Gold prices are higher in Asia trade, trading up 0.4% at $1064.80 an ounce, ahead of the Federal Reserve's policy statement due later today. Fed officials will update their forecasts for the growth, unemployment and inflation, and Chair Janet Yellen is scheduled to give a post-meeting press conference. While some feel that after months of declines a rate hike is unlikely to affect prices in a significant way, some believe that Fed's language on future interest-rate increases will matter the most.

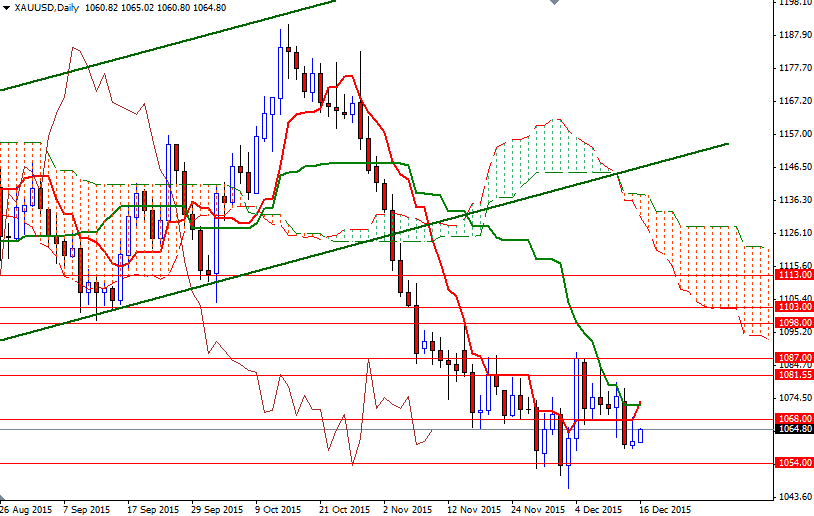

We have seen pretty much sideways action in gold lately but ultimately the market will break out of this relatively tight area. If the Fed signals a more cautious approach to the path of subsequent increases, we could see a rebound in prices. But in the long run, gold will probably continue to struggle with multiple headwinds (China's slowing economy, low inflation, weak global growth). However, markets don't act rationally all the time so staying on the sidelines until we see how much of the decision was priced in may be a smart choice.

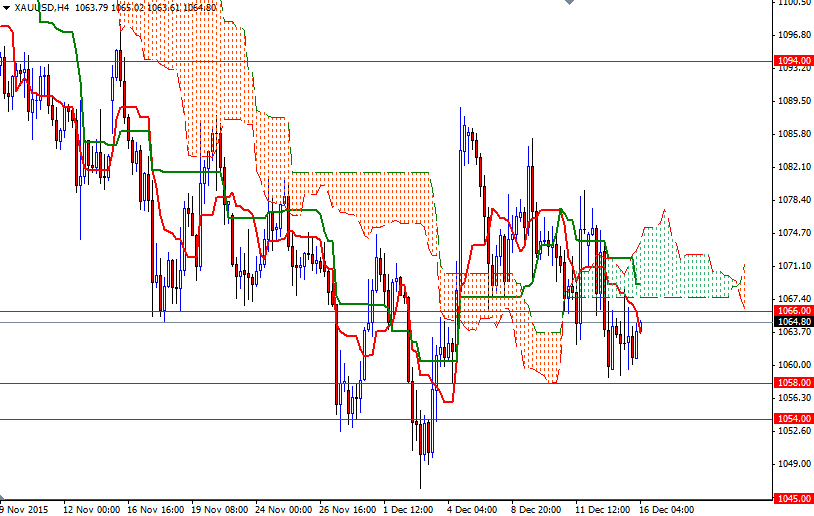

To the upside, the initial resistance stands in the 1068/6 region but since the 4-hourly Ichimoku cloud sits on top us, the bulls will have to break through 1072.20 and 1075.50 area in order to gain enough momentum to tackle the next barrier standing in the way at 1081.55. A sustained push above the 1087 level would attract new buying and trigger a move towards the daily cloud. To the downside, support can be found at 1058 and 1054, If the American dollar gets a boost and XAU/USD drop through 1054, then the market will possibly fall to 1046.25 - 1045 before finding some support. Breaching 1045 is essential for a bearish continuation targeting the 1036 level.