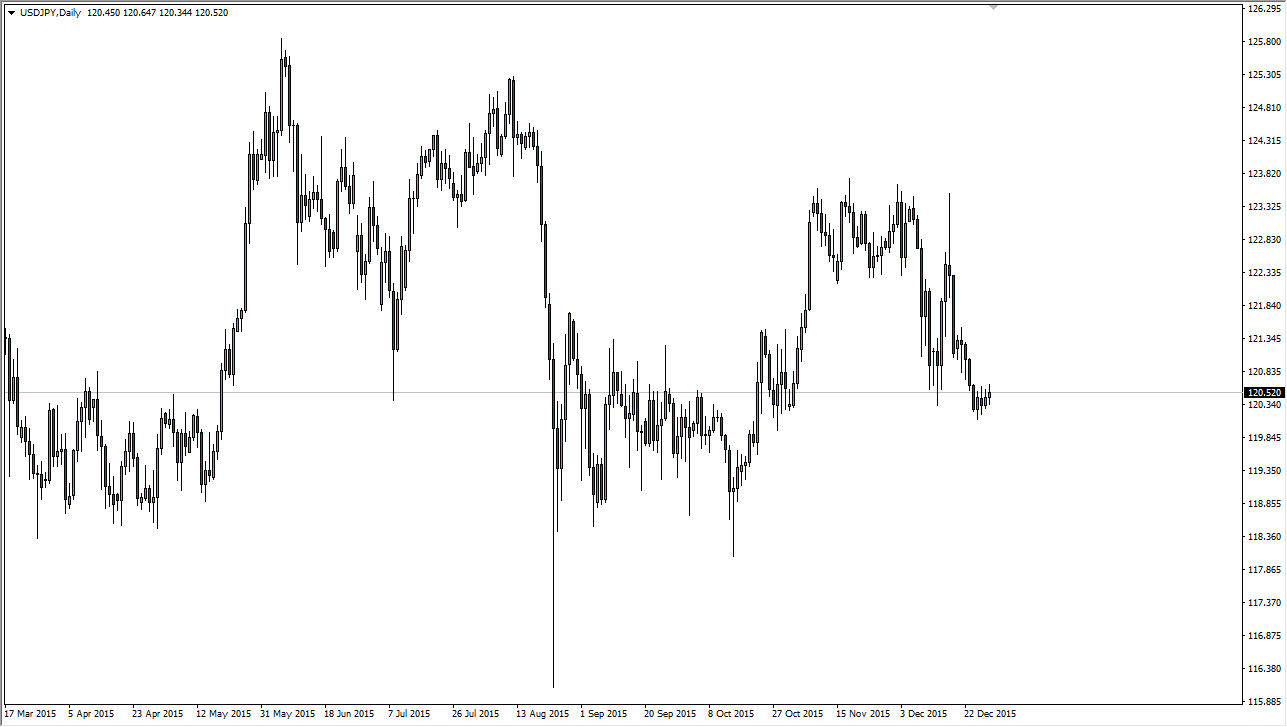

The USD/JPY pair bounced slightly during the day on Wednesday, but having said that it appears that the market isn’t quite ready to move. This isn't a big surprise though, because quite frankly the liquidity will be an issue over the next several sessions. That being said, I do recognize a couple of important levels in this market, with 120 being one of them. I think that begins a significant amount of support all the way down to the 118.50 level, so at this point in time anytime this market pulls back, I think value hunters will return.

Looking at the interest-rate differential between the 2 currencies, I believe that the US dollar continues to strengthen overall. At this point in time, the market should grind its way back towards the 123.50 level, which is the top of the recent consolidation region. The 120 level below has been previously defended, and quite frankly the bounce that we have seen all the way from the 118.50 level previously shows just how important all of this area is.

Buying Dips

I think that every time this market rallies on a short-term chart and then pulls back, you have to look at buying dips. I do not think that we’re going to see any real longer-term moves, but at this point in time you could get involved in this market on the short-term, picking up 20 or 30 pips at a time. This is not a market that’s ready to go drastic in one direction or the other and out, but given enough time I think that we will not only reach the aforementioned 123.50 level, but eventually take on the 125 handle. I do not think that selling will be safe to do, at least until we get below the 118.50 level, something that I do not see happening anytime in the next several weeks, if not months. 2016 should be very good to this pair.