The CAD/JPY pair fell slightly during the course of the session on Wednesday as we continue to consolidate in what most certainly would be thin trading. After all, even though the Canadian dollar and the Japanese yen are both major currencies, this cross pair isn’t exactly one of the most liquid pairs. That’s not to say that it can be traded officially, and most certainly can, it’s just that it’s not exactly like the EUR/USD pair, so during time frames like the holidays, it will certainly drop in volume.

The first thing you have to think in this market is when oil is going. After all, the Canadian dollar is highly influenced by oil, and the Japanese economy derives 100% of its petroleum from other sources. There is no internal source of crude oil for Japan, so this essentially is a proxy for the oil markets, even more so than the USD/CAD pair in my opinion.

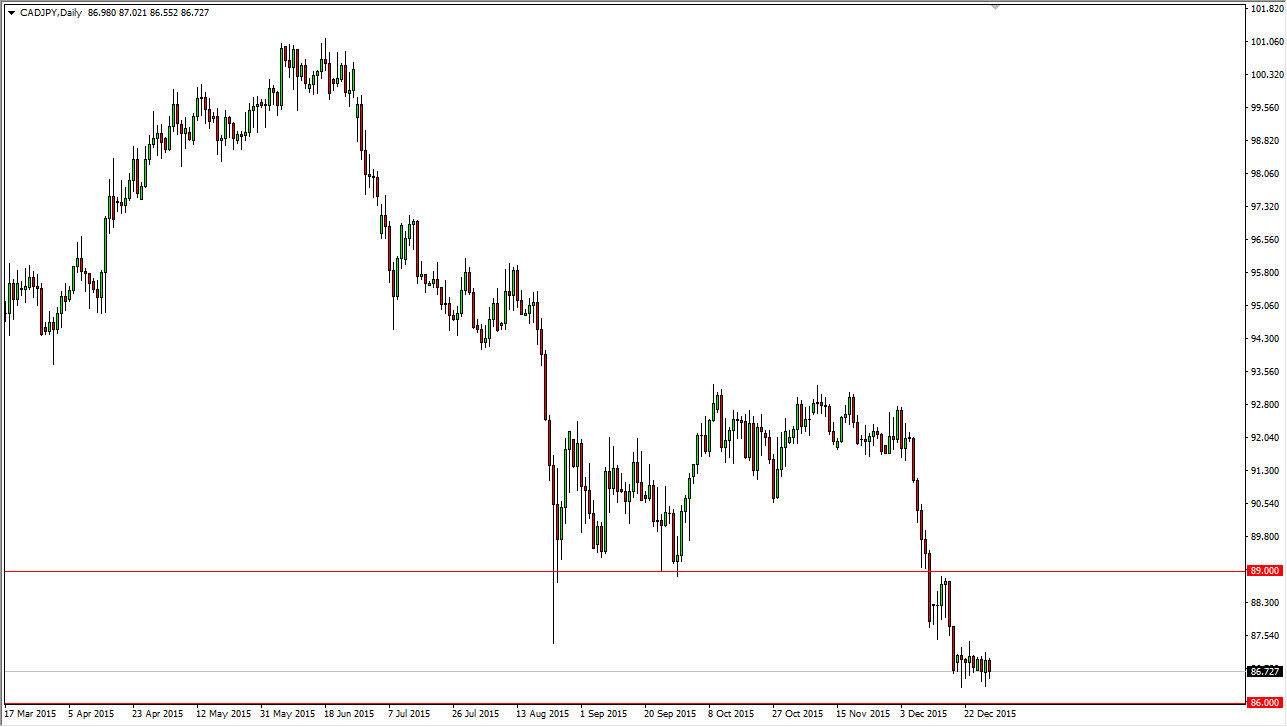

Range Bound

I think that overall we are range bound anyways, with the 86 level offering quite a bit of support on longer-term charts. We are currently 70 pips or so above there, so I think that it’s going to be difficult to break down below there anytime soon. But once we do, I think it’s an excellent selling opportunity. This will coincide with the breakdown below $35 in the WTI Crude Oil market, which you should be watching if you are trading this pair as well.

The 89 handle above looks to be rather resistive as it was previously supportive during the month of September, and as a result I’m willing to sell any resistive candle on a rally between here and there. I don’t know if we will get the trading opportunity today, but quite frankly this is a very interesting market for me. With everything is going on in the oil markets, you have to be thinking about oil when trading currencies these days.