The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 3rd January 2016

Last week I highlighted long UISD/CAD as the probable best trade of the week. This did not work out well as this pair fell by 0.14%. Nevertheless, there is a strong, long-term uptrend here that is still valid and is statistically likely to continue. I also highlighted short GBP/USD as a good trade and this worked out much better, falling by 1.28%, more than offsetting USD/CAD.

This week I see the best opportunity as short GBP/USD. It is in a very strong bearish trend and has made new multi-month lows for each of the past 3 weeks. I also see long USD and short CHF, EUR, and CAD as all having good potential.

This week is the start of a new year and so we may well see strong money flows and volatile markets with lots of movement.

Fundamental Analysis & Market Sentiment

The strong currency is the USD. The fundamental data could be stronger, however there have been no bad surprises and we now seem to be set on a course of gradual rate rises. The position technically for the USD also looks quite strong. The currency is now trading higher than it was 6 months ago against every major global currency except the JPY and the NZD.

Weaker currencies are a little less clear but there are two that stand out: the CAD and the GBP. European currencies in general are fairly weak.

Canadian fundamentals are poor and the price of oil, with which the currency is very highly positively correlated, has fallen to new multi-year lows. Although there has been something of a recovery in recent economic data releases, the economic picture going forward is far from rosy. The Bank of Canada recently stated that it would theoretically consider negative real interest rates should another financial crisis arise, which probably contributed to the latest round of weakening of the currency.

British fundamentals are also looking dubious and the Bank of England is seen as unlikely to raise rates any time soon.

Swiss fundamentals look poor and the country has a negative interest rate. The fundamental picture is similar for the Eurozone but is looking a little improved.

