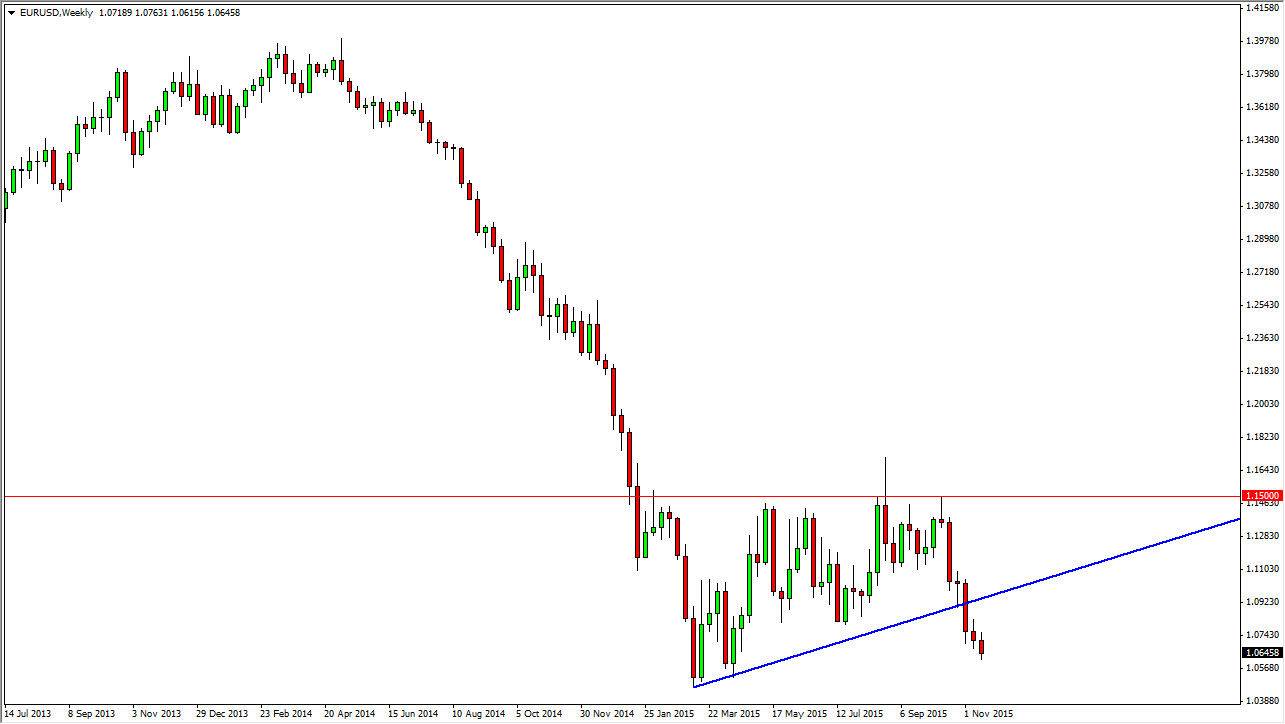

EUR/USD

The EUR/USD pair had a slightly negative candle print during the course of the week, as we continue to drop. I believe that anytime we rally in this pair, it is going to be a selling opportunity on the short-term charts as the market looks as if we are heading towards the 1.05 handle. Ultimately, we will more than likely try to break down below the aforementioned 1.05 level, but ultimately that is an argument for another day.

