USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.50%

Trades must be entered between 8am and 5pm New York time only, and then after 8am Tokyo time later.

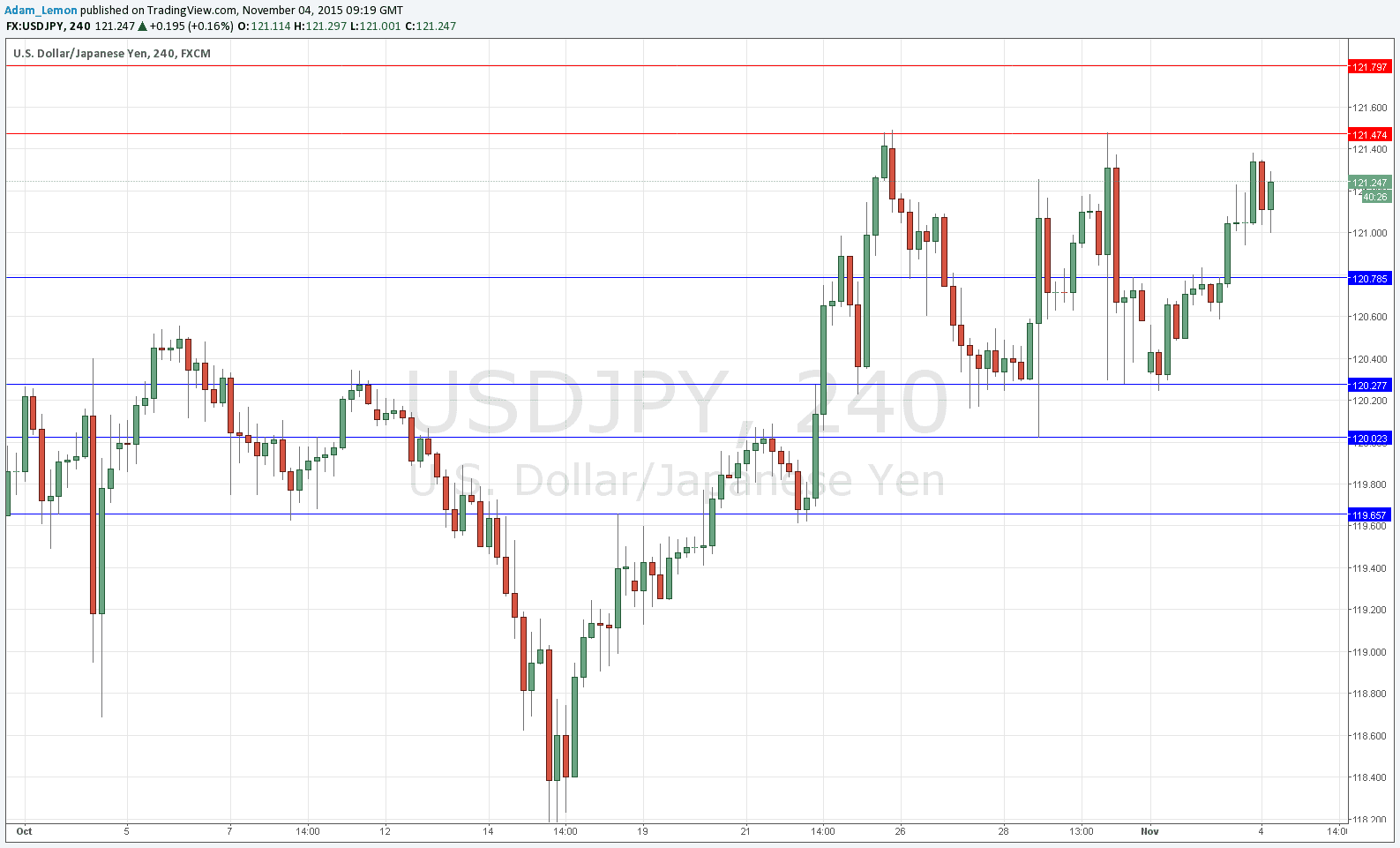

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 120.79.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 120.28 and 120.08.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.47.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.79.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I forecast yesterday that “we now seem to be stuck between 120.28 and 121.47 and probably will remain there until we get more dramatic US economic news at some stage over the next few days.” This is exactly what is happening. There is no meaningful change to the technical picture since yesterday, although there seems to be some minor resistance developing at around 120.80. A strong break past there might see a move up to 121.25 or thereabouts, but as it is a public holiday in Japan and there is no major USD news scheduled, it is probably going to be another quiet day. My directional bias is slightly bullish.

There is nothing regarding the JPY. Concerning the USD, there will be a release of the ADP Non-Farm Employment Change Number at 1:15pm, followed by Trade Balance data at 1:30pm and then finally ISM Non-Manufacturing PMI and Fed Chair testimony at 3pm.