USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.50%

Trades must be made from 8am New York time to 5pm Tokyo time only.

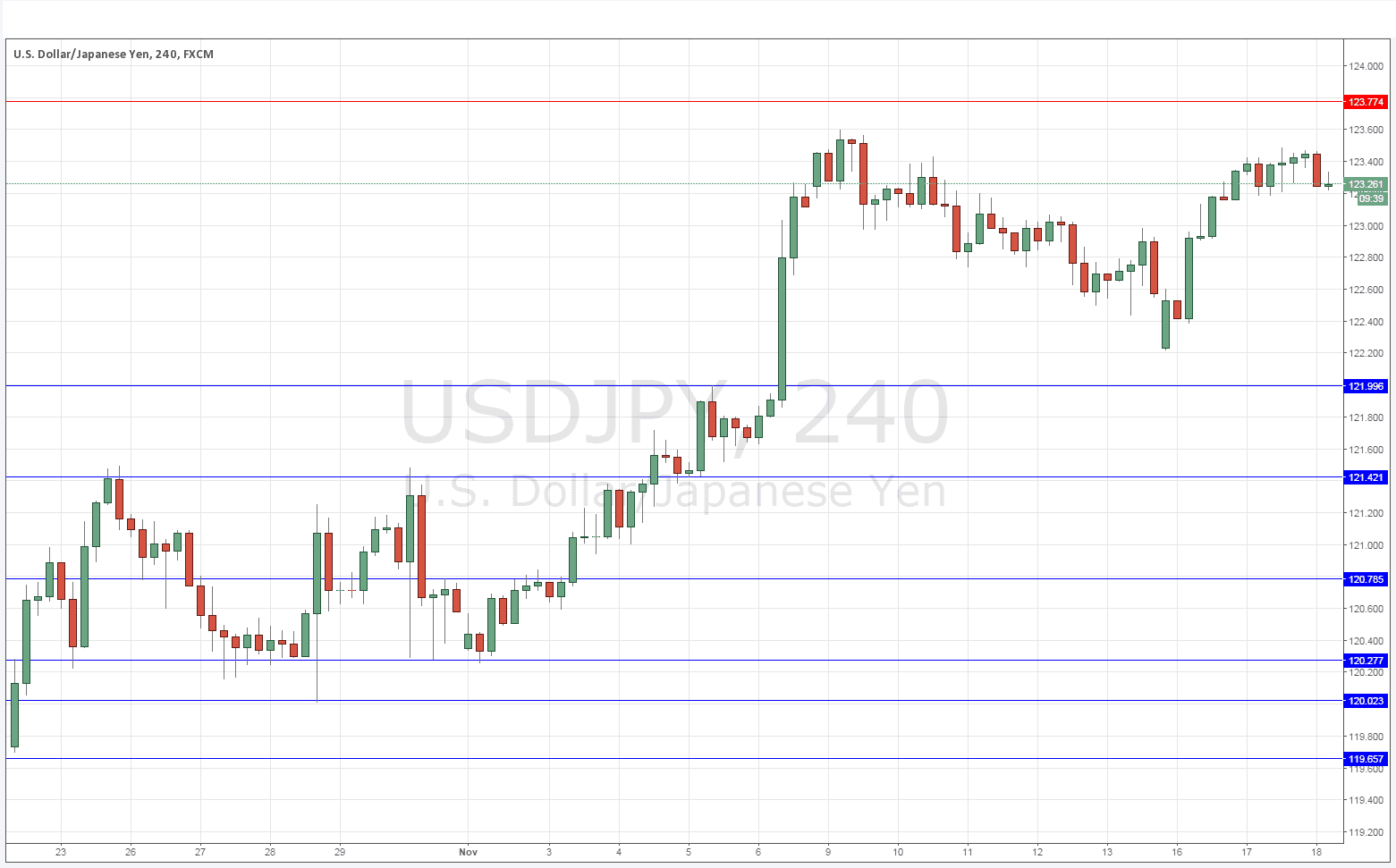

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 122.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.42.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 123.77.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 125.00.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair continues to go nowhere, avoiding major levels and ranging quietly, albeit within an overall bullish context. If the FOMC news is poor later, along with GBP/USD it might be the best pair to use to short the USD.

Concerning the USD, there will be a release of Building Permits data at 1:30pm London time, followed by the FOMC Meeting Minutes at 7pm. Regarding the JPY, there will be a release of the Bank of Japan’s Monetary Policy Statement after Tokyo opens.