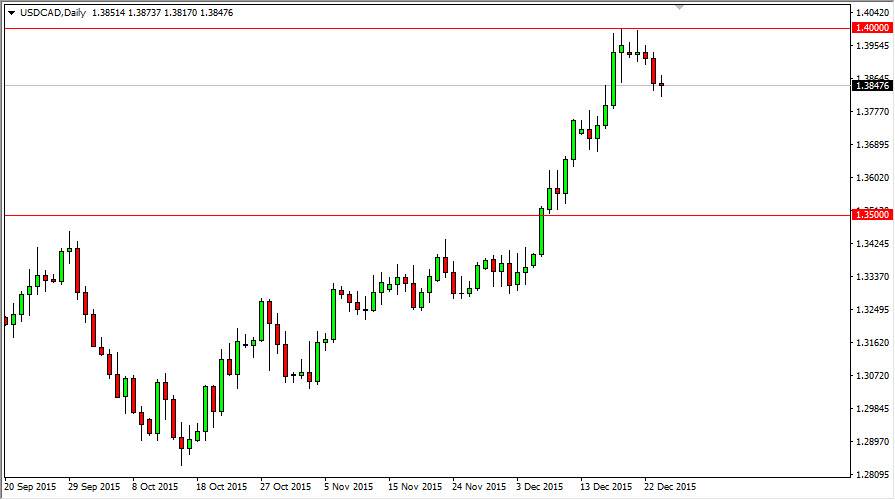

The USD/CAD pair did very little during the day on Thursday, as we continue to struggle. The pullback isn’t necessarily something that I see as a selling opportunity though, because quite frankly the 1.40 level above should offer quite a bit of resistance so it’s not a surprise that it might take a couple of attempts to finally break out. I do think this happens, but it’s likely to happen during the holidays in my opinion.

Even if it did, the one thing that I do look at is the fact that a pullback is a bit overdue. If we can pull back from here I think we will find support sooner or later, and the first area that I would anticipate seeing it would be the 1.37 handle. That area has been resistance in the past, so it should be support now. So I am looking for a supportive candle in that general vicinity in order to serve buying, and looking at this market as one that is simply trying to pullback in order to build up enough momentum to finally go higher.

Do Not Forget Oil’s Role

Don’t forget that oil has a huge influence on this pair, as the Canadian dollar is highly leveraged to the petroleum markets. Quite frankly, those markets fell, but have been rising recently. This looks like a bit of a “dead cat bounce”, so I feel that this is simply a reprieve in the selling pressure as we look for more sellers in the oil market, and of course buyers of the US dollar over the Canadian dollar.

Given enough time, I believe that the 1.35 level will prove itself to be a floor if we go that low, so this point in time I have absolutely no interest in selling. I think that the oil markets will continue to fall, the Canadian dollar will continue to lose value, and of course the US dollar should strengthen overall.