The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 17th January 2016

Last week I highlighted short GBP/USD and long USD/CAD as the probable best trades of the week. This worked out very well as the GBP/USD pair fell by 1.47% and the USD/CAD pair rose by 2.58%. I also mentioned short USD/JPY as still having some potential, and this did indeed fall by 0.21%.

For this coming week, I see the strong currencies as JPY and USD, and the weakest currencies continuing to be the CAD and the GBP, however I add to this list now the AUD. I prefer to use the USD as USD pairs usually move in a more orderly way than JPY crosses. Therefore my current list is short AUD/USD and GBP/USD, as well as long USD/CAD. The EUR has been showing strength but I do not want to trade it as it looks to be moving in much more slowly than several better alternatives.

Fundamental Analysis & Market Sentiment

The strongest currency is the JPY, but the USD is also strong. The JPY’s strength comes from its reputation as a safety currency rather than from underlying Japanese economic fundamentals. Regarding the USD, the fundamental data could be stronger, however there have been no bad surprises and we now seem to be set on a course by the Federal Reserve of gradual rate rises. The position technically for the USD also looks quite strong. The currency is now trading higher than it was 6 months ago against every major global currency except the JPY and the EUR.

Weaker currencies are very clear: CAD, GBP and AUD.

Canadian fundamentals are poor and the price of oil, with which the currency is very highly positively correlated, continues to reach new multi-year lows, trading below $30 per barrel late last week. Although there has been something of a recovery in recent economic data releases, the economic picture going forward is far from rosy. The Bank of Canada recently stated that it would theoretically consider negative real interest rates should another financial crisis arise, which probably contributed to the latest round of weakening of the currency.

British fundamentals are also looking dubious and the Bank of England is seen as unlikely to raise rates any time soon.

Australia is hard hit by Chinese problems and in fact as the Chinese stock market crashes, it falls faster than anything else, mainly due to the facts that there is a large volume of trade between Australia and China and also because Australia exports a lot of commodities, to China in particular.