Technical Analysis

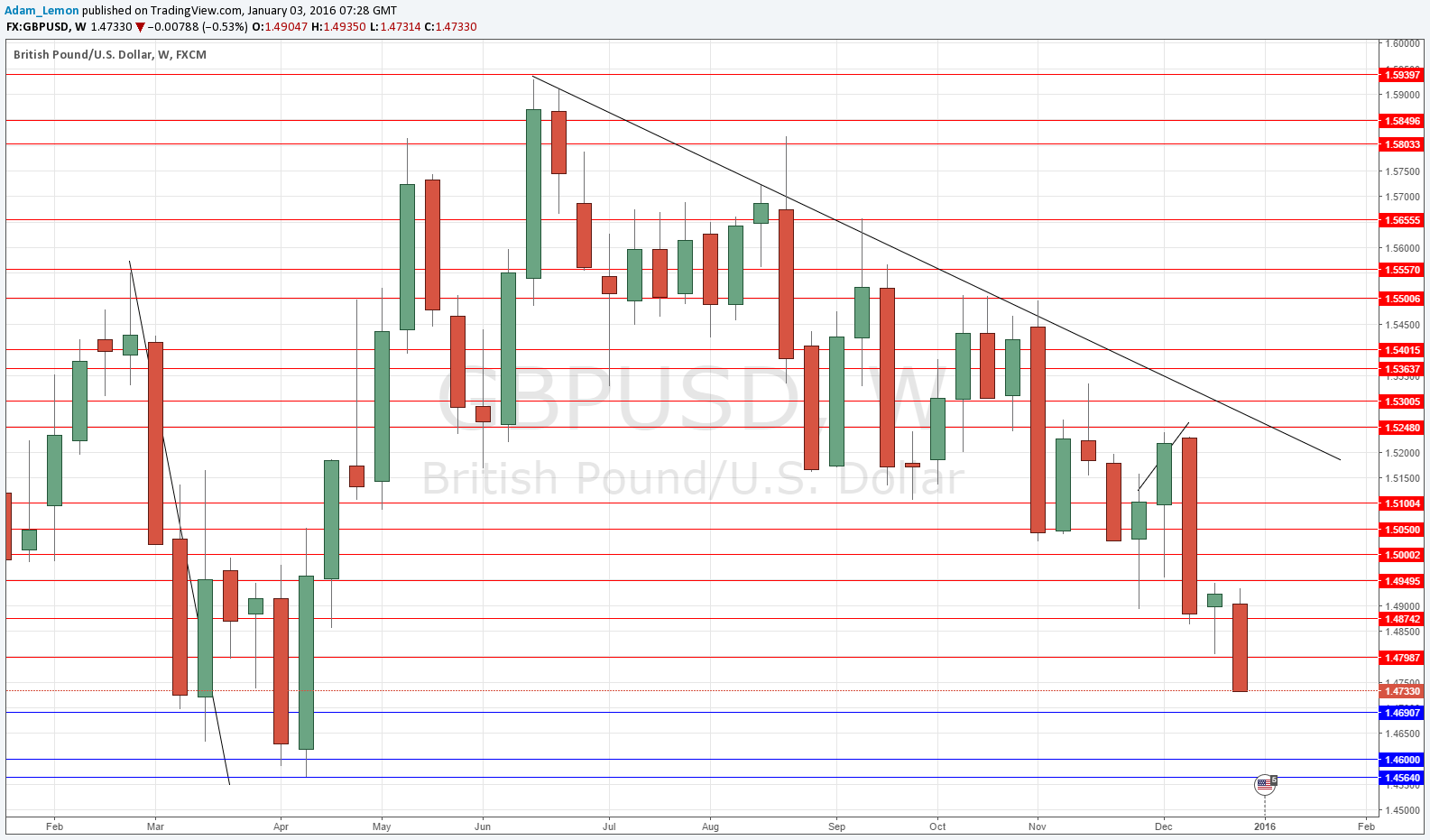

GBP/USD

The price is in a clear, long-term downwards trend, making new lows and breaking through support at around 1.4800 that held for a few days. The price also closed the week right on its low which adds to the bearish picture. We are getting close now to the lows you can see on the left of the chart which are actually multi-year lows. There is a first level of support at around 1.4700 but the area around 1.4600 to 1.4564 will probably see a meaningful rebound and profit-taking, so it may be hard to move below those prices.

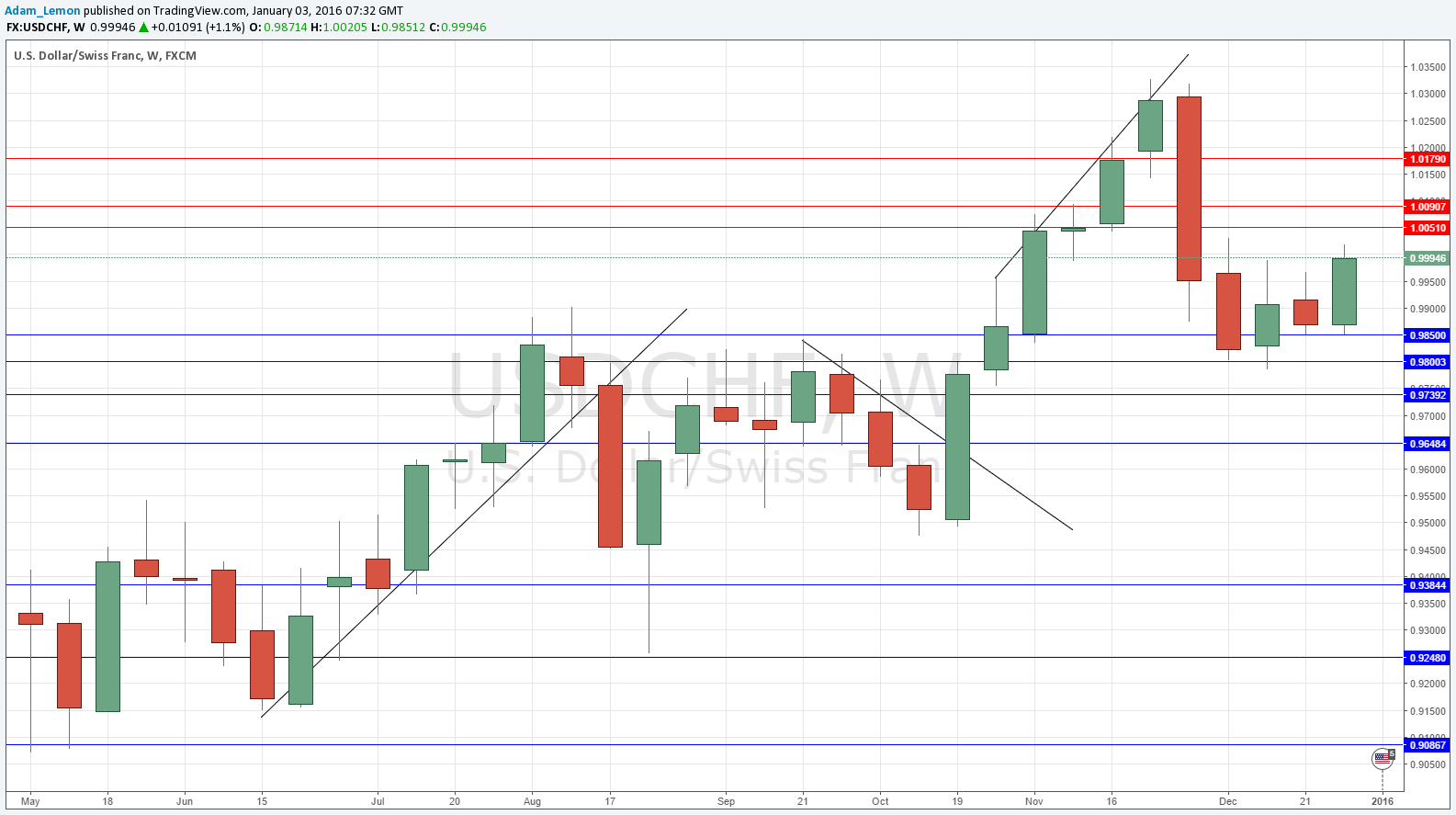

USD/CHF

The weekly chart below shows how the 0.9800 level has held as support, in spite of the sharp fall off from the recent highs made in the long-term upwards trend. It had acted as good resistance during August and September and now it has flipped. The price hovered around 0.9850 for quite a while last week and has now moved up with momentum. It looks like a good buy on pull-backs as the long-term trend is reasserting itself.

