its Monetary Policy Statement today, it’s very likely that we will get a catalyst to continue in one direction or the other. Beyond that, we also have the FOMC Meeting Minutes coming out of America, so we essentially have news coming from both sides of the equation today. If there’s ever been a day that should send this market scrambling, it’ll be today.

Keep in mind that we have recently seen a stronger than anticipated jobs number, and that of course is very bullish for America. It means that the Federal Reserve will more than likely have to raise interest rates fairly soon, and with that it’s likely that the value of the US dollar will increase against most currencies around the world, especially in the case of the Japanese yen, as the Bank of Japan is light years away from being able to raise interest rates.

Buying Dips

Quite frankly, I hope that the Bank of Japan spooks the market enough to make a massive knee-jerk reaction to the downside. I believe at that point in time core has will prevail and we will see buyers step back in and pick up this market. It will be a value play as far as I can see, as the greenback continues to strengthen overall.

At that point time, I would anticipate a move to the 125 level, as it was previously resistive. It may take several attempts to get above there, but eventually we will. Once we do, it will continue to be a “buy on the dips” type of situation. Longer-term, I anticipate this market will make a move towards the 130 handle.