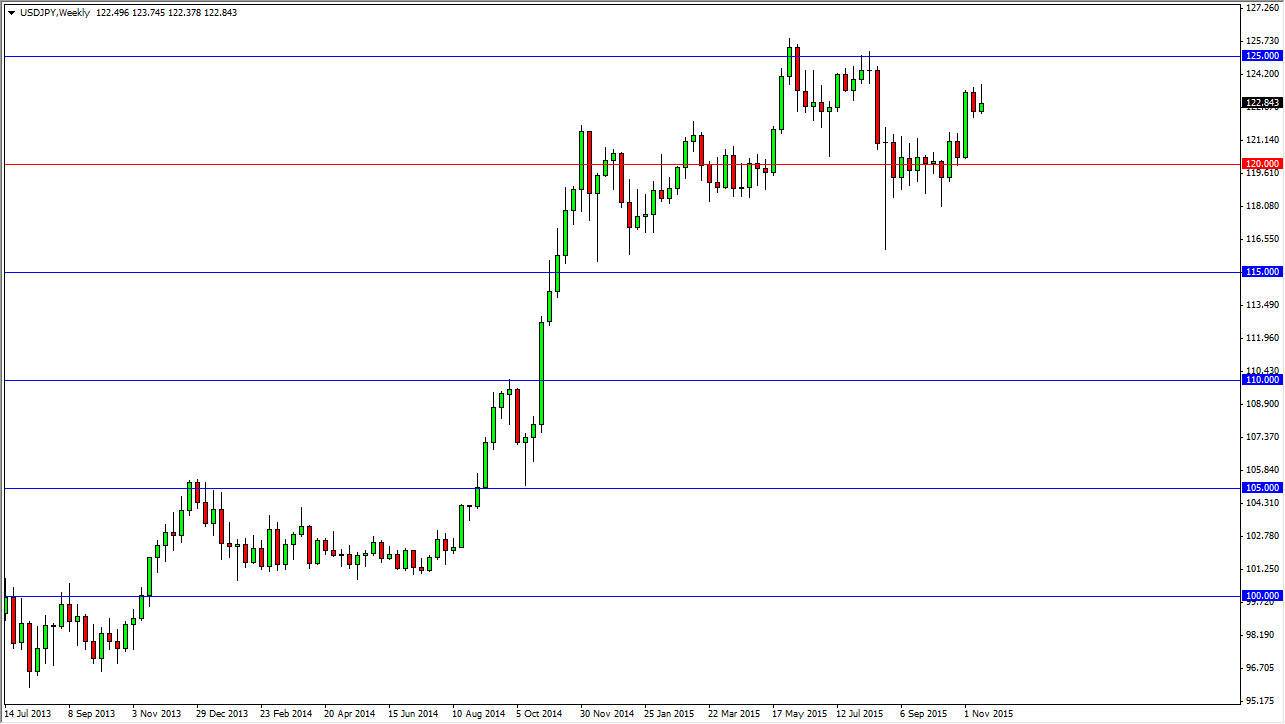

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week, but turned back around in order to form a bit of a shooting star. The shooting star for the week suggests that we are going to drop from here, and go looking for support at lower levels. I believe that somewhere around the 121 level we will start seeing buying opportunities, and therefore I am simply going to wait in order to get my long positions going.

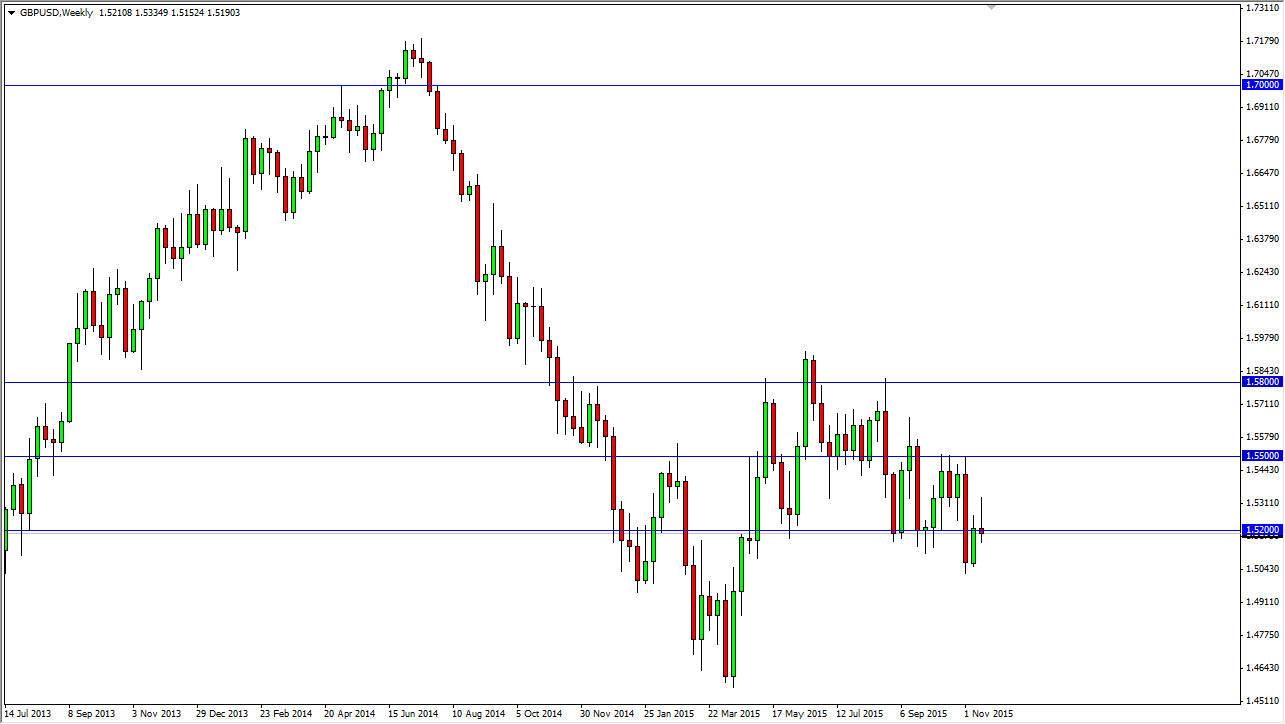

GBP/USD

The GBP/USD pair initially rallied during the course of the week, but turned back around to form a bit of a hammer. The hammer sits right at the 1.52 level, and if we can break down below the bottom of the hammer we should then reach towards the 1.50 level. Ultimately, we believe that the market does continue to break down and even if we rally from here I am more than willing to start selling yet again on signs of resistance.

NZD/USD

The NZD/USD pair initially fell during the course of the week, but then bounced back above the 0.65 level in order to form a bit of a hammer. I believe that the hammer shows that the market should go higher, perhaps to the 0.6750 level first. However, I would not be surprise at all to see the sellers step back into this market at that area. On the other hand, if we break down below the bottom of the hammer, it is more than likely a sign that we are going back to the 0.60 level.