While most of you will be familiar with the correlation between the USD/CAD pair and the crude oil markets, the reality is that there are few markets that more represents oil than the CAD/JPY. In order to understand that, you have to recognize that Canada is an exporter of oil as most of you would know, but many of you may not be aware the fact that Japan imports 100% of its crude oil. In other words, this is a highly sensitive currency pair went comes to oil because it represents a pure play on demand.

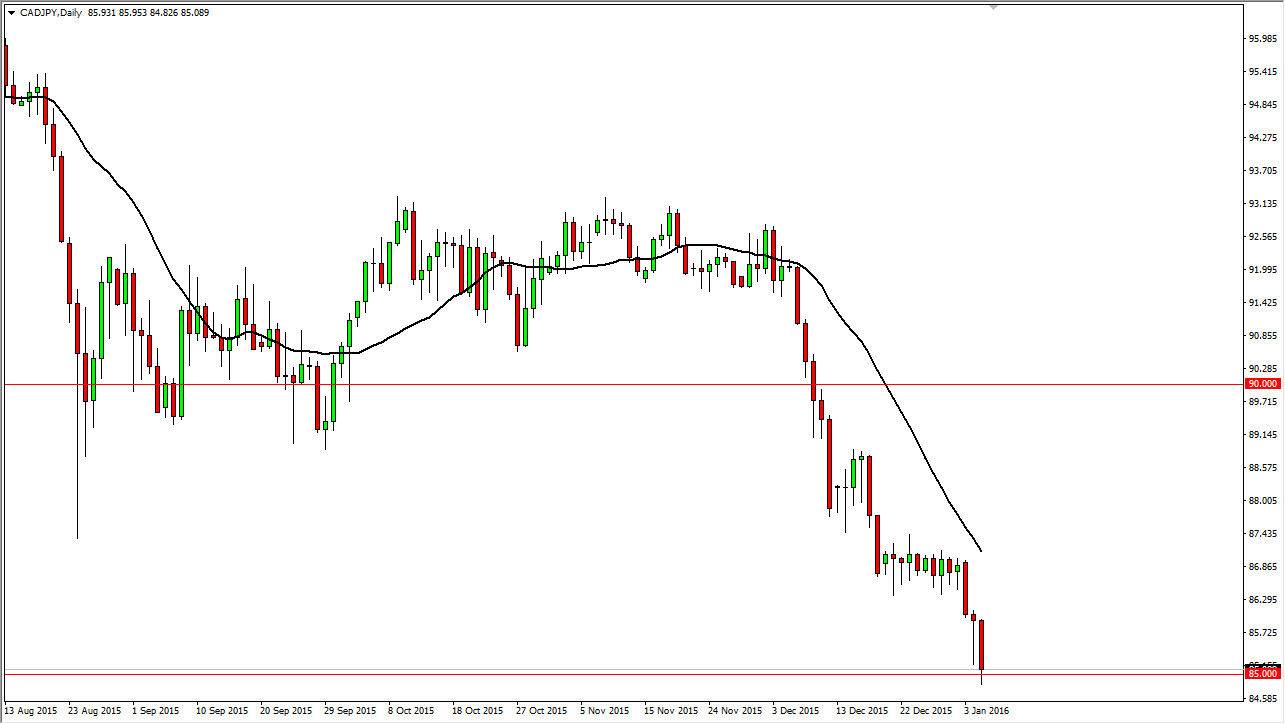

The Japanese yen has been strengthening for some time, but it is especially true against the Canadian dollar. As oil prices continue to fall, it starts to affect the demand for the Loonie, and as you can see we have crashed into the 85 handle. This is a large, round, psychologically significant number, and then of course caused a bit of support during the session on Monday. The resulting Monday candle was a hammer, and that of course is a very bullish sign.

Hammers Can be Negative as Well

Hammers can be negative as well. Better put though, a break down below the bottom of the hammer is very negative. Quite frankly, the only thing that stopped this market from going lower is the fact that the 85 handle was just below. For me, this is an easy trade if we break down below the bottom of the range for Tuesday, as it should show a significant continuation of downward pressure.

The 20 day exponential moving average is currently just at the cluster near 87, so this point in time I assume that the market will not rally beyond there. I like resistive candles on short-term charts in order to sell after small rallies, or of course the aforementioned break down. I believe this pair will target the 83 handle next.