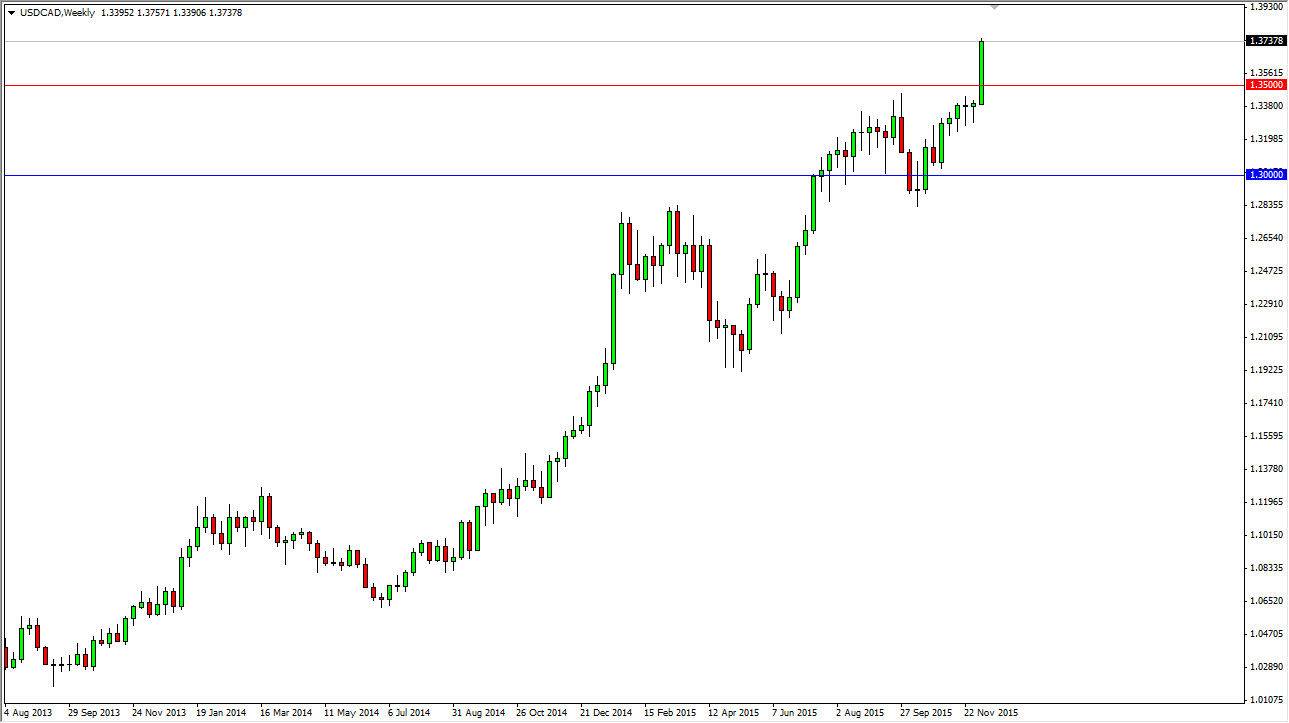

USD/CAD

Without a doubt, this is the most interesting market that I see at the moment. Oil markets are absolutely falling apart and it of course punishes the Canadian dollar in general. Now that we broke above the 1.35 level, I think that anytime this market pulls back you have to start thinking about value. I now have a bit of a floor in this market just below the 1.35 handle, and I think we are eventually reaching towards the 1.40 level given enough time.

