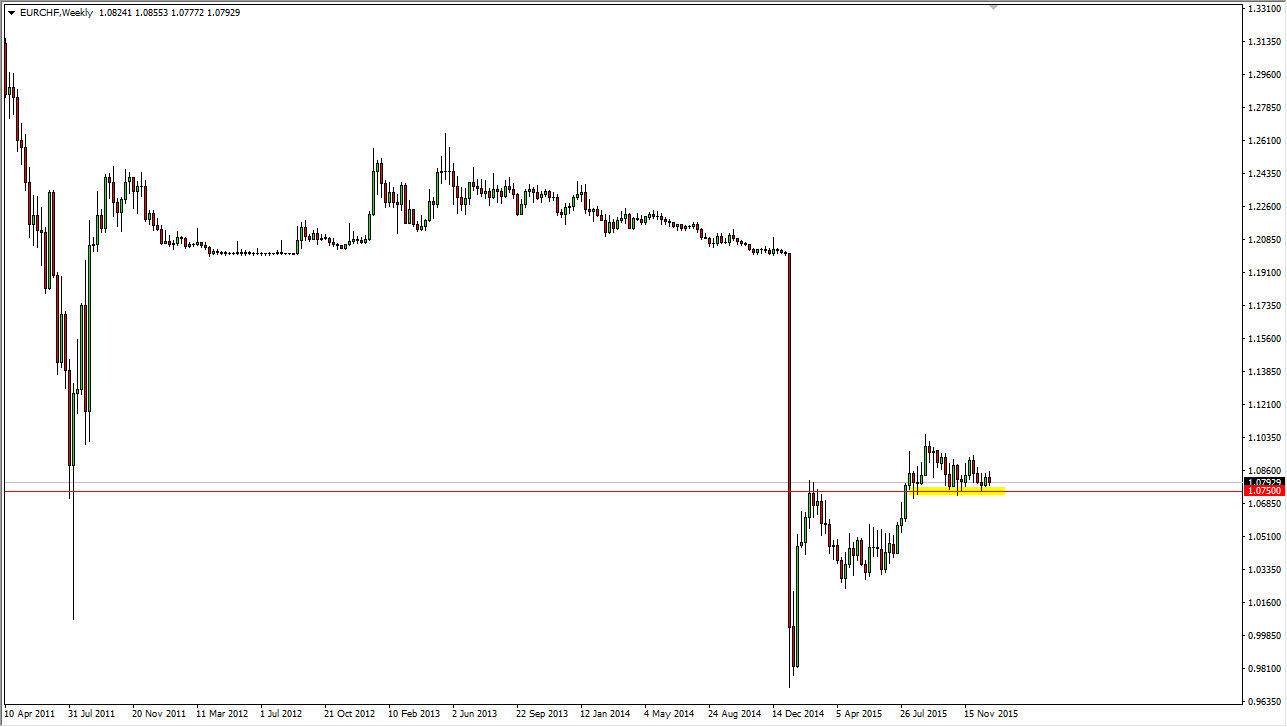

The EUR/CHF pair has been going sideways for some time now, and as you can see on the chart I have highlighted the 1.0750 level with not only a line, but a yellow box. I believe that there is a massive amount of support here that can be relied upon, and therefore I am buying every time we dipped down to that general area. I think that it will continue to be choppy though, so not looking for any type of major league. In fact, I am taking 50 to 75 pips of profit every time I buy this pair, and I believe it will continue to be that way.

On the other hand, we can break above the 1.10 level, at that point in time this becomes a “buy-and-hold” type of situation. I believe that will happen, but I don’t know that will happen this month. After all, there are a lot of concerns when it comes to the European Union currently, as there is quite a bit of instability.

No Selling

I do not believe that there’s any way to sell this pair right now, and I believe that pullbacks will continue to offer value that traders will continue to play off of this obvious support level. I also believe that the Swiss National Bank has been involved in this market at the 1.0750 level, as it is known that they have been buying Euros. I think this is essentially their “floor in the market”, as we had seen previously at the 1.20 handle.

I believe a break above the 1.10 level should send this market looking for the previous currency peg at the 1.20 level, as there should be essentially “empty air” between here and there. I think that we could see a massive bullish rally at that point, but I don’t know that is going to happen in January. If it does, hang on, profits will follow to the upside in a massive way.