USD/JPY Signal Update

Last Thursday’s signals expired without being triggered as there was no bearish price action at 121.79.

Today’s USD/JPY Signals

Risk 0.50%

Trades must be entered between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

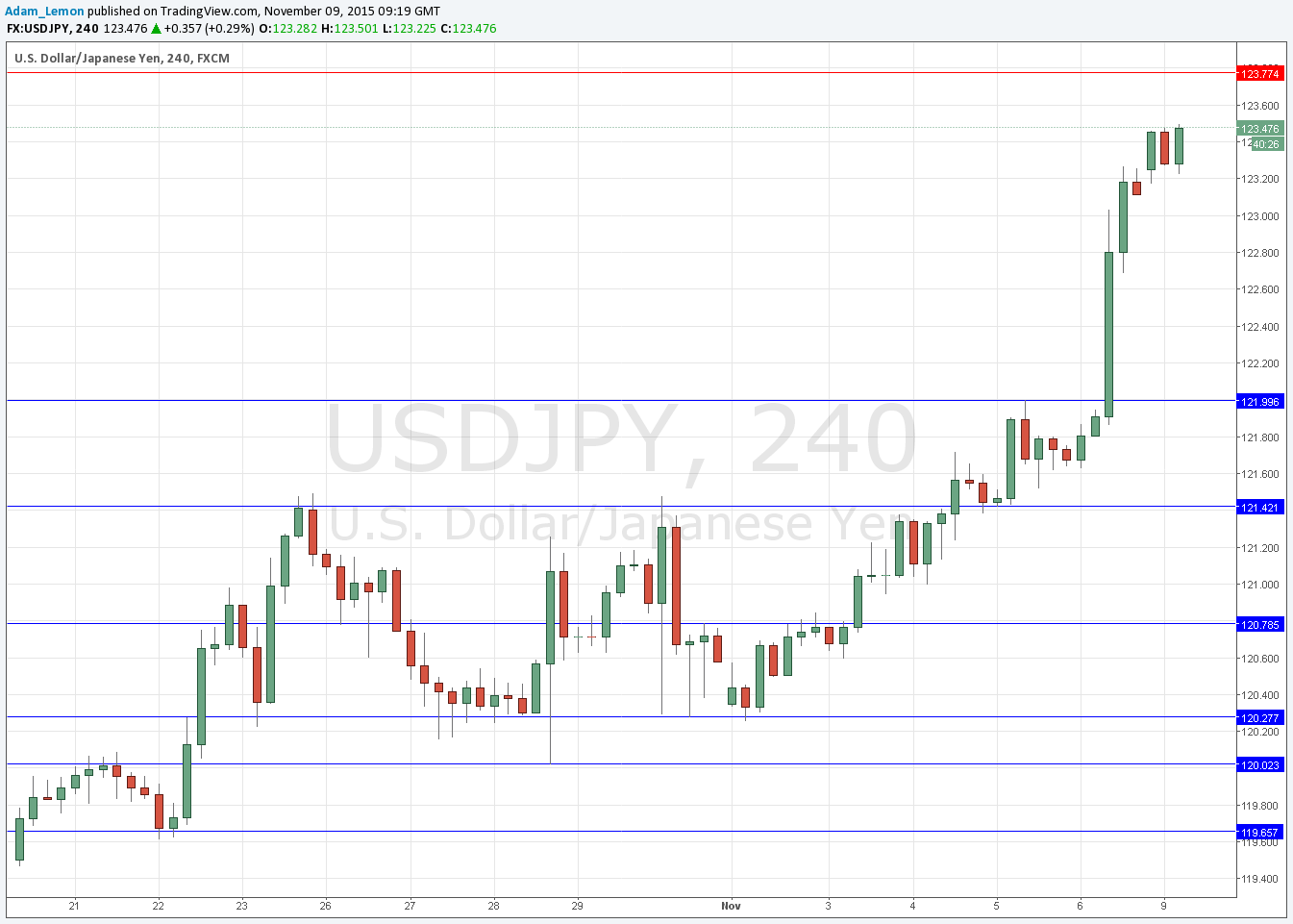

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 122.00.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 123.77.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The USD’s move up against the JPY around the NFP release was powerful and, more significantly, has continued to make new highs since this week opened this morning in the Far East. As I write, the price continues to make new highs and is now beginning to threaten the resistant level at 123.77.

Similarly to EUR/USD, the fundamental, sentimental and technical outlook for this pair looks very bullish. However it is worth pointing out that there are still fairly recent highs not far above that are somewhat likely to cause the upwards move to pause and pull back.

There is nothing due today regarding either the JPY or the USD.