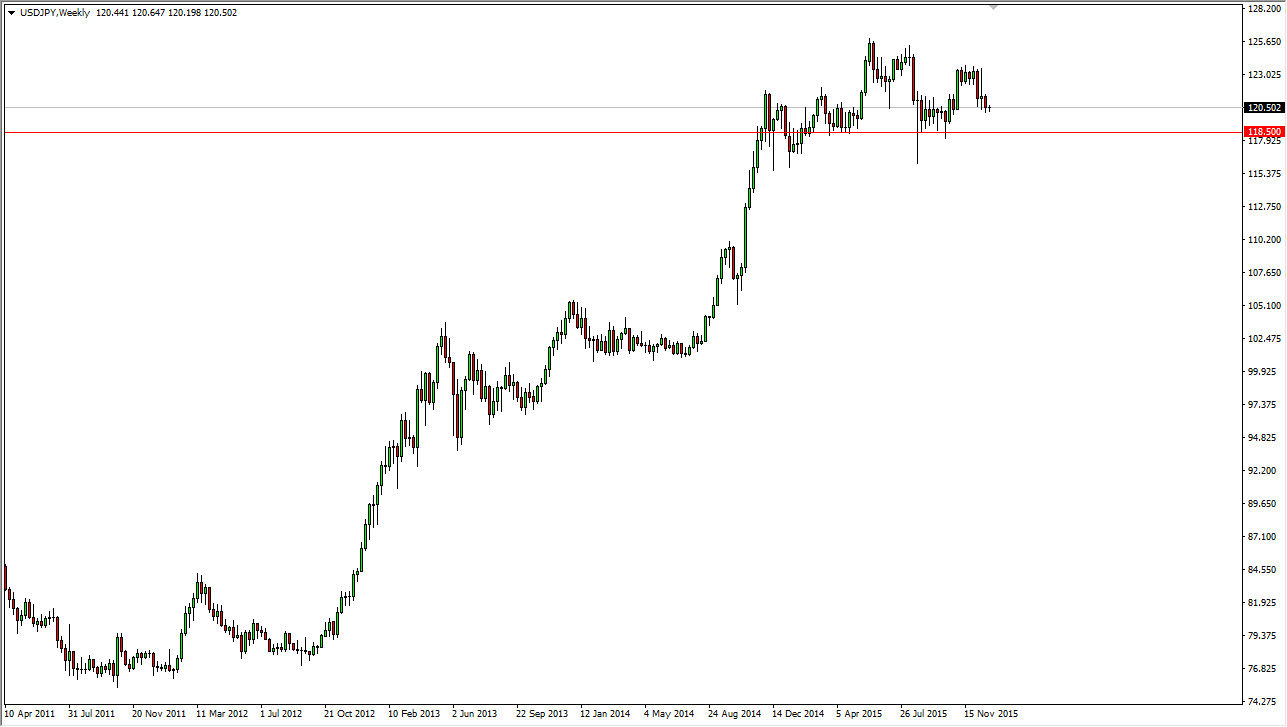

The USD/JPY pair continues to grind sideways overall as the 118.50 level has offered significant support. I believe that this will continue to be the case, and as a result I think that it’s only matter of time before buyers push this market much higher. I believe that the uptrend should continue given enough time, but we may have to pull back in order to find the support near the 118.50 level. A supportive candle should be a buying opportunity, and we should reach towards the 123.50 handle. I also think that the 120 level is psychologically important, so at this point in time I believe that there’s far too much in the way of positivity for the US dollar in general, so I can only buy this pair. I think that the interest-rate differential will continue to push this market higher, so at one point or another the buyers will take over again.

Buying Dips

At this point in time, I believe that the market is one that you can buy dips and, and I believe that the theme going forward will be very much the same. I believe that the month of January will end up being positive, as liquidity should pick up after the holidays. I believe that this market will try to get back to the 1.25 handle and will break above there over the longer term.

Longer-term trend is most certainly to the upside as far as I can see, so once we get above the 125 level I think that it is a “buy-and-hold” situation, but between now and then you will have simply buy dips off of shorter-term time frame such as daily or even four hour charts. It’s really not until we break down below the 115 level that I think the trend would change back to the downside, but at this point in time I don’t see it happening anytime soon.