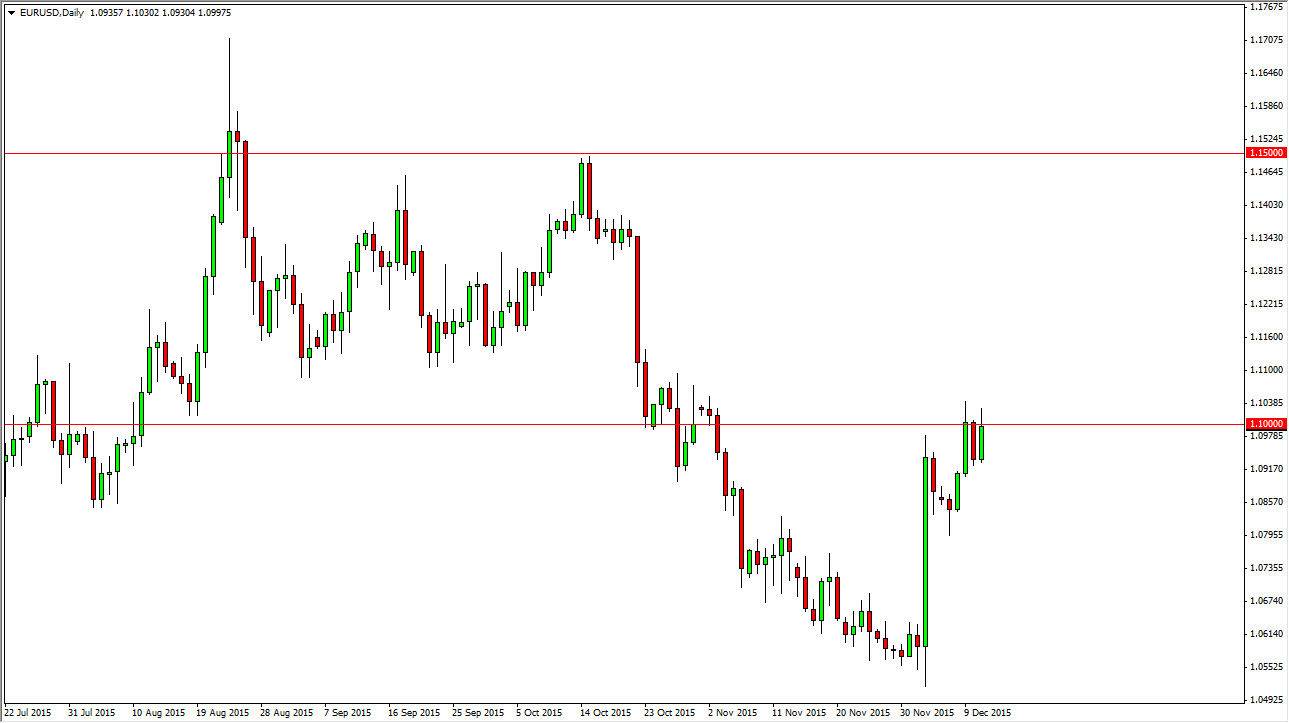

The EUR/USD pair certainly has been resilient lately. We completely wiped out all of the losses from Thursday during the Friday session, as we crashed into the 1.10 level. This of course is a fairly bullish sign, and we have seen quite a bit of recent bullish pressure. The upward candle from last week and the European Central Bank surprising the markets with less than stellar stimulus of course really through a monkey wrench into a lot of traders plans.

The 1.10 level is of course a large, round, psychologically significant number, and of course the site of a cluster during the end of the month of October. Because of this, I am a bit hesitant to get involved at the moment, as I think the volatility is going to be very tough to deal with. However, that’s not to say that I don’t see a couple of areas that could be interesting in the future, it’s just that in the next couple of sessions we could have a real fight on our hands, and is much easier to trade pairs that are clear in their desires.

300 Pips

I believe that we are simply bouncing around in a 300 PIP range, with the 1.08 level being the support based upon the hammer from last Monday, and the 1.11 level above being resistance due to the aforementioned cluster. I think that between those 2 levels, it is going to be very difficult to trade this market unless you can babysit your trade in real time. I prefer not to do that, as scalping is a great way to lose money as far as I can see.

That being said though, we could very well find yourselves breaking above the 1.11 level today. After all, it is only 100 pips, and we have seen quite a bit of impressive bullishness lately. Ultimately though, I think we are going to have to work a bit to get above there, I do think that it will happen though. On the other hand, my contingency plan is to sell below 1.08 going forward.