EUR/USD

The EUR/USD pair had a very volatile week, going back and forth and ended up forming a hammer right on top of the ascending triangle uptrend line. Because of this, I feel that this market will go higher, and as a result I look at pullbacks on shorter-term charts as potential buying opportunities. I think eventually we will reach towards the 1.15 level. However, if we manage to break down below the bottom of the range for the week, at that point in time I imagine this market drops down to the 1.08 handle.

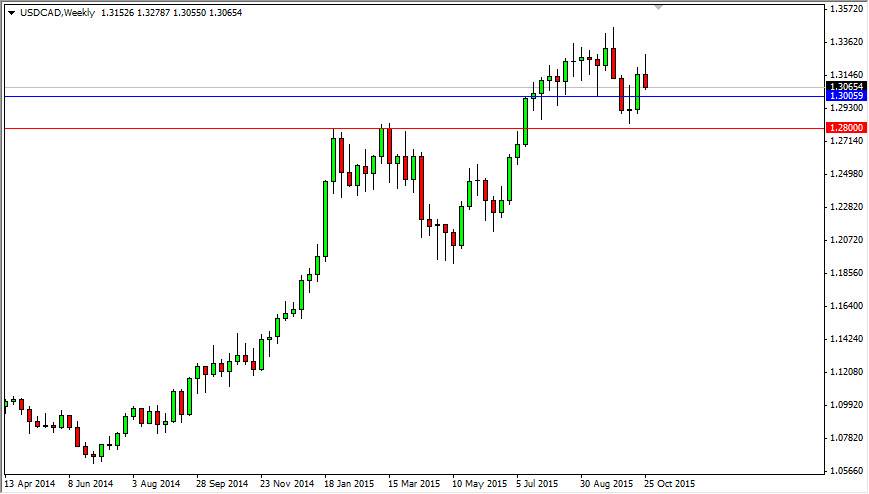

USD/CAD

The USD/CAD pair initially tried to rally during the course of the week but turned back around to form a very bearish looking shooting star. The shooting star sits just above the 1.30 level but I believe that we will drift below there and reach towards the bottom again of the current support barrier. I believe that the 1.28 level below is essentially the bottom of the market. If we broke down below there, things would get rather ugly but I think we will in the short-term at least try to get in that general vicinity.

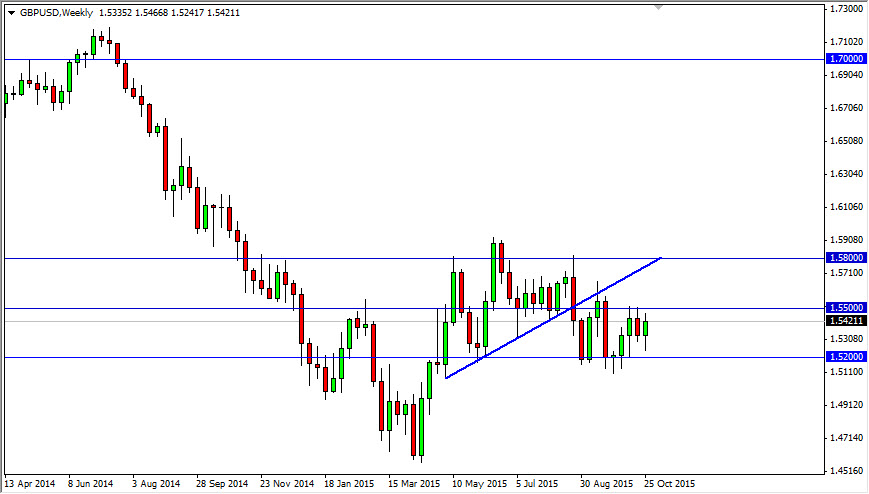

GBP/USD

The GBP/USD pair fell initially during the course of the week but turned back around to form a hammer. Because of this, the market looks as if it is trying to break out to the upside but the 1.55 barrier above is of course rather important. If we can get above there, I am much more comfortable buying this pair at that point in time as it should then reach towards the 1.57 level.

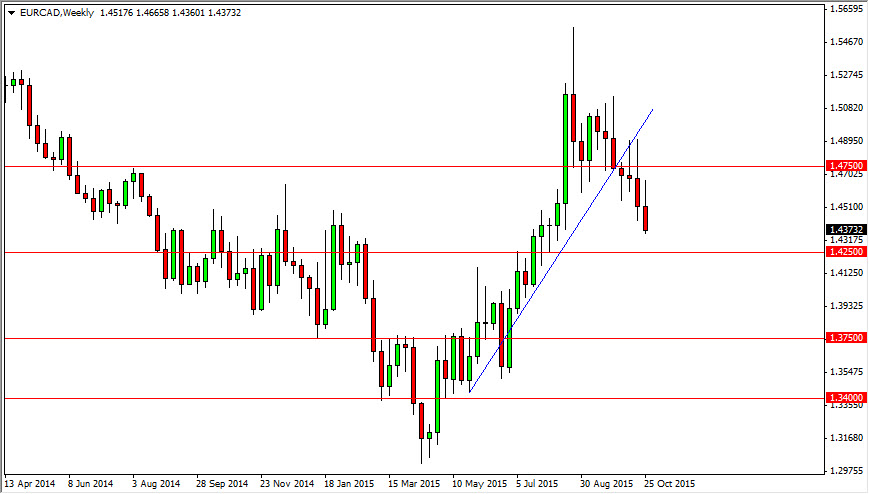

EUR/CAD

The EUR/CAD pair tried to rally initially during the course of the week but found enough resistance just below the 1.4750 level to turn things back around and form a bit of a shooting star again. Because of this, it looks like the sellers will continue to push this market lower and control the market in general. With this, I believe that the market is going to drop to the 1.4250 level and then short-term rallies should continue to be selling opportunities.