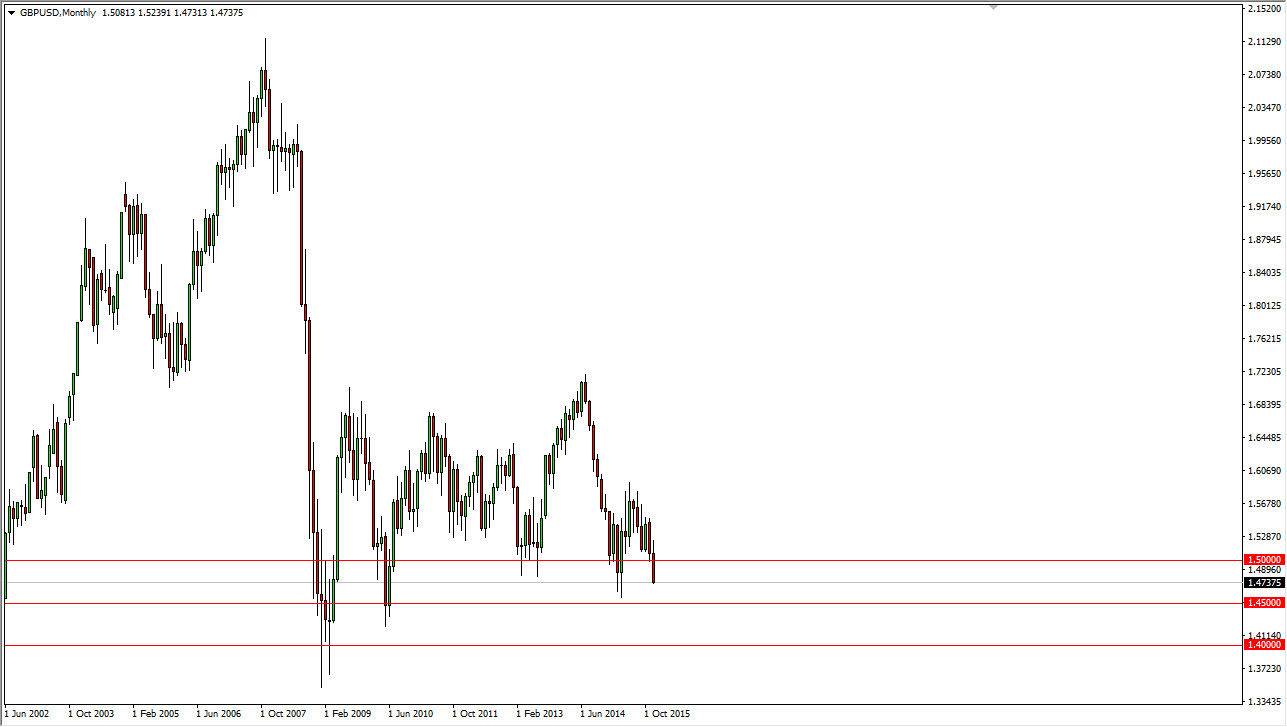

The GBP/USD pair has fallen significantly over the last several months, as we are now well below the 1.50 handle. However, I think that we are starting to get to the point where the buyers will reenter the market fairly soon. What I mean by this is that the 1.45 level should be supportive as it has been in the past, and most certainly below where the 1.40 level will be. I think that’s this may be one of the first currencies to rally against the US dollar later in the year, but the one thing that I do know is that it will be very volatile on the way down.

When you look at the monthly chart attached, you can see just how depressed the value of the British pound is, and therefore I think that it is quite a bit oversold at this point. Given enough time, the rallies will calm, and when they do they could be very violent.

Federal Reserve

I think that the Federal Reserve will have a part to play in this, and as a result there are several things it could happen. However, I think that the Federal Reserve may find themselves in a situation where they cannot raise interest rates quickly enough to pacify more US dollar strength, at least against some of the other currencies that may not be from economic conditions that are as bad as people believe at the moment. I think that the United Kingdom is one of these rare exceptions, so it’s only a matter of time before the markets realize that the British pound is oversold. I don’t think that this is going to happen anytime soon, and I expect a fairly quiet yet negative beginning of the year. By the time the market closes at the end of 2016 though, I fully suspect that this pair will be back above the 1.50 level. However, I think that it is going to be difficult to hang onto any long-term trade until at least March.