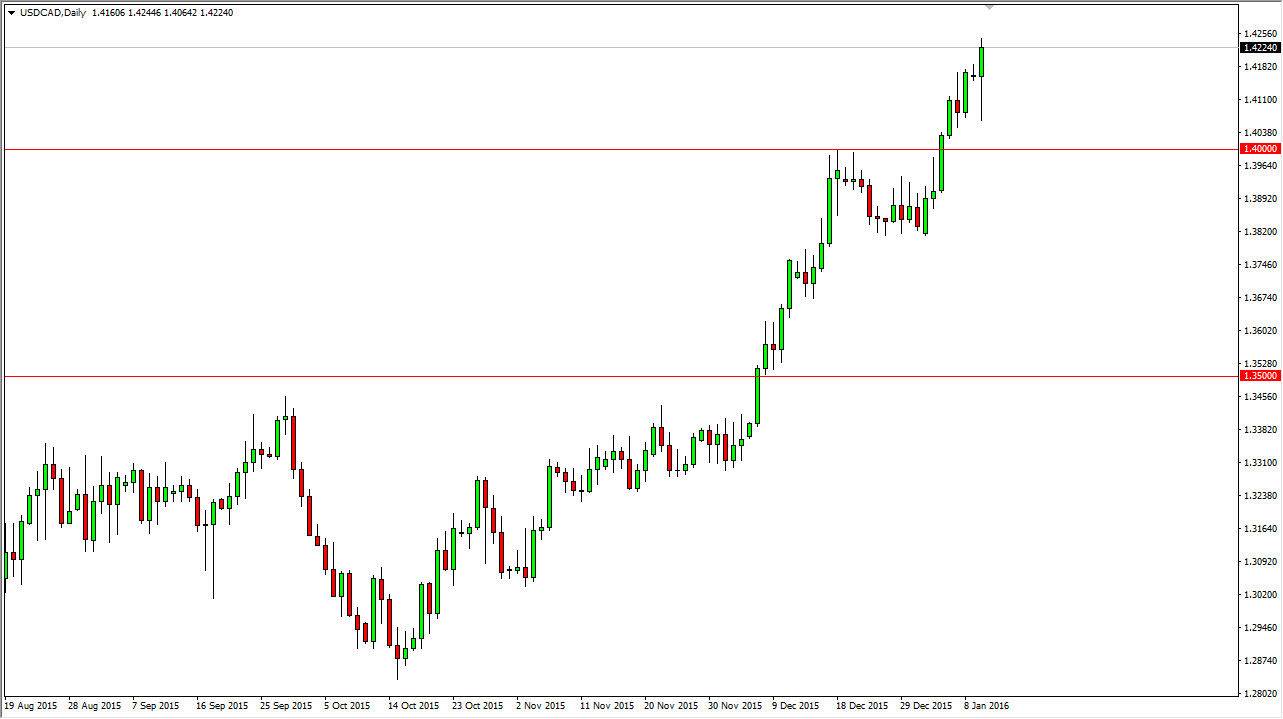

The USD/CAD pair continues to be one of my favorite trades, as you can see the market has been very reliable to the upside. After all, the US dollar continues to show strength in general, and at the same time at the Canadian dollar has been absolutely horrible as the biggest driver of the Canadian dollar is of course the crude oil market.

The crude oil market continues to fall, and as a result the Canadian dollar has been punished. We are above the 1.42 level, which had previously been somewhat resistive. Now that we are broken above there, I believe that we will then reach towards the 1.45 level, as it is the next large, round, psychologically significant number and of course was important on the way down. That tends to be the case, as a phenomenon known as “market memory” is one of the most reliable technical analysis tools.

Oil Continues to Drive this Market

The oil markets falling through the $32 level in the WTI grade during the session on Monday is of course another reason why we will go lower in that market, therefore going higher in this one. The fact that we pullback and bounce significantly in this market shows just how much interest there is in buying the US dollar over the Canadian dollar, so having said that it is very likely that the uptrend should continue with quite a bit of momentum in the next several sessions.

I believe that the 1.40 level below is essentially the “floor in this market”, and with that I believe that as long as we can stay above there, the market is one that you can buy on dips, as we continue to see bullishness in the US dollar overall. I see no reason to short this market, and even if we break below there, I think that the support goes all the way down to the 1.38 handle.