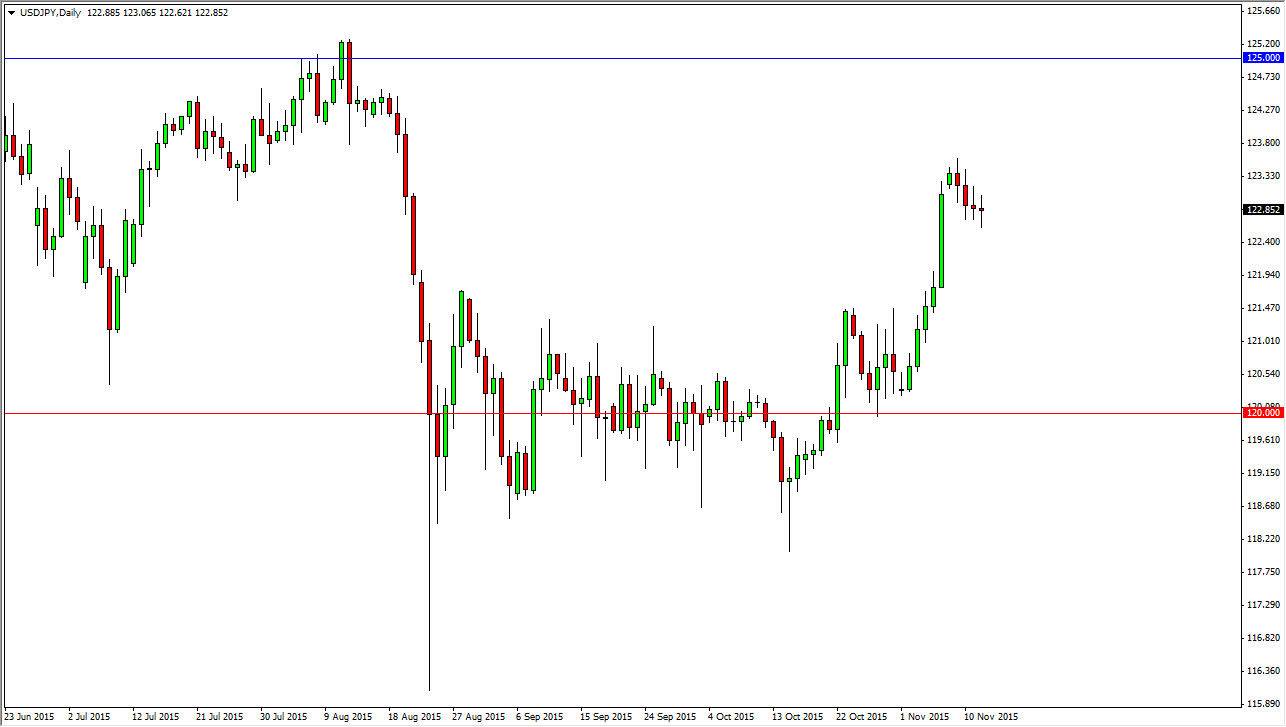

The USD/JPY pair went back and forth during the course of the day on Thursday, as we continue to bounce just below the 123 handle. Ultimately, the market should find plenty of support just below, as we recently broke out of significant consolidation. The massive rectangle being broken to the upside due to the jobs number of course is something that the market will be very cognizant of right now, so I believe that there will be more than enough support below to turn this market back around at the 122 handle.

With this, I’m simply waiting for a little bit of a pullback and signs of support in order to start buying, and as a result I am more than willing to sit on the sidelines at the moment considering that the market really seems to be trying to find its footing.

Interest-rate differential

With the stronger than anticipated jobs number coming out and forcing this market out of the recent consolidation, it would make sense if the interest-rate differential between the 10 year notes of each country continues to expand. Because of this, we should see more and more money flow into the United States, and then eventually push this pair towards the 125 handle. The 125 level of course is fairly significant from a large, round, psychologically significant aspect, and of course the fact that it had been so resistive previously. I believe that we will test this area several times before we can break out, so this is more or less a “buy on the dips” type situation that we see in this market at the moment.

Selling isn’t even a thought. In fact, it is and until we break down below the bottom of the rectangle that we had been in until I would consider selling and that is all the way down at the 118.50 handle. That doesn’t seem very likely, therefore we should continue to be bullish.