The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 6th December 2015

Last week I highlighted long USD/CHF and short EUR/USD and GBP/USD as good trades. All three of these pairs moved last week in my predicted direction, until the ECB surprised the market on Thursday by not acting as strongly as expected to further weaken the Euro. This led to the Euro and highly correlated Swiss Franc rising in value against most currencies by more than 3% in just a few hours, so if you hadn’t already taken meaningful profits, it would have been a losing week. This happens sometimes and it is large, sudden movements like this that can remind you why using stop losses in trading is so important. Note also that although the British Pound was up on the week against the U.S. Dollar, this move was much smaller.

This week I still say that the best opportunities are likely to be going long the USD against the GBP, EUR and CHF, in spite of the strong counter move that has just happened. It may well be that this is not the most profitable course of action, but very often strong counter movements such as this evaporate fairly quickly. It should become obvious by the end of Tuesday whether this is going to happen or not. The best opportunity looks to be short GBP/USD.

Fundamental Analysis & Market Sentiment

The strong currency is the USD. The fundamental data could be stronger, however there have been no bad surprises. The position technically for the USD also looks strong. The currency is now trading higher than it was 3 months ago against every major global currency, with the exception of the NZD and AUD.

Weaker currencies are a little less clear but there are three that stand out: the CHF, GBP, EUR. Let’s take each currency in turn.

Swiss fundamentals are neutral. However there is a feeling that the “real” Swiss economy has been in trouble for a while, and the SNB wants to see the CHF fall in value to make Swiss exports more competitive. One tool to achieve this was setting a negative interest rate of 0.75%. This negative rate combines with the gloomy economic sentiment to produce a currency that feels weak, although this may have changed now as the Euro has dragged it upwards with an extremely strong positive correlation.

British fundamentals are neutral. However the Bank of England has recently revised its forecasts downwards and most economic data lately has been coming in below the market’s expectations. It seems the currency is not going to be rising, so sentiment is fairly bearish here.

Eurozone fundamentals are slightly negative, with most data coming in below expectations lately. The ECB has however signaled it is not interested in weakening the currency much more.

This suggests that the weakest currency is the GBP right now, but a down week for the EUR and CHF is very possible now.

Technical Analysis

EUR/USD

The price action looks uncertain, with a very strong move up from the 6 month lows the pair was making until last Thursday. There is probable resistance beginning at the key round number of 1.1000, because the price has come so far. The action of the next few days will be crucial: if the price holds up for most of the week, it is probably not going to fall significantly for a while.

