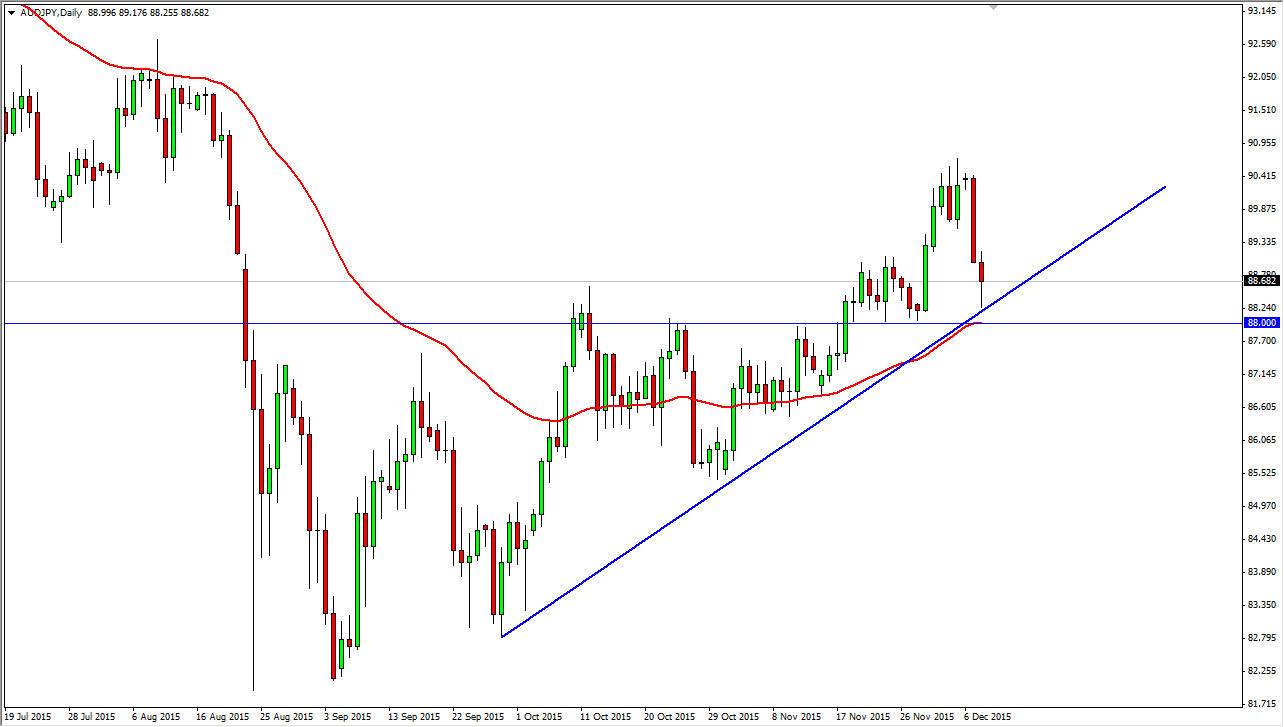

The AUD/JPY pair fell initially during the day on Tuesday, but as you can see on the chart ended up forming a nice-looking hammer. There seems to be plenty of support near the 88 handle, which has been both support and resistance recently. We ended up finding support not only because of the 88 handle, but also because of the uptrend line that you can now see on the chart. This is a market that appears to be changing overall attitude, as the Australian dollar has found itself gained strength overall.

The hammer is normally a bullish sign, so if we can break above the top of the range for the Tuesday session, I am a buyer. I think at that point in time the market will reach towards the 90 handle again, as we continue to grind our way higher overall. That’s not to say that this will be the easiest move to make, but quite frankly the Bank of Japan is more than likely going to continue to work against the value of the Japanese yen going forward anyways.

Moving Average

On the chart, you can see that the 50 day exponential moving average is sitting just below that hammer, and as a result it appears that the market is ready to continue going higher as the moving average has turned in a more upward slope at this point as well. I believe that the support from not only the trend line but also the moving average and the large, round, psychologically significant number should continue to keep this market afloat as we grind our way higher.

At this point in time, I don’t really have any interest in selling this market, at least not until we break down below the 86 handle. A move down below there would of course be a lot of negativity in one shot, and have that point the sellers will have taken over again. Until then, I think this pair goes much higher.