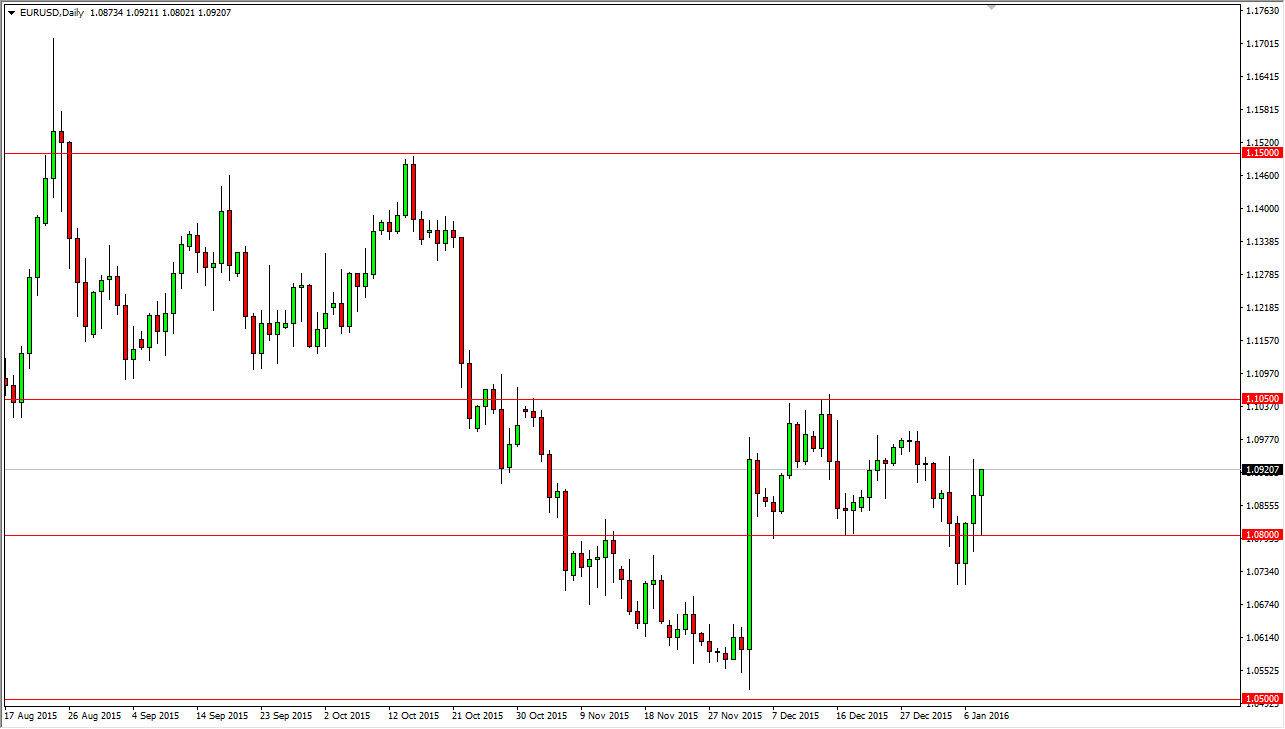

EUR/USD

The EUR/USD pair initially fell during the day on Friday, in reaction to a stronger than anticipated jobs number. Ultimately, we did find enough support at the 1.04 level to turn things back around and form a nice hammer. The hammer of course suggests that the market should continue to go higher, perhaps reaching towards the top of the previous consolidation area at the 1.1050 level. Ultimately, this is an area that the sellers have been very aggressive in, so it’s likely that we could see sellers enter the market in that area. However, it does look at this point in time as the buyers are in control. Because of this, I believe that in the short-term, pullbacks will offer value in the Euro that you can take advantage of. It is not until we break above the 1.1050 level that I would consider buying this market for any real length of time.

GBP/USD

The GBP/USD pair fell significantly during the course of the day on Friday as the jobs number in America was quite a bit stronger than anticipated. With that being the case, the market looks as if it is ready to continue going even lower. After all, we broke down below the bottom of the hammer that formed during the session on Thursday, and that in and of itself is a pretty negative sign. The 1.45 level below of course is supportive due to the fact that it is a large, round, psychologically significant number, so it’s not a surprise that we could not break down below both the hammer and that level on Friday. However, I believe that we most certainly will given enough time.

If there was any place where you would anticipate some type of bounce, it would be here. The fact that we are closing towards the bottom of the candle for the session suggests that we should see continued selling pressure and eventually break down. I am a seller below the 1.45 level. I am also a seller on short-term rallies that show signs of exhaustion.