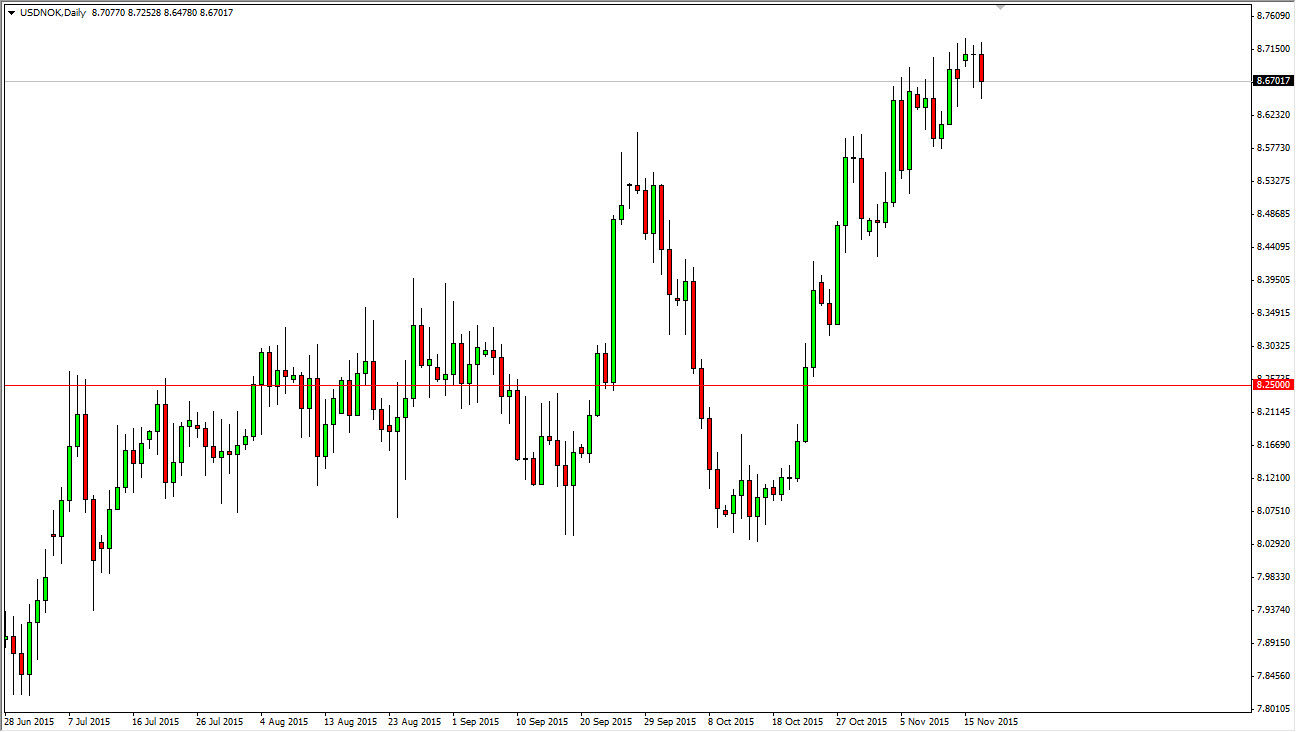

The USD/NOK pair fell a bit during the course of the session on Tuesday as we continue to struggle near the 8.71500 level. However, I believe that eventually this market will continue to go higher based upon what we are seeing in the crude oil markets. Remember, the Norwegian krone is highly leveraged to the oil markets as Norway exports quite a bit of oil out of the North Sea.

This market tends to be a bit of a proxy for the oil markets, and goes higher every time oil falls. On top of that, we have the US dollar which is highly sensitive to risk aversion, which is exactly what the markets are experiencing at the moment. I think that a supportive candle below would be an opportunity to go long on a market that is without a doubt very bullish to begin with over the longer term.

Looking for Support

I believe that there is more than enough support below, extending all the way down to the 8.55000 level. Any supportive candle between here and there should be a buying opportunity as far as I can see, and I have no interest in buying the Norwegian krone as the oil markets simply do not dictate that being possible. Unless of course the Norwegian central bank decides to suddenly raise interest rates, I believe that this market will still be based upon what we are seeing in the Brent market. At this moment, Brent is making new lows, and that of course should continue to put pressure on the Krone.

Ultimately, I believe that this market is trying to reach towards the 8.80000 level, although it could take a bit of time as this pair tends to be rather choppy. Do not be discouraged by the wide spread that you see in this pair, because the pip value is in anywhere near as strong as it is another currency markets.