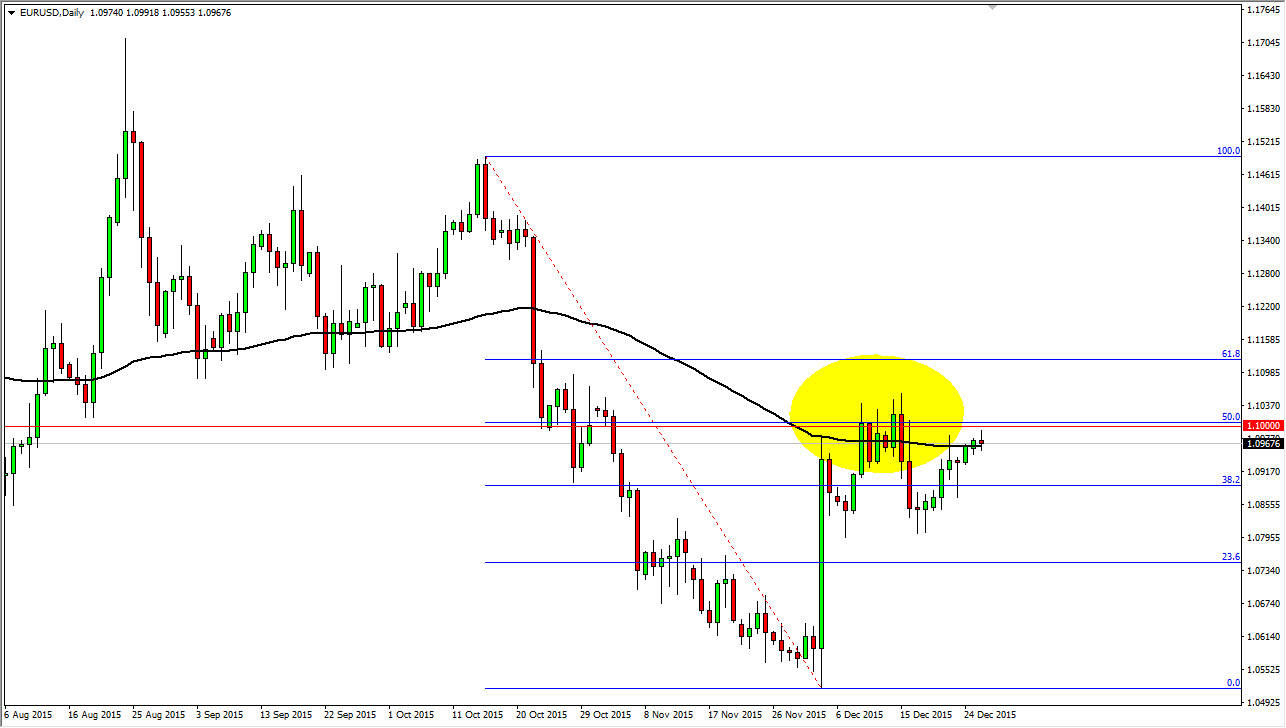

The EUR/USD pair went back and forth during the course of the day on Monday, ultimately forming a bit of a shooting star. With this being the case, the market looks as if it is struggling with the psychologically significant 1.10 level, which of course has quite a bit of resistance wrapped around it as it not only is psychologically significant as a large, round, big number, but also the fact that the 50% Fibonacci retracement level is right there. We have seen quite a bit of selling pressure in this area, and the fact that the 100 day exponential moving average is sitting right there and is also flat suggests that the market isn’t ready to go higher at this point.

As you can see, I have a yellow area on this chart which I believe it is very crucial for the longer-term health of this market. Recently, we have been consolidating between the 1.08 level on the bottom, and the 1.1050 level on the job. Because of that, I think that since we are close to the top of the consolidation range, it makes sense that we pullback.

No Matter What, It’s Not Going To Be Easy

Be aware and keep in mind is that it’s not going to be easy to move in one direction or the other anyway. After all, we have the resistance above that of course will be influential but then again we have supportive candles just below that should offer a bit of support. So having said that, if you are willing to sell this market on a break down below the bottom of the Monday session as I am, you are also going to have to put up with quite a bit of volatility.

Nonetheless, we should grind our way down to the 1.08 handle given enough time, but it may take a bit of time due to the fact that it is not only choppy in this area, but the fact that we are in the middle holidays.