Gold Find Support at $1080

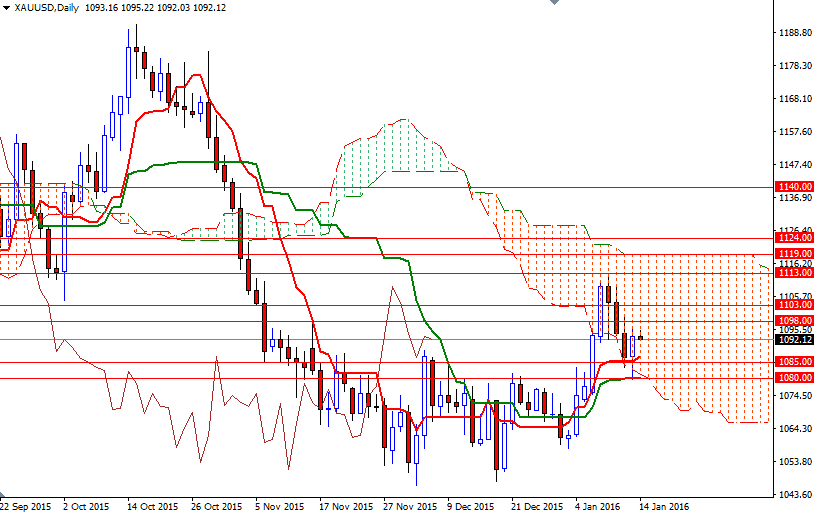

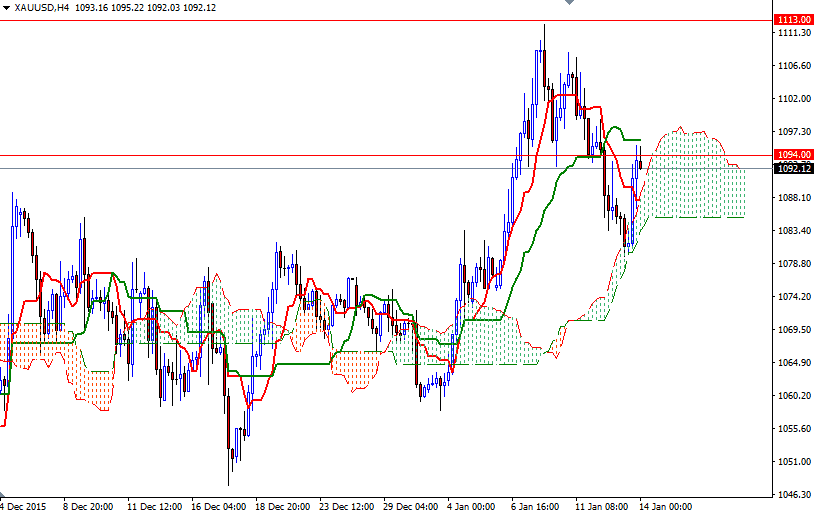

Gold prices rose on Wednesday, breaking a three-session losing streak, as the rout in global stocks fueled demand for the perceived safety of the metal. The U.S. dollar index retreated from a one-week high and the deepening slide in oil prices, along with concerns about China's economy rattled global equity markets. The XAU/USD pair initially fell but bounced up quite nicely from the anticipated support level at 1080 - where the daily Kijun-Sen (twenty six-period moving average, green line) and the bottom of the 4-hourly Ichimoku cloud converged.

Technically these clouds not only identify the trend but also define support and resistance zones. So, unless we fall through 1080 convincingly, the downside will be limited. In other words, this is a key support that the bears have to capture, if they intend to put more pressure on the market and make an assault on the 1075 level. A daily close below the 1075 level means it is likely that we will see the XAU/USD pair testing the next support at 1068.

On the other hand, if the market continues to rise and break out above the crucial 1098/4 area, then we are likely to proceed to 1105.50 - 1103. Breaking through this former support/resistance is essential for a bullish continuation. In that case, the next stop will probably be the 1113 level.