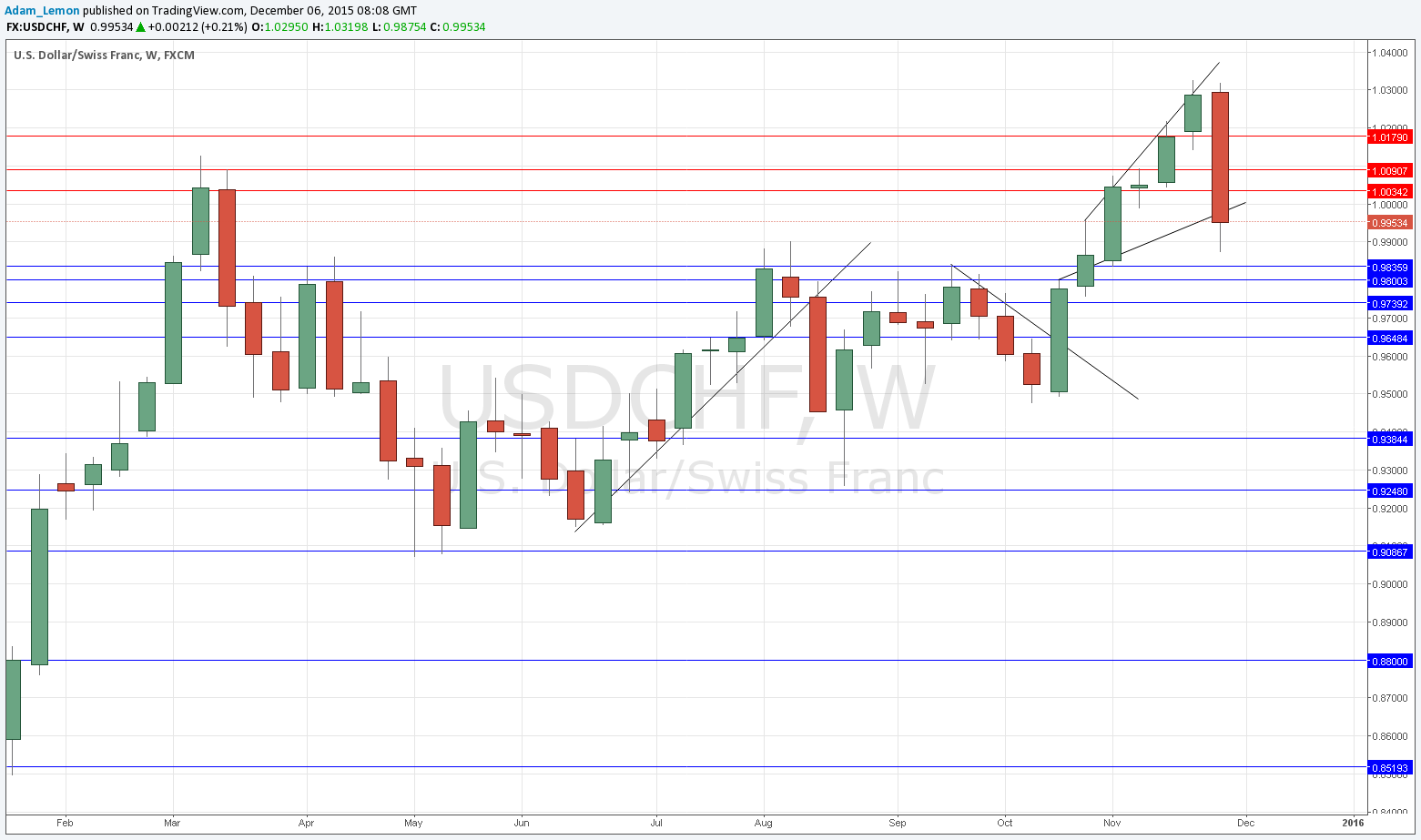

USD/CHF

The price action looks uncertain, with a very strong move down from the 5 year highs the pair was making last week. There is probable support beginning at the nearest weekly low of 0.9836, because the price has come so far. The action of the next few days will be crucial: if the price stays down for most of the week, it is probably not going to rise significantly for a while.

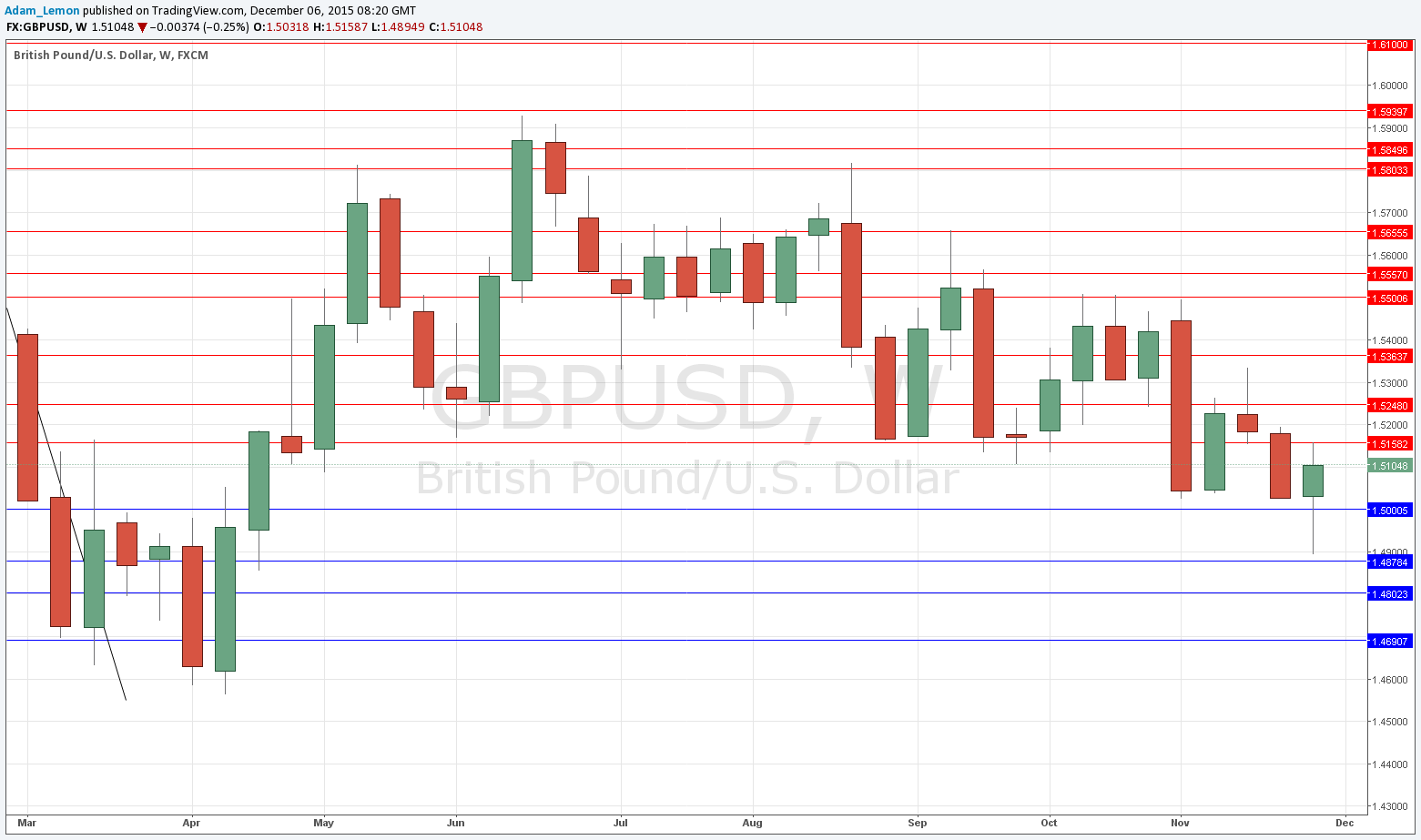

GBP/USD

The price action looks slightly bearish, but somewhat uncertain. There is probable resistance beginning at 1.5158. Beware of the major multi-year support below.

Technically, it looks as if the strongest move over the coming week is likely to come in GBP/USD.