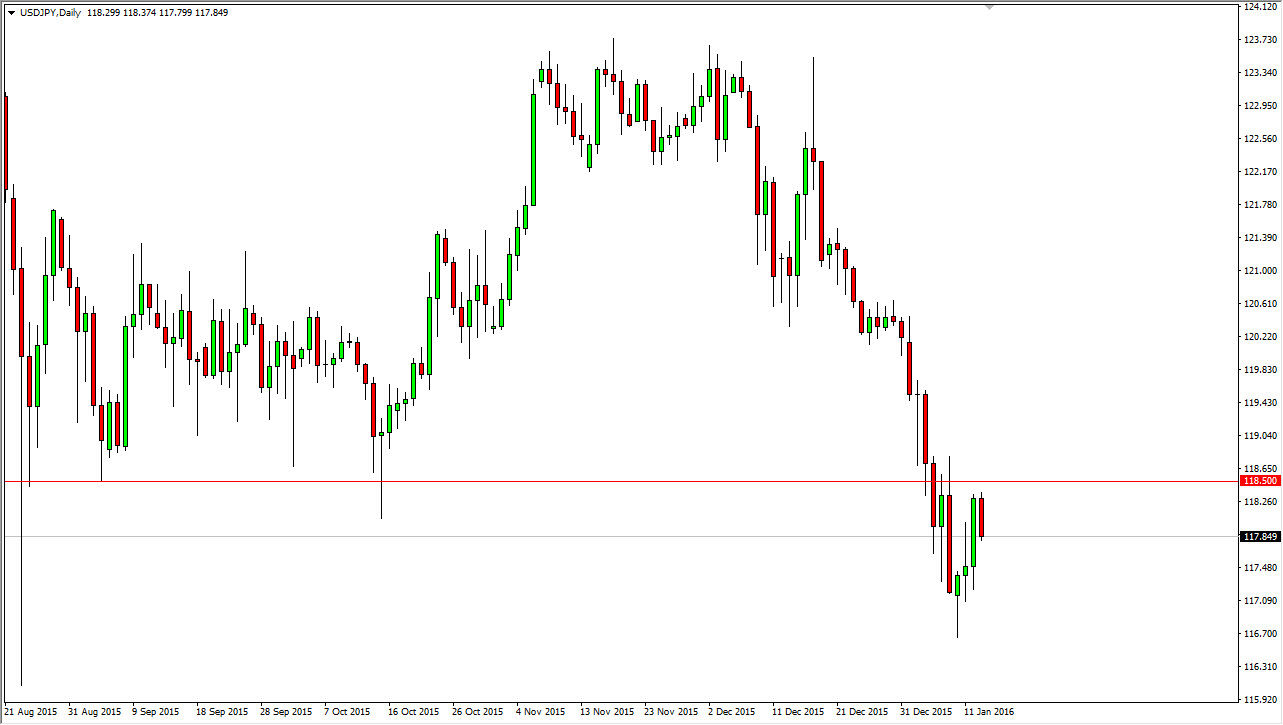

USD/JPY

The USD/JPY pair fell during the course of the day on Wednesday as the 118.50 level continues offer significant resistance. That of course is a sign of continuation of the downtrend, as breaking below the 118.50 level was indeed significant. The real question at this point for me is going to be whether or not we can continue to go much lower. I don’t think we will, but I do think that a move to the 115 level is probably realistic.

In the meantime, I believe that short-term traders will push this market to the 116 handle, and as a result short-term traders will probably do quite well. I believe that buying this pair is going to be almost impossible until we break above the 119 level above, which would be a reentry into the previous consolidation zone that the market had been stuck trading in for quite some time.

AUD/USD

The AUD/USD pair continues to look very bearish as we sold off during the session on Wednesday. Recently, we had broken down below and uptrend line that I thought was rather important, and since then we’ve seen quite a bit of selling pressure. What I find interesting is that during the day on Wednesday the string dollar fell while the gold markets actually had a very substantially supportive candle form. The 2 markets typically follow each other, but recently we’ve seen quite a bit of a divergence.

I think that the key for Australian dollar buyers will be China. Recently, the numbers out of China have been very poor so the Australian dollar suffers as a result as most currency traders will use the Aussie dollar as a proxy for Chinese demand. After all, the Australians provide quite a bit of raw materials for the Chinese to produce the world’s goods, and at this point in time there just seems to be a serious lack of demand. I believe selling rallies and breakdowns will be the way forward.