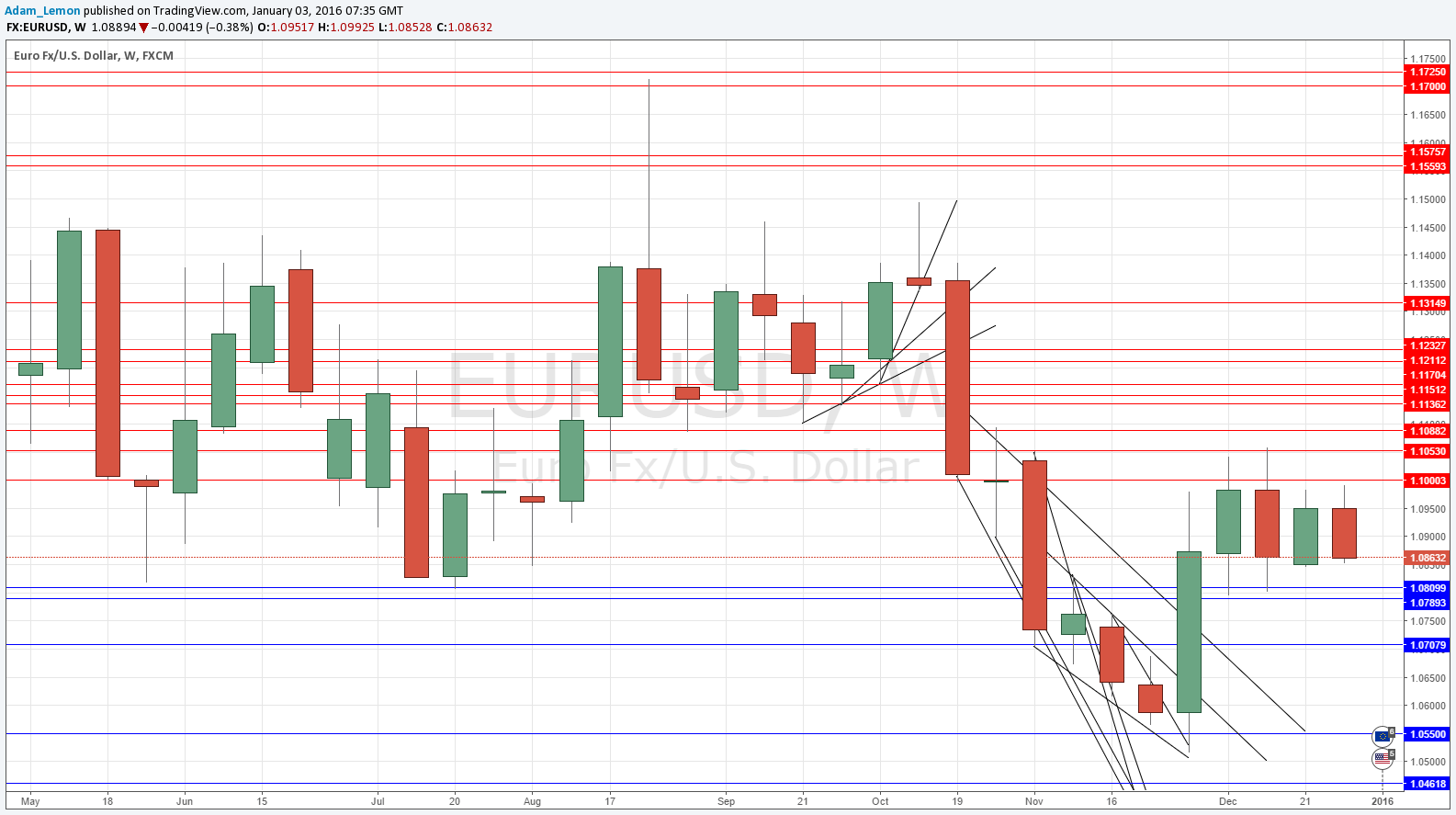

EUR/USD

The weekly chart below shows something very similar to USD/CHF, which is not surprising as CHF and EUR are so highly positively correlated. However I am more cautious here than I am with USD/CHF because we can see from the chart below there is a significant area of support at around 1.0800 that is very strong and crucial. I think we will get down there, but whether we will break down past it is another question. Note how it has acted as both resistance and support a few times over recent months.

The safest trade of the week is probably going to be short GBP/USD.