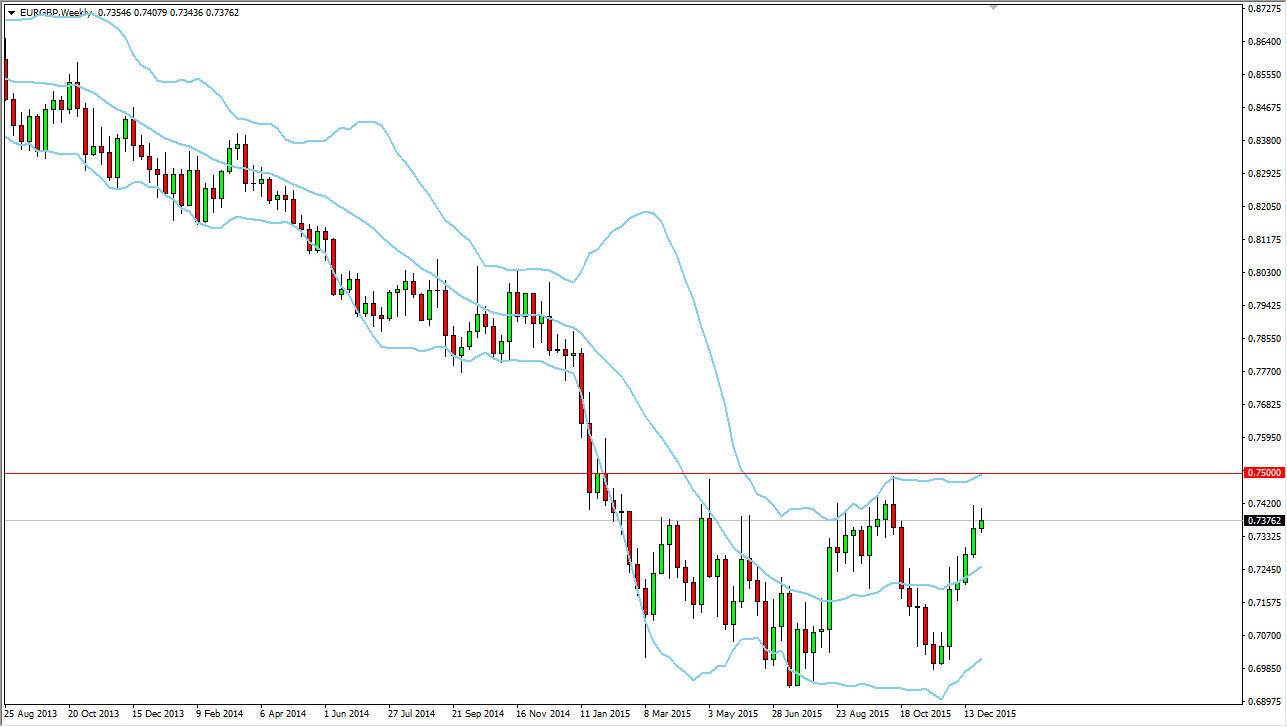

The EUR/GBP broke higher during the course of the last several weeks, but as you can see I have Bollinger Bands placed on the chart, and as a result I am looking at the market from a perspective of being overbought. The 0.75 level above is massively resistive as far as I can see, based upon the previous reaction of resistance and of course the large, round, psychologically significant number.

On top of that, we are starting to reach towards the top of the Bollinger bands, so I think that the 0.75 level above will continue to be a difficult barrier to break above. With this, I think that January will see this market initially trying to rally, but then pullback yet again, maybe towards the 0.7250 level. I think that this market will be very quiet during the month, but at this point in time it’s difficult to imagine that you’re going to be able to hang onto the trade for longer-term moves. After all, both of these currencies are suffering from the same types of issues, and as a result I think that with the Forex markets preferring the US dollar overall, that will make this market a bit more subdued than anything else.

Short-Term Charts

I believe that the best way to play this market does look at short-term charts, such as the four-hour timeframe, and perhaps even lower than that. Given enough time, I believe that you can sell this market over and over. Again though, if we break above the 0.75 level, we could very well find ourselves reaching towards the 0.7750 level where I see resistance after that. I’m not a huge fan of Bollinger Bands, but I cannot dispute the fact that they do tend to measure markets that are a bit over or under done at the moment. I think that perhaps with the moving average looking relatively flat, and the fact that we are reaching towards the psychological resistance above, it makes sense that we just simply will continue to grind away sideways during the month.