NZD/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am New York and 5pm Tokyo times today.

Long Trade 1

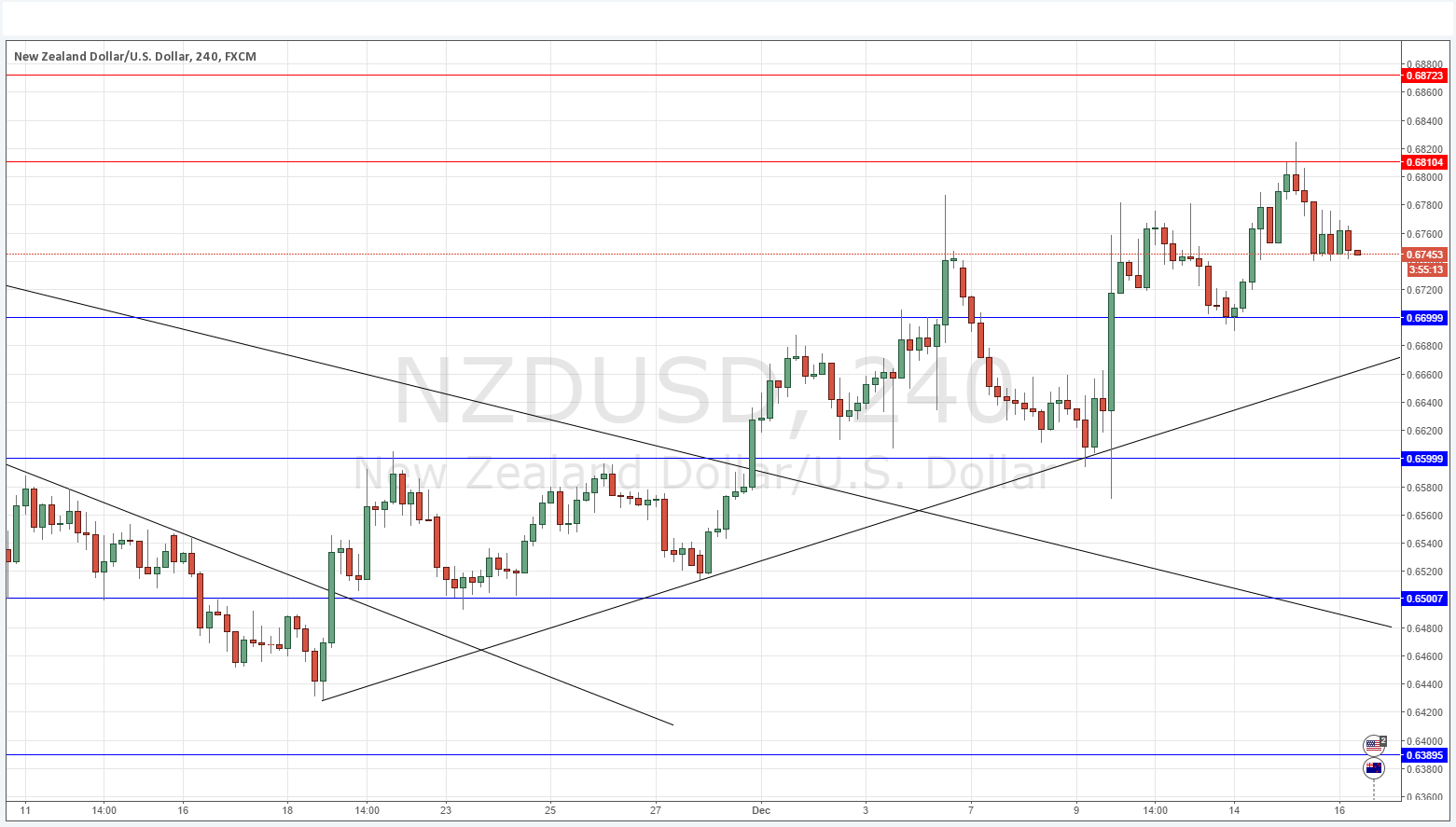

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6700.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the supportive trend line currently sitting at around 0.6670.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 3

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6600.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 4

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6500.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6810.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6872.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

I predicted yesterday that a break below the triple top at 0.6780 might signal a fall back to 0.6700 if it happens in the next few hours. It did happen but the fall has not yet been as sharp as I had expected, although there is still the New York session to come.

The NZD is the strongest currency apart from the USD and if the Fed passes on the expected rate hike tonight, we can expect this pair to rise, and if that is after a touch of the bullish trend line or just 0.6700, that would be even more ideal as it should pick up some orders there.

A break above 0.6872 would be a very bullish sign and place this pair in a strong upwards trend.

If rates are hiked by the Fed, the downside might be a little difficult to take advantage of with this pair.

Regarding the NZD, there will be a release of GDP data at 9:54pm London time. Concerning the USD, there will be a release of Building Permits earlier data at 1:30pm, followed by the FOMC at 7pm.