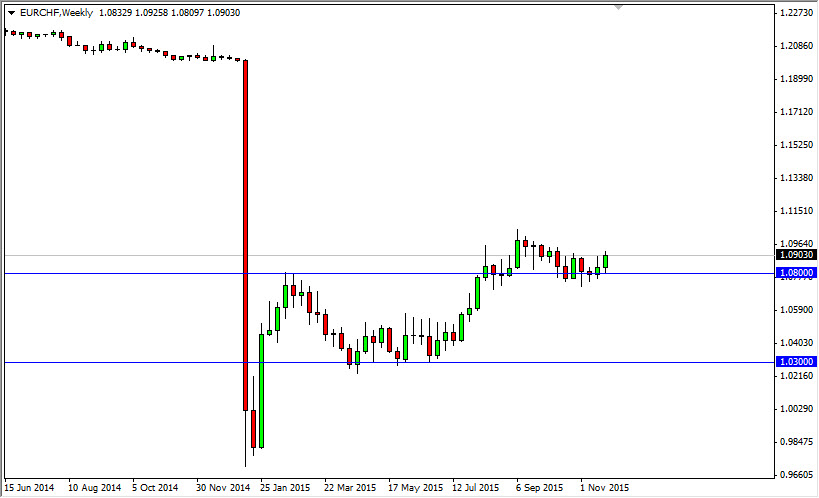

EUR/CHF

The EUR/CHF pair bounced off of the 1.08 level, as we continue to bounce around between the 1.08 level and the 1.10 level. I believe eventually we do break out to the upside though, so I am buying pullbacks as it is obvious that there is a massive amount of support just below the 1.08 handle and I suspect that the Swiss National Bank has something to do with it.

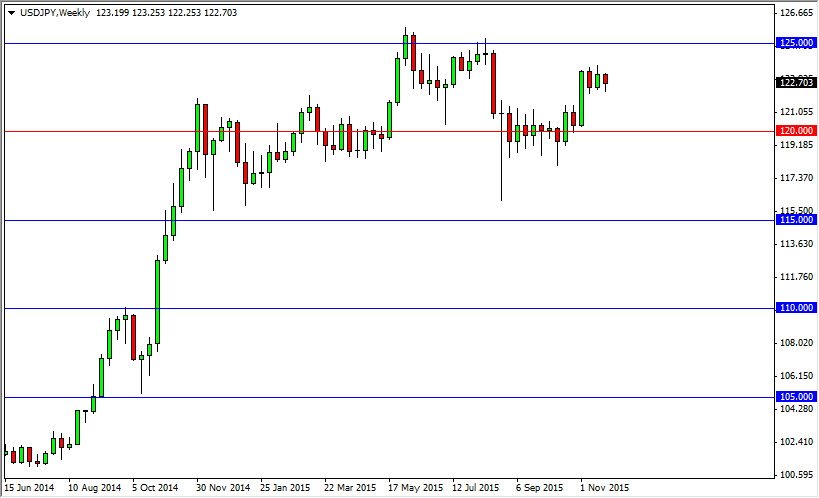

USD/JPY

The USD/JPY pair initially fell during the course of the week but we did find enough support near the 122 handle the turn things around again. Regardless, I feel that it’s only a matter of time before the buyers step in and push this market towards the 125 handle. I believe that pullbacks continue to offer value, and we will have to take advantage of it. The 120 handle should be the “floor” in this market.

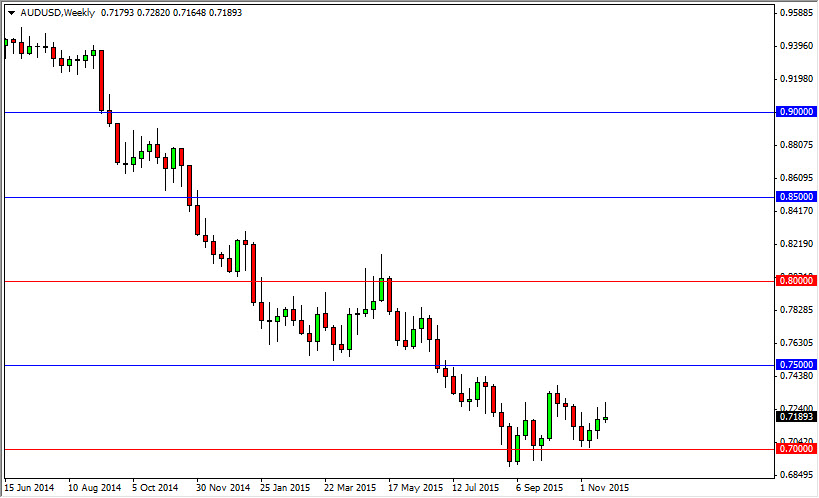

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week but found enough resistance near the 0.73 level to turn things around and form a massive shooting star. The shooting star of course suggests that this market is going to go lower, so we are sellers. We have no interest in buying this market and we believe that we will more than likely make the move to the 0.70 level below.

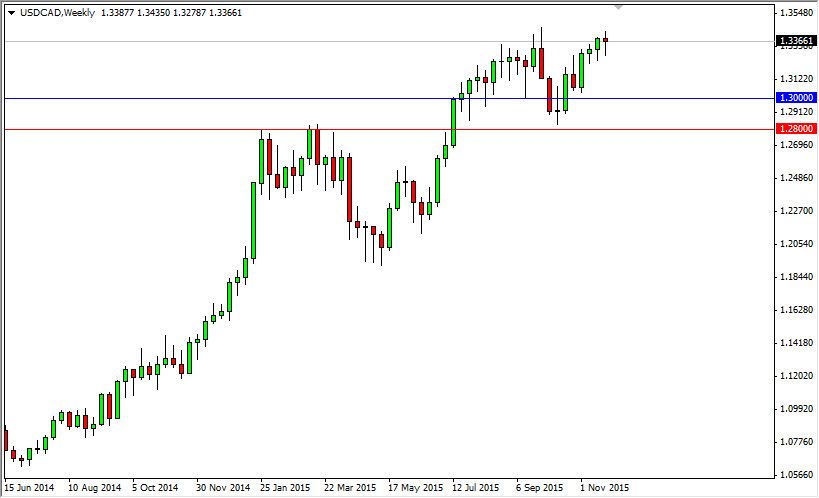

USD/CAD

The USD/CAD pair initially fell during the week but found enough support to turn things back around and form a hammer. I believe that the USD/CAD pair will eventually break out to the upside, breaking above the 1.35 level. With this, buying short-term pullbacks will be the way going forward as is market continues to show strength, and of course the oil markets are doing no favors for the Canadian dollar at all.