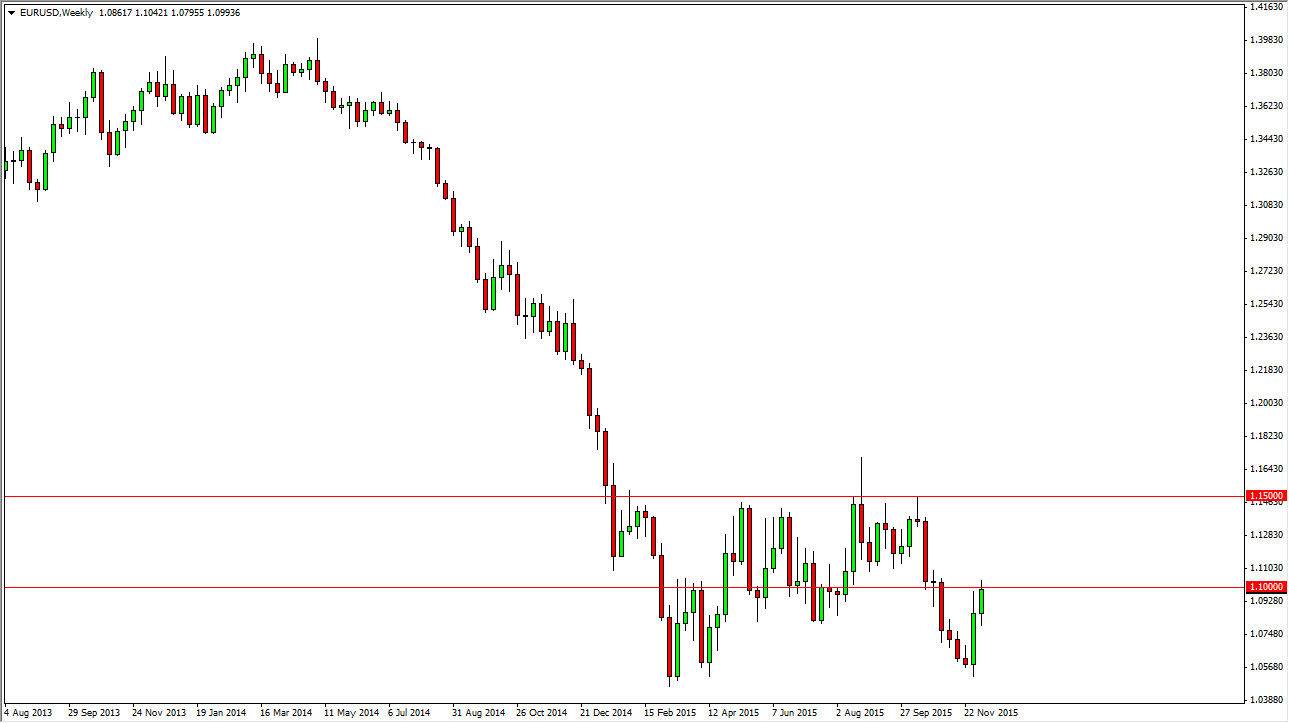

EUR/USD

The EUR/USD pair finished the week in the 1.10 level, a psychologically significant barrier. However, this market does look like it’s trying to break out to the upside and if we can reach above the 1.11 handle, I think that the next move will be to the 1.14 level. I’m not interested in selling this pair, at least not until we clear the 1.08 level to the downside. Regardless, I think you can count on volatility.

