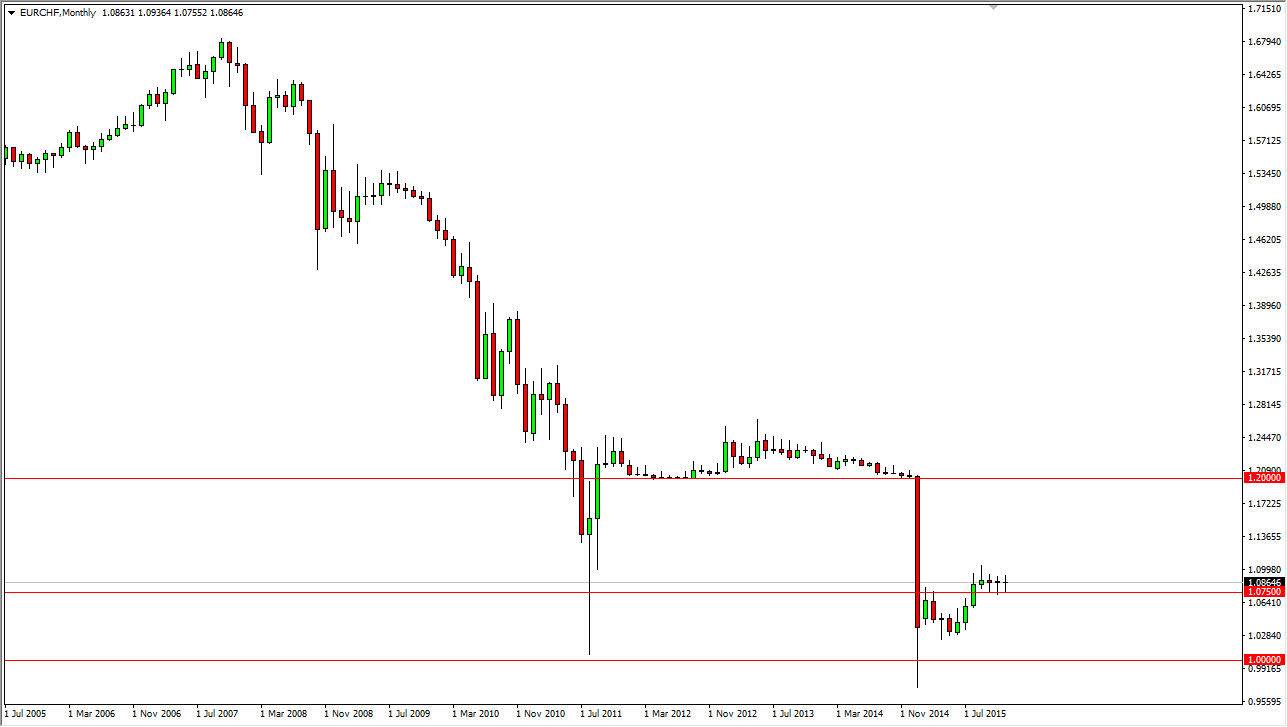

The EUR/CHF pair has been very sideways for quite some time now, as the second half of the year was essentially continued stagnation. Because of this, this has been the domain of short-term traders, but this pair is a little bit different than most other ones in the sense that there is quite a bit of central bank intervention in the form of the Swiss National Bank. While they haven’t explicitly set in, and pretty much made it obvious that the 1.0750 level is now the currency peg in this pair.

When you look at the monthly candle that absolutely collapsed late in 2014, that is a result of leaving the currency peg behind, and the market simply bailing out. That being the case though, there should be essentially a lot of “dead air” in this market, and I believe that we finally get a little bit of momentum to the upside this market should go much higher, probably trying to overtake the 1.20 handle.

Euro

While this pair is of course greatly influenced by the Euro itself, the reality comes down to whether or not the Swiss will be aggressive in their defense on the 1.0750 level, which I personally believe they will. Given enough time, I believe that we will reach the 1.20 level, and I believe it will happen during this year. I have no interest in selling this pair as the Swiss franc is certainly been sold off hand over fist against most currencies, and even while the Euro falls, it simply won’t do it here.

I don’t know that we will get above the 1.20 level for the year, but I certainly expect to see it hit, so obviously selling isn’t even a thought. Ultimately, I think this pair should continue to offer short-term buying opportunities, but once we break above the 1.10 level, I feel that you will be hanging onto a long position and pick up some serious profit.