Technical Analysis

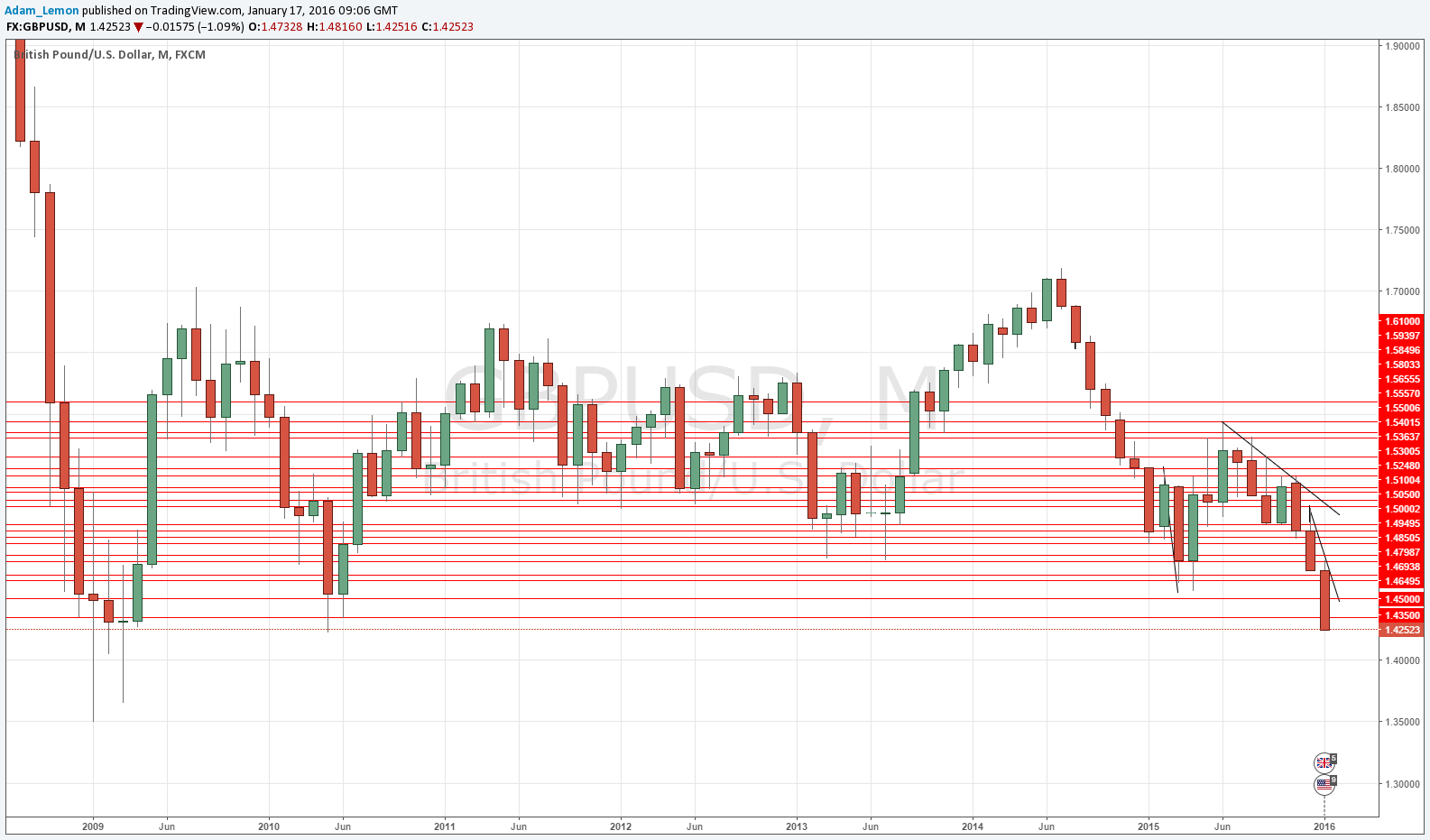

GBP/USD

The price is in a clear, long-term downwards trend, making new lows and breaking through support. In fact the pair made new 5 year lows last week only about 20 pips away from the lowest prices since 2009, as can be seen in the monthly chart below. The price also closed the week right on its low which adds to the bearish picture. It is hard to know where the next support might be, although the 2010 low of 1.4226 might be important.

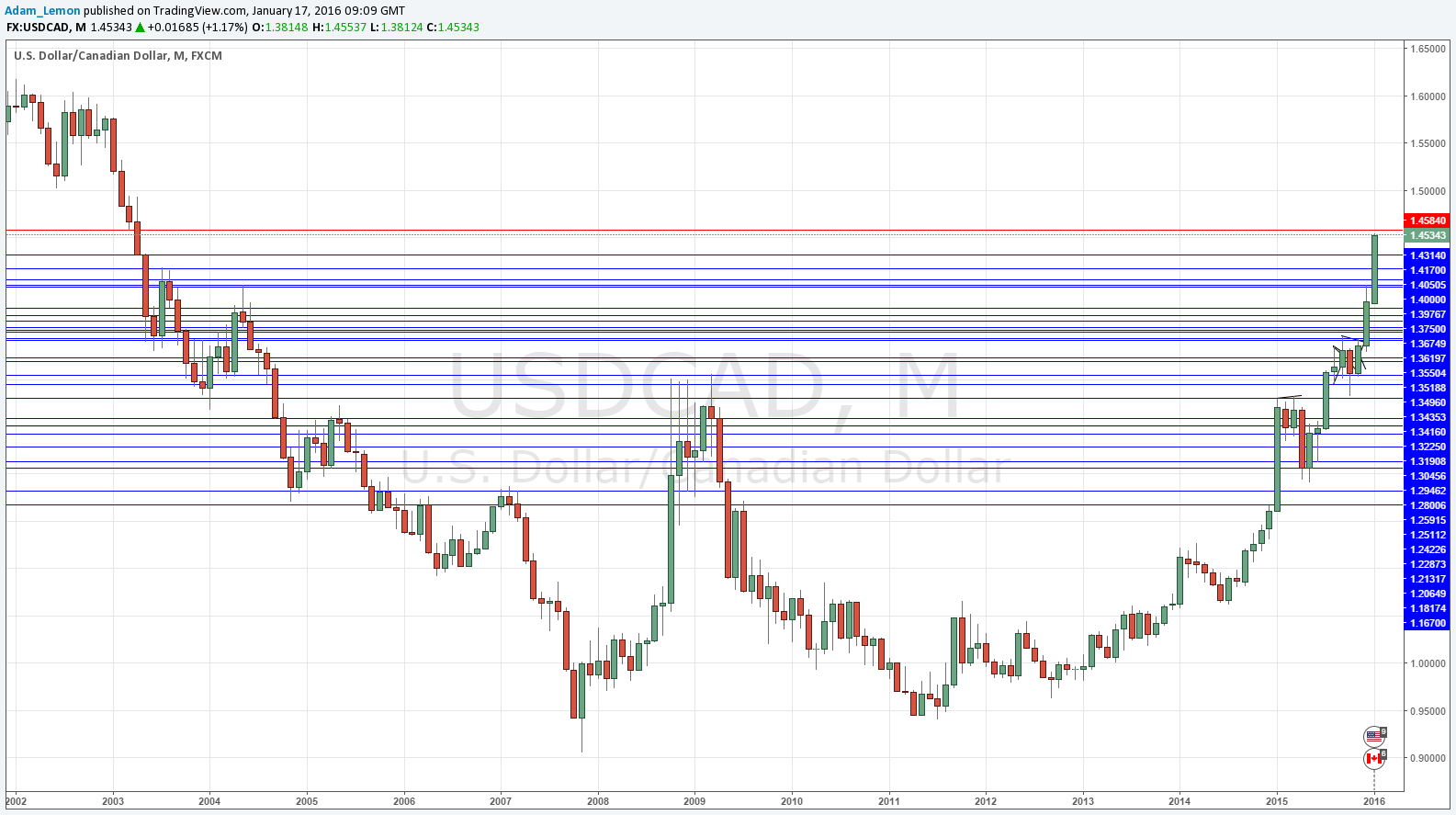

USD/CAD

The monthly chart below shows how we broke up past the resistance at the key psychological level of 1.4500 this week, rising above that level and making new 12 year highs. The price has closed right on its high which is a very bullish sign. The only obvious possible resistance nearby is at 1.4584 but overall this pair looks extremely bullish.

AUD/USD

The monthly chart below shows how we broke down past the year’s low at 0.6907 earlier this week, falling to a new 5 year low. The price has closed close to its low which is a very bearish sign. However there may be some support here at around 0.6850 as it was previously a key monthly high.

The safest trades of the week are probably going to be short GBP/USD and long USD/CAD.