By: DailForex.com

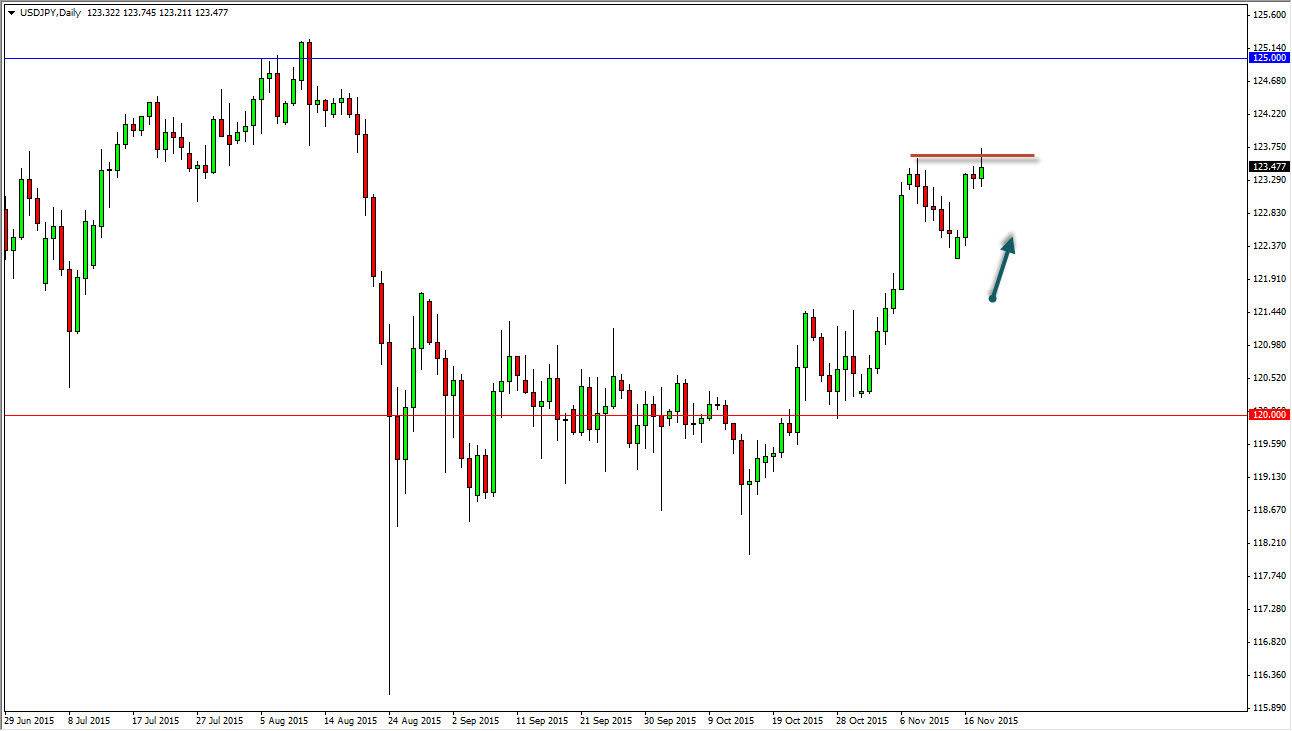

The USD/JPY pair tried to break above the 124 handle during the day on Wednesday, but struggled and ended up turning back around to form a bit of a shooting star. Ultimately though, I do feel that this market goes higher and that this simply represents the struggle ahead. I believe that there is a lot of noise between here and the 125 handle, but I also believe that we break above that aforementioned 125 handle before it’s all said and done. There are a lot of different reasons for this, not the least of which can be summed up in one word: jobs.

The US employment picture is looking better and better recently, with the most recent announcement being one of the strongest that we have seen for some time. With this, I believe that the Federal Reserve will have to raise interest rates sooner rather than later, and most certainly before the Bank of Japan well. In fact, it’s very likely that the Bank of Japan will have to perhaps continue with stimulus, and that should continue to drive the direction of this pair higher as the interest-rate differential widens between the two bond markets.

Buying Dips

I believe that buying dips and pullbacks will be the way to go forward in this market. We should ultimately reach towards the 125 level, but it might be a bit volatile between here and there. Once we get above that level though, I feel it becomes more or less a “buy-and-hold” situation going forward, and that we should reach towards the 130 level although I do not think we will get their between now and the end of the year. Regardless, this becomes a longer-term trade, and I think a lot of people will continue to add to existing positions every time we pullback and show signs of support. One thing that’s great about this particular pair, it does tend to trend for years at a time.