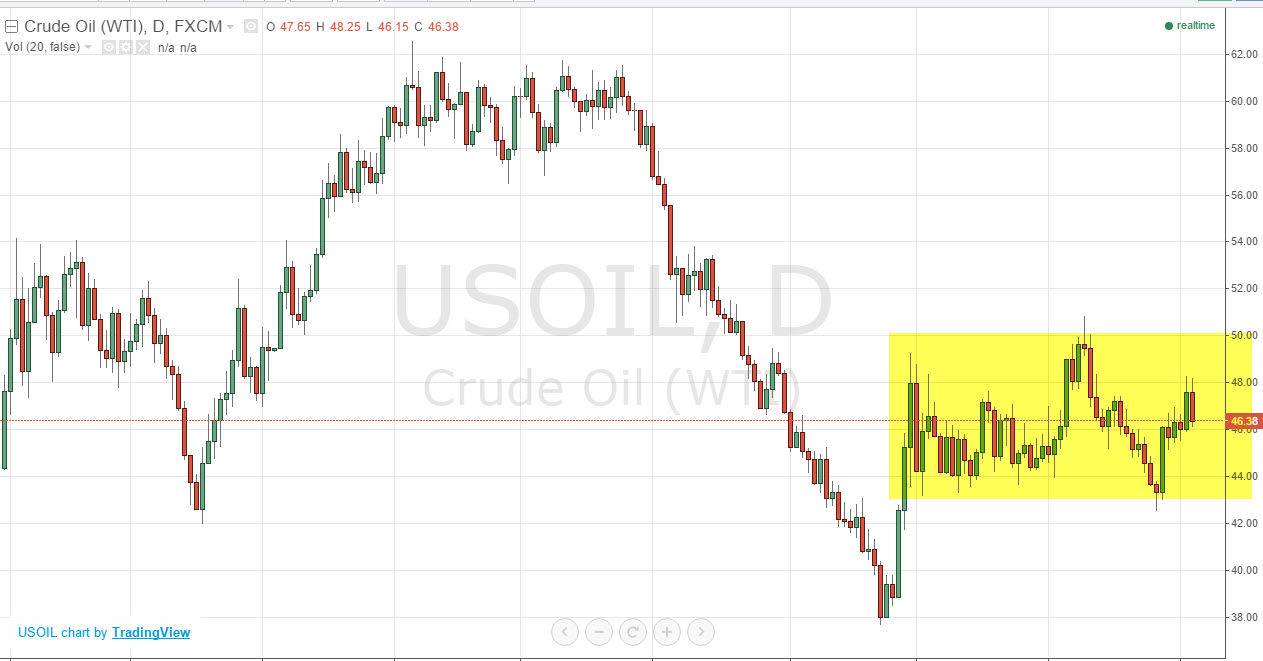

The WTI Crude Oil market initially tried to break above the $48 level, but turned back around to a relatively negative candle. However, we are still well within the consolidation area that we have been stuck in for some time. $48 of course has been important time and time again, and the fact that it offered resistance now isn’t that big of a surprise to me. The $46 level below just below is supportive, so at this point in time I’m not ready to search selling this market quite yet. However, if we get below the $45.50 level, I think short-term selling opportunities could present themselves in this market. At that point in time, I would anticipate that the $44 level below would be the next target. That area has been supportive in the past several times though, so it means to me that I would be willing to take profit a little bit above that level.

Supply and demand

What we can see from this market is that the oil markets simply don’t have enough demand for them at the moment. After all, the global economy is a bit sluggish at the moment, and that of course means that oil demand will shrink. This was especially in the forefront of traders’ minds after we had bad Chinese numbers recently. With that being the case, it will mean that we will have to pay attention to GDP of various countries, with a bit of significant attention paid to the United States and China of course.

We also have the US dollar going back and forth as far as strength is concerned, and at this point in time a strengthening US dollar seems to be working against the value of commodities as well. So at this point in time we don’t have reason enough to start buying. However, I recognize that support below should continue to keep this market afloat given enough time.