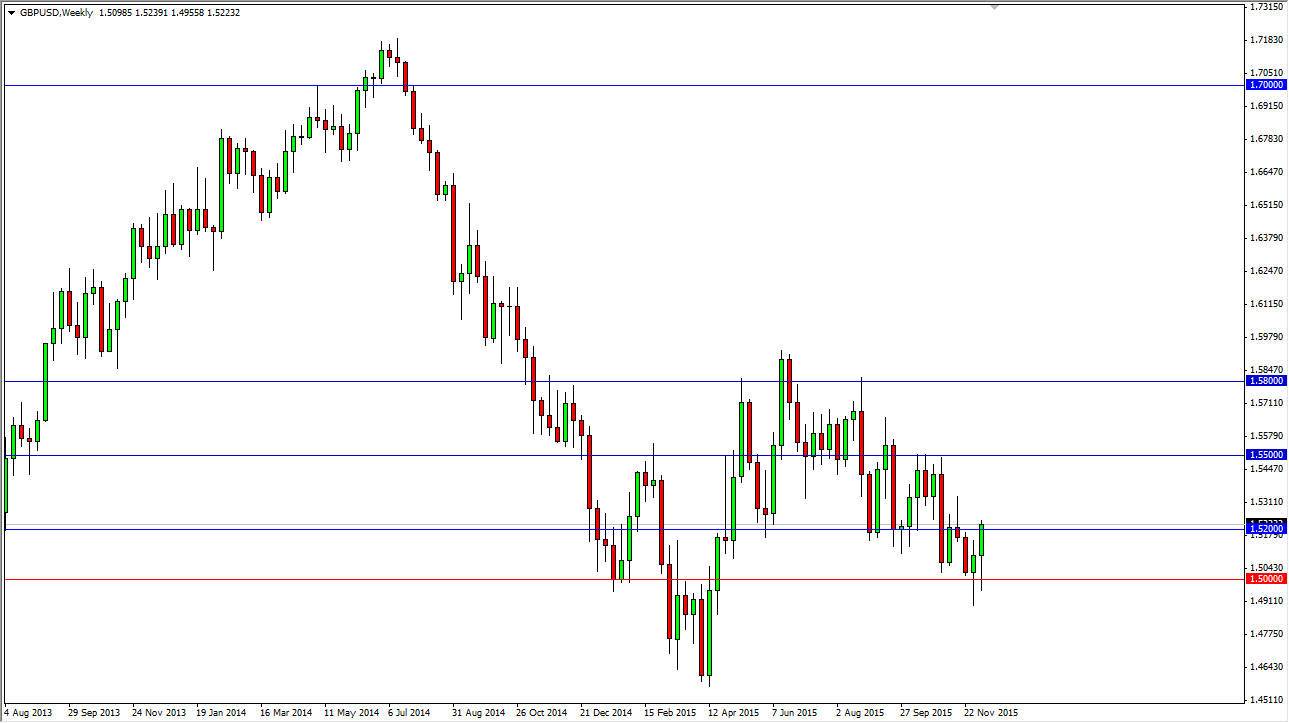

GBP/USD

The British pound initially fell during the course of the week, cracking below the 1.50 level again. However, we turned around and broke above 1.52 by the time Friday closed. I think that we are going to go higher, but it is going to be very choppy. Look for pullbacks as potential buying opportunities.

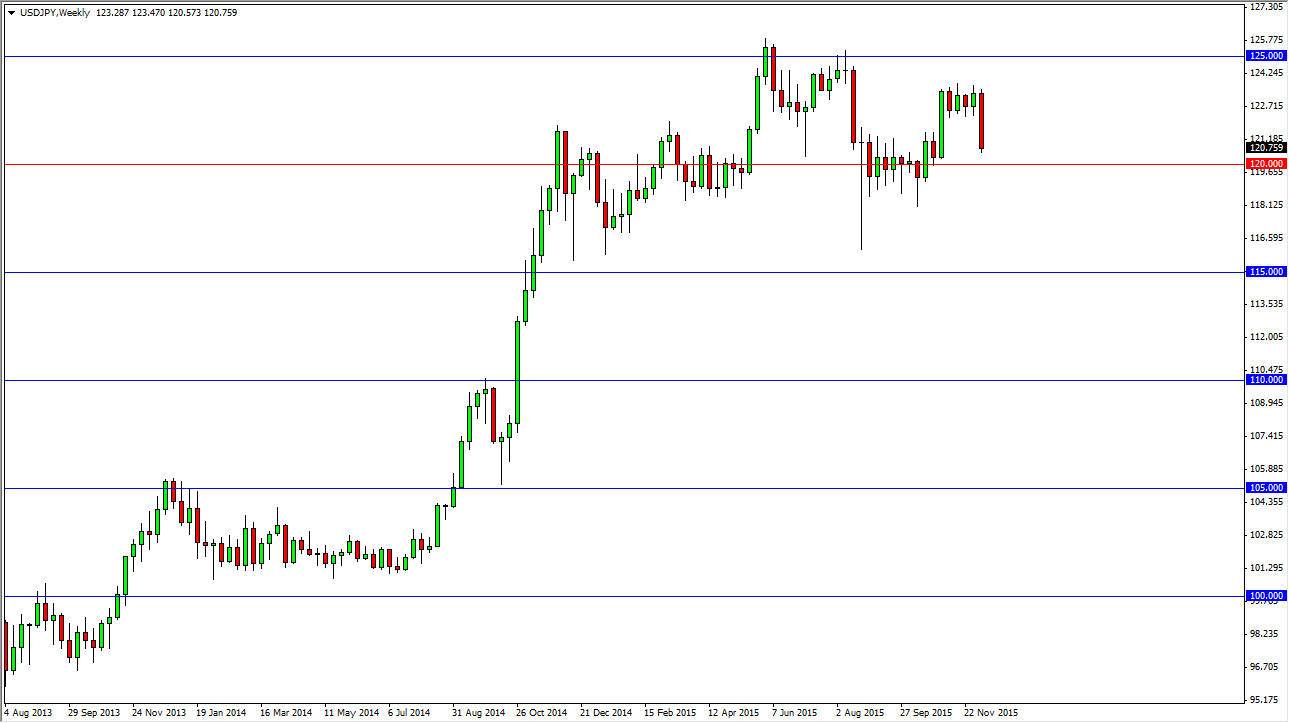

USD/JPY

This pair fell apart during the course of the week, but we still have massive amounts of support on the red line that I have plotted on this chart. The 120 level is psychologically significant due to the fact that it is a large, round, and even number, but I think that the previous support should continue to hold. I’m looking for supportive candles in this general vicinity in order to start buying again. I have no interest in selling this pair until we break well below the 118 handle.