By:DailyForex.com

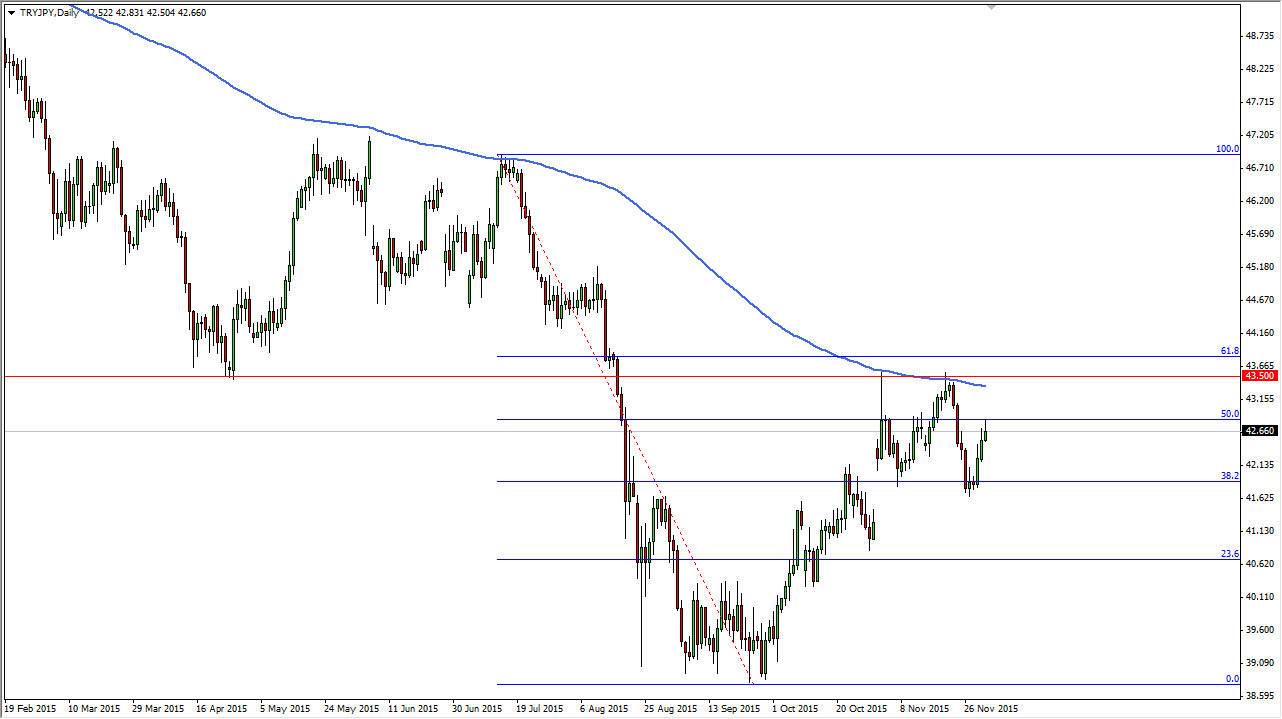

The TRY/JPY pair initially tried to rally during the course of the day on Wednesday, but found far too much in the way of resistance at the 50% Fibonacci retracement level in order to continue going higher. In fact, we ended up forming a shooting star which of course is a very negative sign. On top of that, this pair has been in a downtrend for some time, which of course makes sense as the Turkish lira is considered to be a very risky currency and at this moment in time with everything that’s going on in the world, a lot of the riskier currencies are shunned.

You can also make an argument for a bit of concern when it comes to the Turkish lira because of the war in Syria, and of course the issues with the Russians at the moment. Ultimately though, it’s only a matter of time before we have to pull back and fill a gap below.

Longer-term Downtrend

We have the 200 day exponential moving average above, and the 50% Fibonacci retracement level at the top of the shooting star, which should be technical resistance in its nature. The shape of the candle is just about perfect, and as a result it makes sense that we would sell off if we can break down below the bottom of the shooting star. At that point, the market should then try to fill that gap mentioned previously, meaning that this market could very well drop to the 41.25 region or so.

If we can break down below there, this market could pick up quite a bit of steam and head down to the 40 handle. At this point in time, I have no interest in buying this pair, because I feel that there are simply far too many moving pieces in the Middle East, and especially with Turkey. We will either get the sell signal or not, but that’s the only way I’m trading this pair.