EUR/USD

The EUR/USD pair rose during the course of the week, testing the 1.10 level. However, the market continues to see selling pressure in this general vicinity. Because of this, I feel that we are simply going to continue to bounce around between the 1.08 level on the bottom, and the 1.1050 level on the top. Given enough time, we will break out, but right now I see far too many reasons to think that we will simply grind sideways.

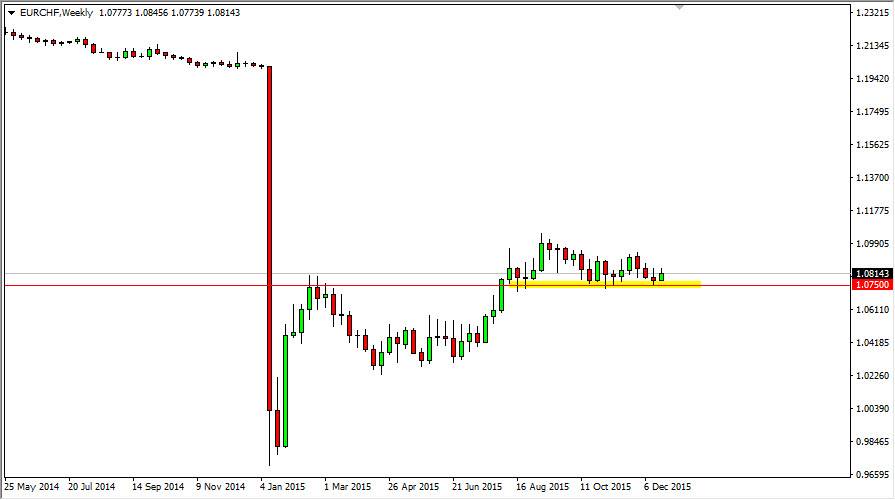

EUR/CHF

The EUR/CHF pair broke higher during the week, as the 1.0750 level continues to be supportive. Because of this, I believe that every time this market pulls back there will be buyers, and that’s probably the best way to trade this market. I would do it from short-term charts though, because quite frankly we don’t look like were in a hurry to break out to the upside for the longer-term move. When we do get above the 1.10 level, that will have happened.

GBP/USD

The GBP/USD pair fell initially during the course of the week but as you can see turned back around to form a hammer. That being the case, the market looks as if it could bounce from here, and quite frankly we could get a bit of a short-term rally. However, think this will be short-term at best, and somewhere near the 1.15 level, perhaps even the 1.52 level, we could see selling pressure. At this point I'm much more comfortable selling rallies that show signs of exhaustion.

EUR/JPY

The EUR/JPY pair went back and forth during the course of the week, ultimately settling on a fairly neutral candle. With that being the case, I feel that the market is simply grinding its way lower, perhaps reaching down towards the 130 handle. I would favor selling in this pair over buying, but either way I recognize that there will be a lot of volatility.