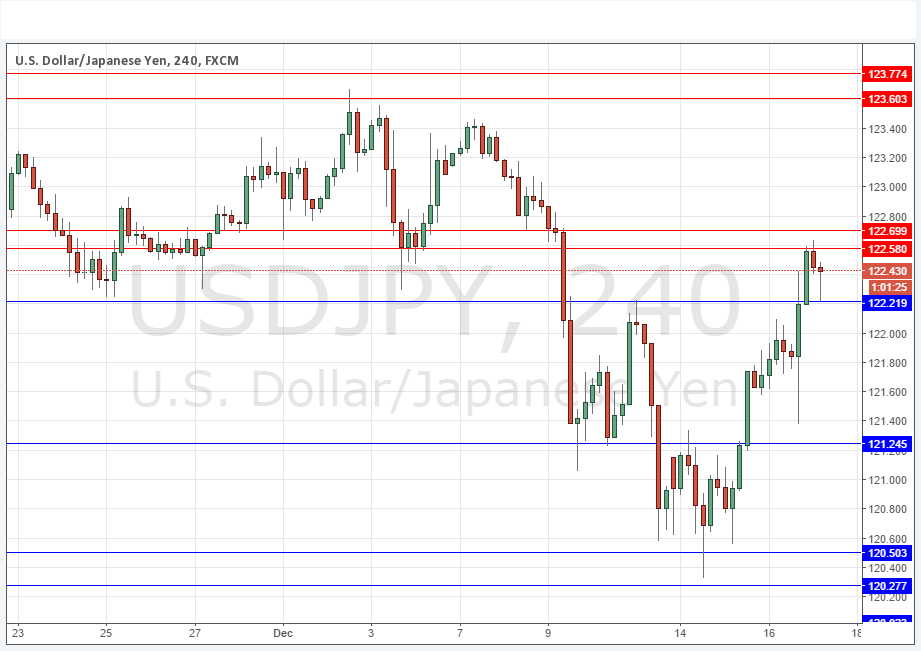

USD/JPY Signal Update

Yesterday’s signals produced a profitable short trade off the bearish rejection of the 122.00 level.

Today’s USD/JPY Signals

Risk 0.50%

Trades must be entered between 8am New York time and 5pm Tokyo time only.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 122.22.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.25.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.58.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 123.60.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

We are in an interesting place as this pair threatens to turn fully bullish. Earlier the price found support and has built a few support levels as it moved up from 122.50 and was also pushed up a bit higher after the US rate hike yesterday. However there remain two key resistant hurdles that will be crucial: the zone that starts at around 122.58, which has already been touched in recent hours, and

then a zone some way above from 123.60 to 123.77. The pair really needs to break above that to become seriously bullish again, and in the meantime all of these levels are going to be high-probability reversal trade as this pair is really stuck in a ranging mode.

Regarding the JPY, there will be a release of the Bank of Japan’s monthly Monetary Policy Statement close to the Tokyo close. Concerning the USD, there will be a release of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time earlier.