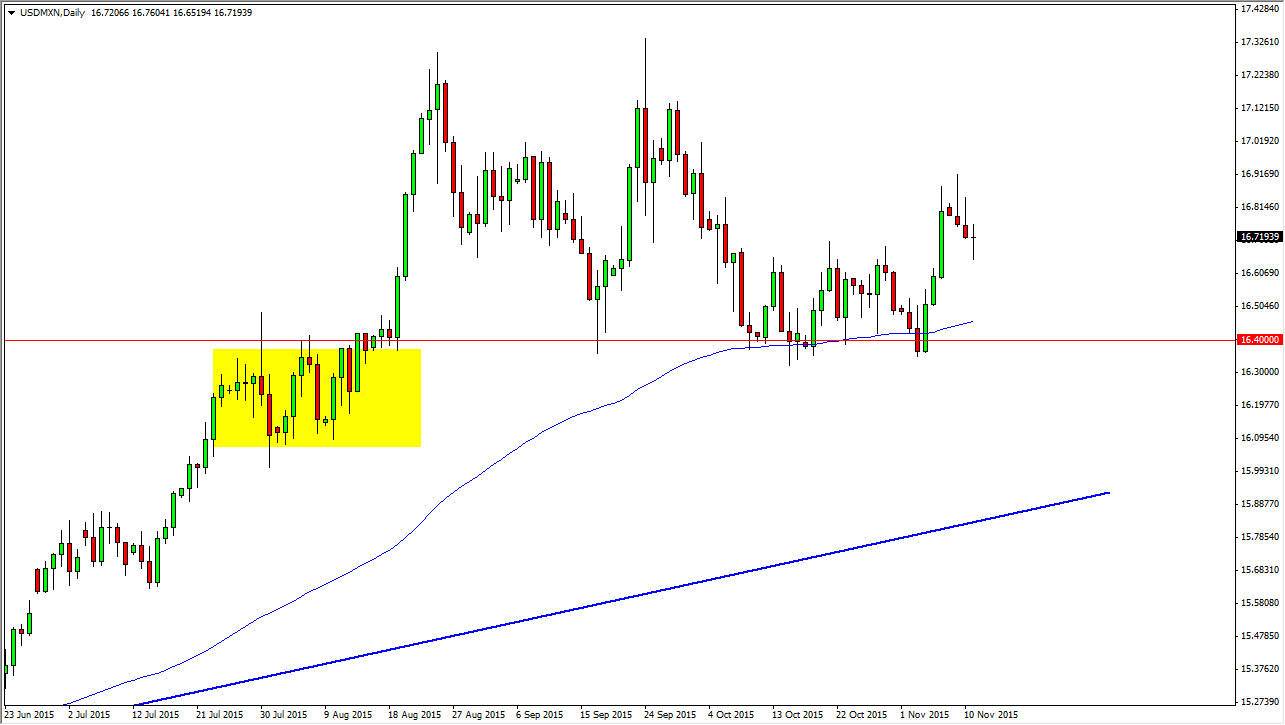

The USD/MXN pair fell initially during the course of the day on Wednesday, but turned back around near the 16.72 handle. This is a market that has recently broken above consolidation, and now that we have pulled back and tested this area, we ended up showing signs of buying pressure again. Looking at the chart, we have the 100 day exponential moving average just below the previous support barrier, which I have marked out the 16.40 level.

The Mexican peso is not a currency that a lot of you trade, but quite frankly you should. While the spread is kind of high, the pip value is very small. With that being the case, you just simply have to adjust your line of thinking. The Mexican peso is a currency that you should trade for longer-term moves. I believe that we are about to see one, as the US dollar should run back to the 17.15 level next.

Crude oil

Keep in mind that the Mexican peso is highly correlated to the price of crude oil, as there are a multitude of oil rigs in the Gulf of Mexico owned by Mexican companies. In that sense, the Mexican peso is very much like the Canadian dollar and the Norwegian krone, in the sense that currency traders tend to use it as a way to play the oil markets. However, you have to keep in mind that the Mexican peso is also the most heavily traded currency in Latin America, and therefore it is used as a proxy for that part of the world as well.

In a world that sees quite a bit of economic uncertainty, it makes sense that Mexico would be less desirable than the United States. After all, the Mexican economy is most certainly one that people look at as an emerging market, so therefore we need to have a significant amount of risk appetite in order to start shorting this market. Technically and fundamentally speaking, this is a market that looks like it’s ready to go higher.