During the day on Monday, the CAD/JPY pair fell rather significantly. In fact, we ended up closing at the very lows of the day, and that of course is a very negative sign. This is a market that is highly influenced by the crude oil markets, and they of course had a bad showing. Keep in mind that Canada is an exporter of crude oil, and Japan is an importer.

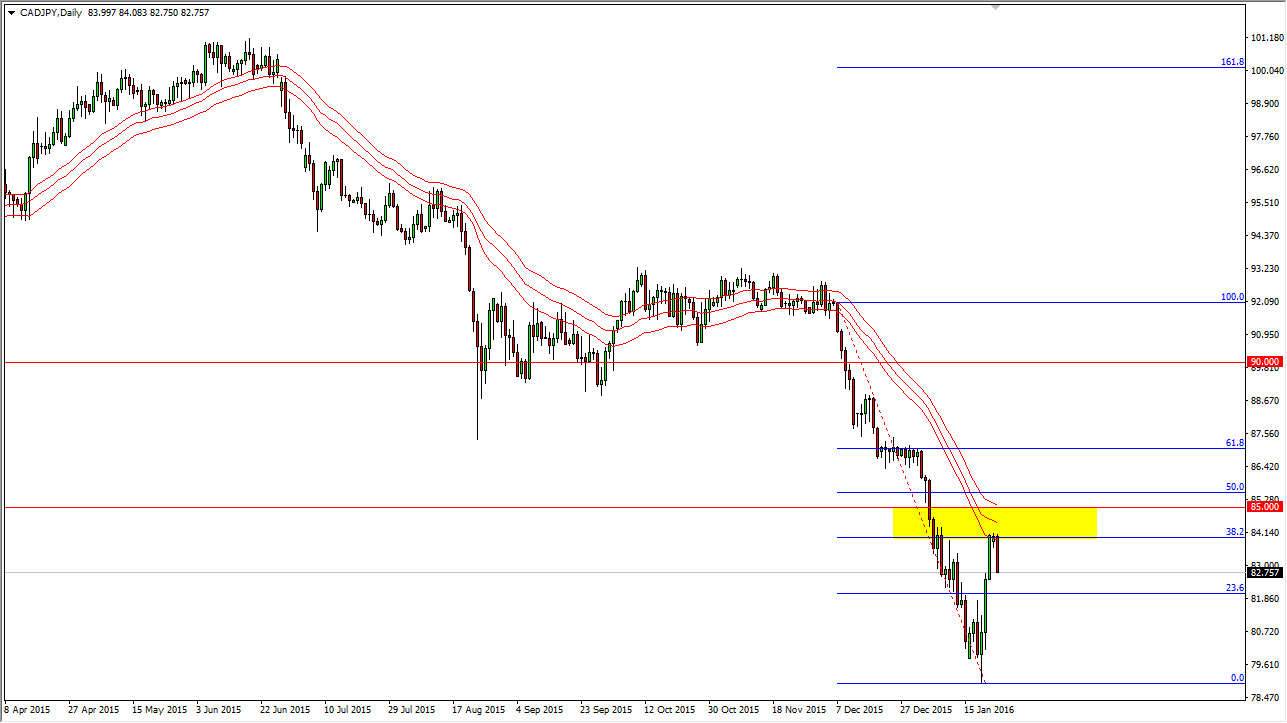

On the chart attached, you can see that the 85 level has been highlighted. This is a region that has a significant amount of noise attached to it, all the way down to the 84 level. The yellow rectangle on the chart is what I think the market is paying the most attention to. On top of that, we also found the 38.2% Fibonacci ratio to be resistive as well.

Longer-Term Downtrend

As you can see by the attached 34 day exponential moving averages (high, low, and close) on the chart, the markets have been very bearish lately and it now appears that the moving averages are continuing to show dynamic support and resistance. Ultimately, I feel that this market continues to go lower since the oil markets are falling apart, and of course the Canadian dollar is used as a proxy.

On top of that, we have a significant amount of fear in the marketplace, and then almost always favors the Japanese yen anyways. With this, I am a seller of short-term rallies, and of course a break down below the bottom of the range for the session on Monday which should symbolize more continuation. I have a target of 78.50 or so, essentially reaching back to the lows that the market had seen previously.

I have no interest in buying until we break well above the exponential moving averages on the chart, and of course show signs of support after that. Given enough time, I think this market continues to go much lower.