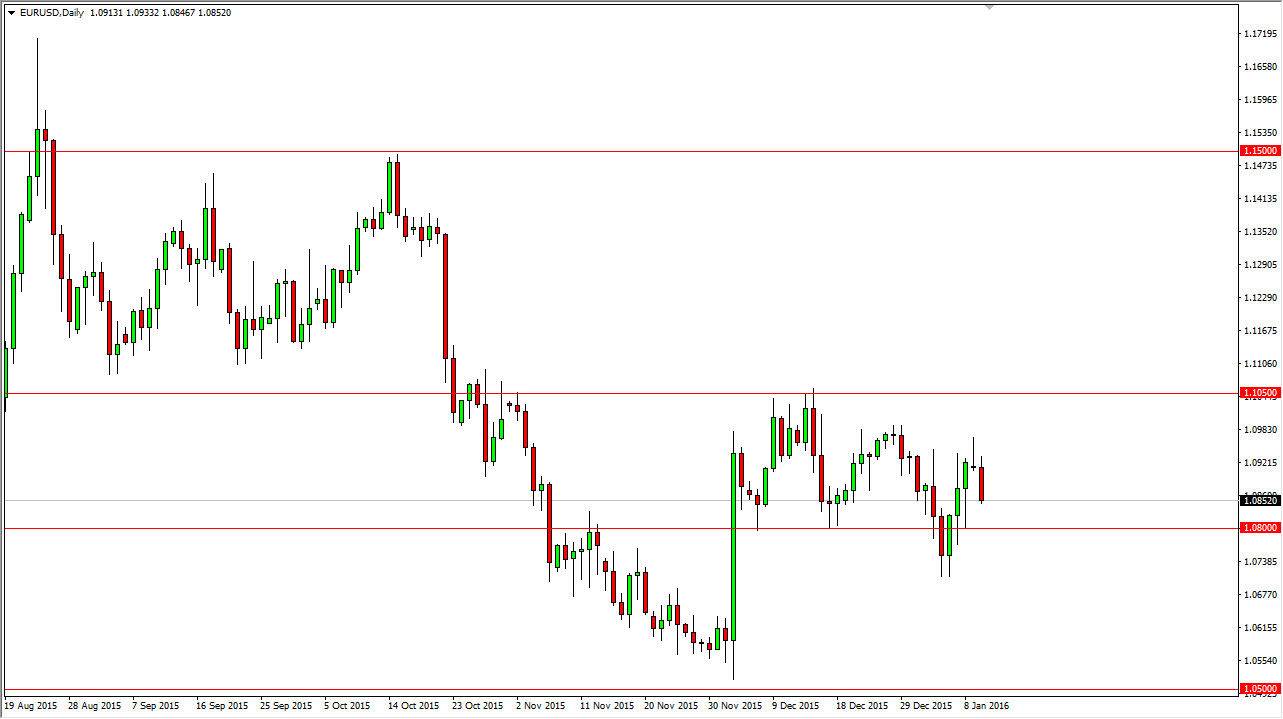

EUR/USD

The EUR/USD pair fell slightly during the day on Monday, as we continue to see sellers step into this market every time we try to rally. However, the market certainly has quite a bit of support just below though, and as a result it makes a lot of sense that we continue to see quite a bit of volatility in this marketplace. I believe that the 50 day exponential moving average and the 100 day exponential moving average will continue to have an effect on this market, so having said that I think that the markets are probably going to be a bit tight.

We have been consolidating between the 1.08 level on the bottom, and the 1.1050 level above. I think in the meantime; short-term traders will probably look to pick up a little bit of profit off of the bounce that should occur somewhere closer to the 1.08 handle.

GBP/USD

The British pound tried to rally during the session on Monday, but turned back around in order to form a shooting star for the daily candle. That being the case, it looks as if the market will continue to soften from here, so I am looking to sell this particular pair. The US dollar of course is very strong, and therefore I think it’s only a matter time before traders return to the safety of the greenback.

The Estimated GDP numbers come out of Great Britain today, so that could have a little bit of an effect on this market. At this point in time though, I believe that every time this market rallies, you have to be looking at selling the British pound. The 1.45 level below continues offer a significant amount of support, so once we break down below there, I am willing to sell this market as we will more than likely reach towards the 1.43 level at that point in time.