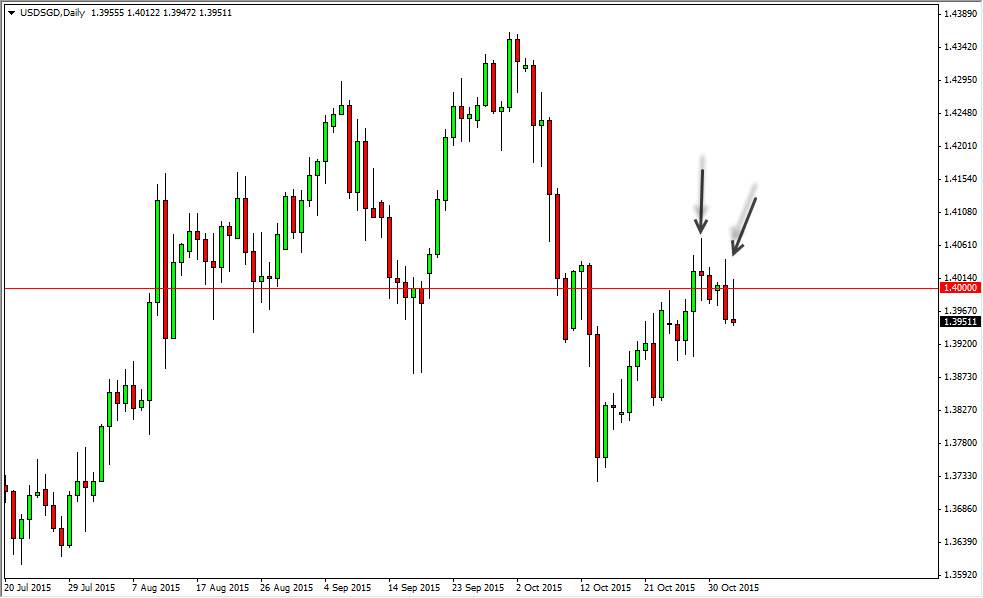

The USD/SGD pair initially tried to rally during the course of the session on Tuesday, testing the 1.40 level. However, the area just above caused enough resistance above to push the market lower, and as a result ended up forming a shooting star. The shooting star of course is a very negative sign and I feel that now we will see this market break down. If we get below the bottom of the range for the session on Tuesday, I anticipate that this market will probably grind its way back down to the 1.3750 level.

On top of the resistive candle for the session on Tuesday, you can also see that there was a candle several sessions ago that ended up forming a neutral candle that looks a bit like a shooting star. We have rolled over since then, and as a result I feel as if the buyers are starting to run out of momentum. When you look at this chart, you can see that we fell apart and then bounced to the next significant resistance barrier in the form of the 1.40 region. Because of this, the market looks as if it is ready to continue what we’ve seen for some time.

Asian safety

The Singapore dollar suggests that money is trying to flow into Asia in order to be invested, because as many of you who follow me know that I look at Singapore as the financier of the Asian construction. It’s a great way to play growth in places such as Indonesia and Southeast Asia, as the banks in Singapore quite often are involved.

Having said that, it is also a safety play in Asia as well. However, at this point in time I think it’s only a matter of time before the Singapore dollar strengthens only because it has been sold off so drastically and then we had the massive selloff at the beginning of the month. That type of meltdown typically gets a bit of follow-through.