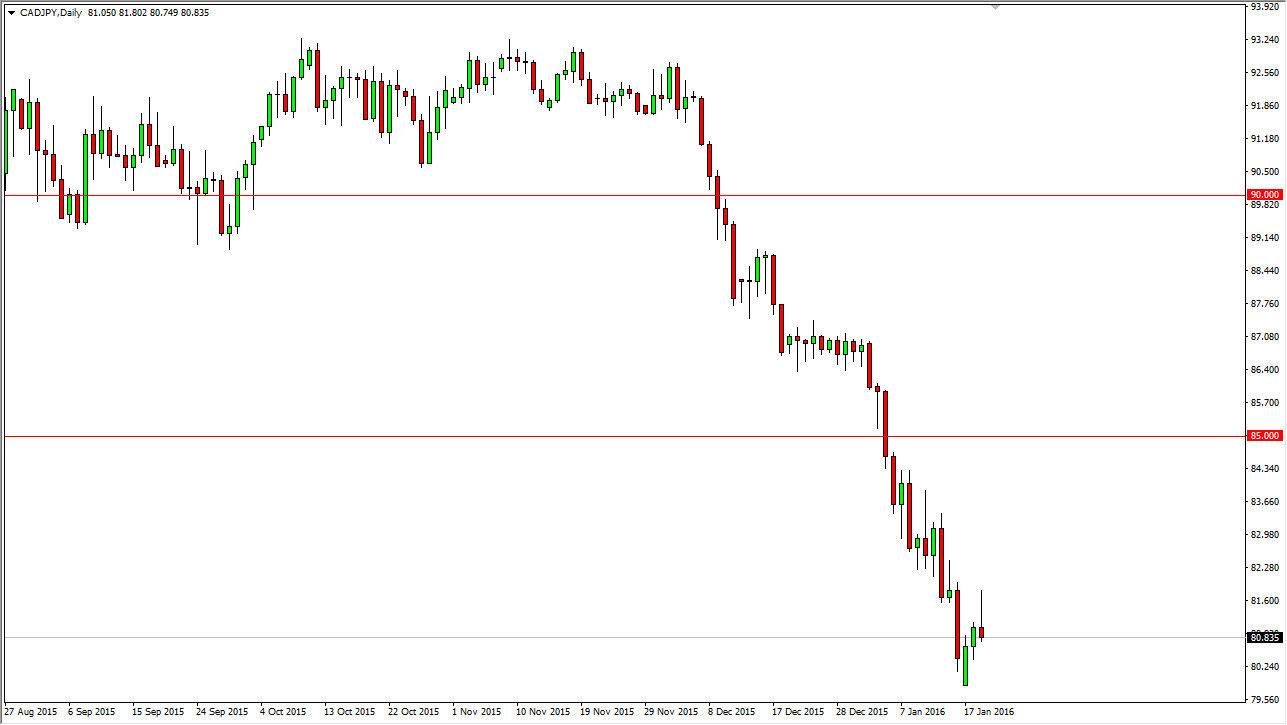

The CAD/JPY pair initially tried to rally during the day on Tuesday, but struggled at the 81.75 region. Because of this, we ended up forming a rather resistive shooting star, which is what I love to see in a downtrend. This shows that the buyers are trying to get into the market and push the Canadian dollar higher, only to fail. With this, we get a bit of a “knock on effect” as the buyers are starting to lose money and will have to close their positions by selling. In other words, it just adds more bearish pressure.

I feel that a break below the lows for the Tuesday session would be reason enough to start selling as the market should then reach towards the recent lows again. I think the market will more than likely not only break down below the region down there, but continue to go even lower.

Selling Rallies

I think selling rallies will be the way to play this market going forward, and every time it rallies on the short-term chart I feel that sellers will get involved yet again. It makes sense, because we do have a major out when it comes to the pricing of oil recently. Remember, the Canadian dollar is highly sensitive to the price of oil, and Japan imports 100% of its petroleum. In other words, this is essentially a reverse image of the oil markets itself.

Even if we broke above the top of the shooting star at this point in time, I feel there is more than enough reason to think that it’s only a matter of time before the sellers get involved. The 85 level above is what I consider the “ceiling” in the market at this moment, and quite frankly don’t even have a scenario in which I’m comfortable buying. I think the Canadian dollar will also be highly volatile today due to the fact that we have the interest-rate decision coming out of Ottawa.