The USD/MXN pair continues to grind its way higher over the last several months, and I don’t think that January will be any different. After all, the Mexican peso represents a lot of different things, most obviously the crude oil market. Right now, the crude oil market looks like it is continuing to fall apart, and I think that it’s only a matter of time before we go much lower.

With that in mind, this market should continue to gain as the US dollar strengthens overall, and of course the underlying commodity does not help the Peso. However, you also have to keep in mind that the Mexican peso is a bit of a proxy for all of Latin America, which has been struggling lately. The risk appetite out there just simply isn’t sufficient enough to have people buying exotic currencies such as the Mexican peso.

Buying pullbacks

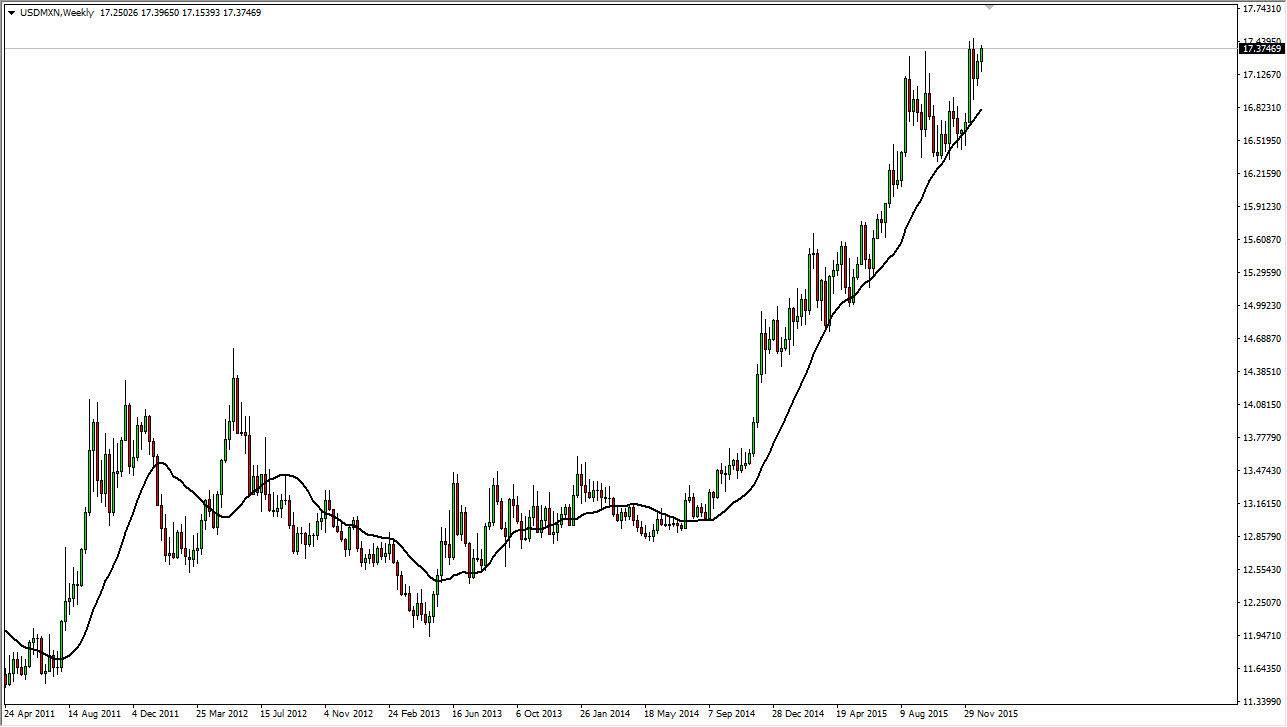

Looking at the weekly chart, you can see that the 20 week exponential moving average has been dynamic support for some time now, and although we are well above the 17 A handle, but the fact is that the Mexican peso continues to soften and there is nothing on this chart that even remotely suggests that we are going to fall for a significant amount of time. In fact, I believe that the 16.25 level is now the “floor” in this market.

If the WTI Crude Oil market can drop below the $35 level, this market will take off to the upside yet again. This is a market that is a bit overextended, but we did spend the last part of summer grinding away to the side, so we could have more momentum going forward. Anytime this market pulls back during the month of January, I’m looking for a supportive candle in order to start buying the US dollar again. I think this is essentially a “one-way trade.”