The USD/NOK pair rose during the session on Monday as we continue to grind higher overall. However, the key word here is most certainly going to be “grind”, simply because the markets have been so choppy over the longer term, even as it has been very bullish overall. After all, the US dollar continues to be very strong, and as long as there are concerns about economic growth and expansion around the world, that will continue to be the situation going forward. After all, even though the oil markets have been soft lately, there hasn’t been any real change in the situations. If given enough of a chance the market should just simply stay the same.

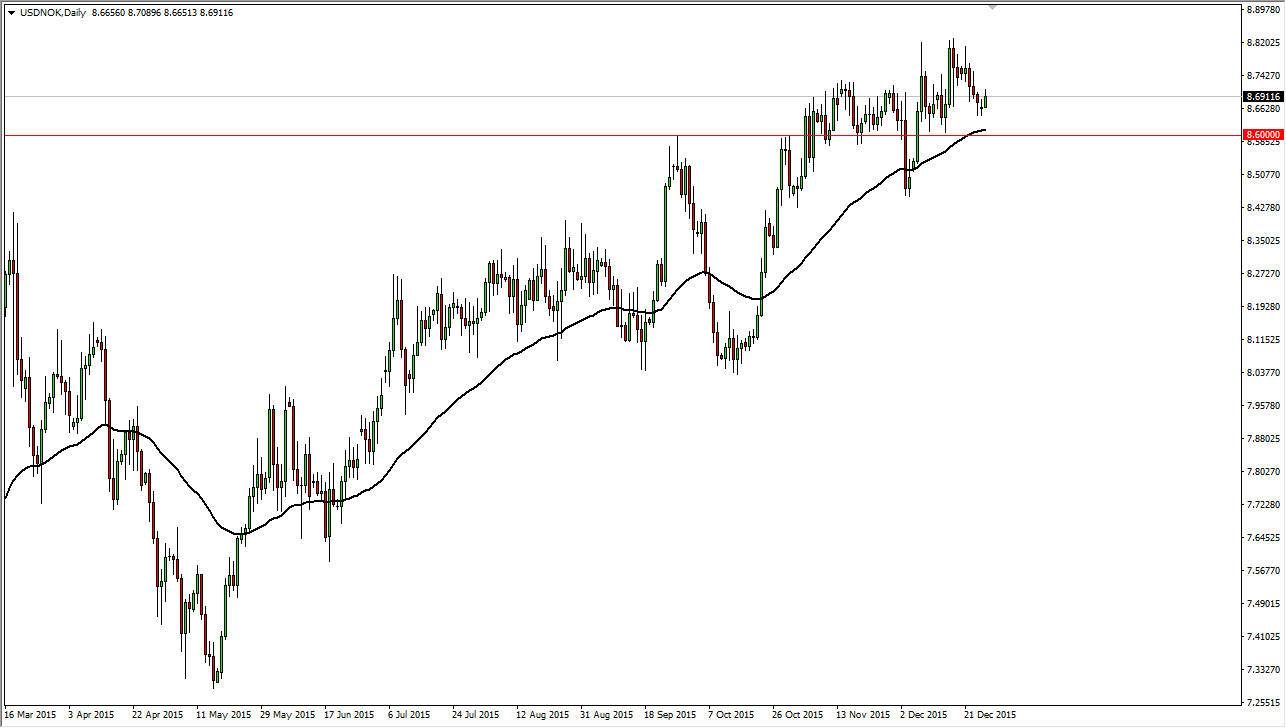

As you can see on the chart, the 50 day exponential moving average has been rather reliable lately, and sits just above the psychologically significant 8.6 level. This market should continue to find plenty of support all the way down to that area, so even though we gave back some of the gains late in the day, we should still continue to go much higher.

Crude Oil

Speaking of crude oil, there is no real hope or sign of a reprieve in the downtrend, and that of course will continue to work against the value of the Norwegian krone as the Norwegians own so many of the offshore oil rigs in the North Sea. Traders will often use the Norwegian krone as a proxy for crude oil, so as long as that commodity hurts, it’s difficult to imagine that the Norwegian krone will suddenly pick up demand, unless of course there’s some type of interest-rate hike, which at this moment in time seems to be almost impossible.

I think that the 8.6 level below is a bit of a floor in the market, and that we will eventually reach towards the 8.8 handle. I have no interest in selling, even if we break down through the floor, because I can find too many reasons the think that the market would bounce given enough time.