Gold prices settled at $1117.83 an ounce on Friday, making a gain of 1.8% on the week and 5.2% over the month. The precious metal's gains were mainly driven by the risk-off sentiment in the markets. Investors channeled some money into the safe-haven metal in order to diversify their assets amid resurgent financial market volatility emanating from China and heightened geopolitical tensions. The metal also got a boost last week after the Federal Reserve said it was looking at international conditions and their impact on the U.S. economy. The Federal Open Market Committee (FOMC) kept an optimistic view on the economy but stated that "In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal."

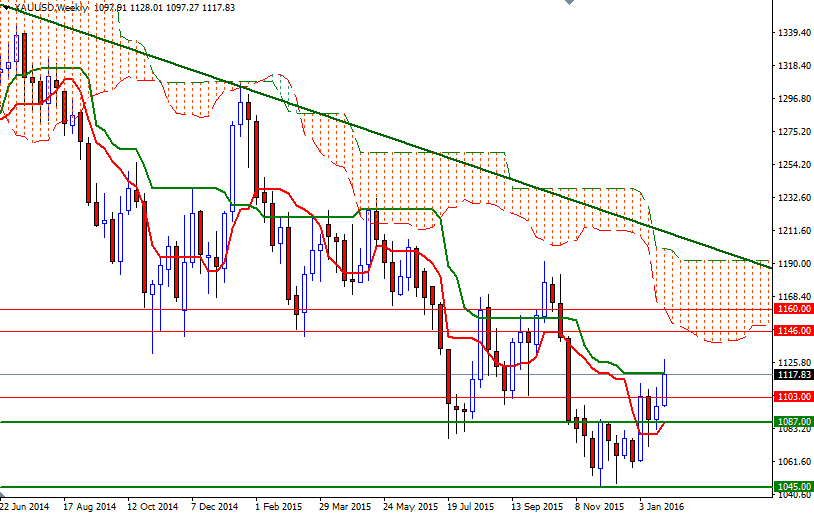

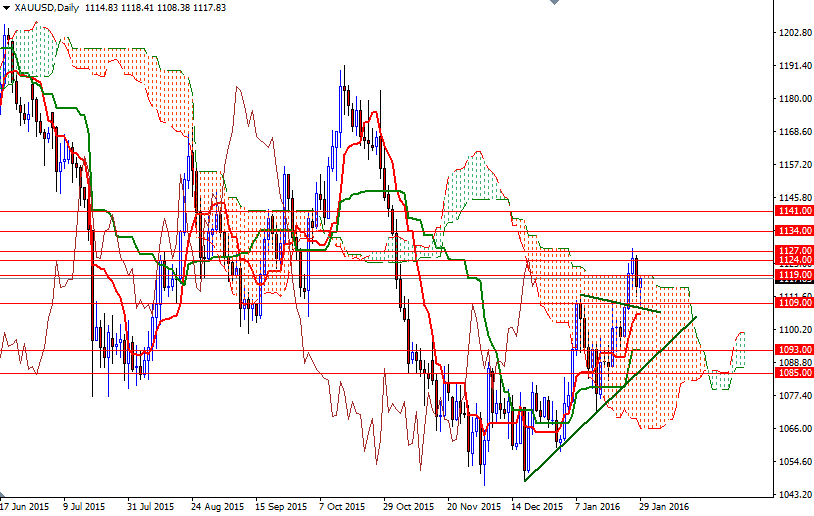

Although some people feel that the labor market's resilience could persuade Fed policymakers to hike rates in March, recent sluggish economic data and sliding inflation expectations add to the case for a slower tightening path. That could support the market in the coming weeks and push prices towards the weekly Ichimoku cloud. If you look at the daily chart, you see a sustained upwards move in the XAU/USD pair that has been supported by a bullish trend-line for almost seven weeks. The first important hurdle gold needs to jump is located in the 1127/4 region, where the market found resistance last week. A successful break up above 1127 should prolong the bullish momentum and pave the way towards the 1160/46 area.

On the other hand, if the bears successfully defend the 1127/4 barrier and increase the downward pressure, the market will probably head down to 1109/8. There is an area below at 1103/0 that should provide support and a crucial one at around 1093 where the bullish trend-line and a horizontal support converge. If it can't trigger another bullish bounce, then the XAU/USD pair will eventually fall to 1087/5 zone that had acted as both support and resistance.