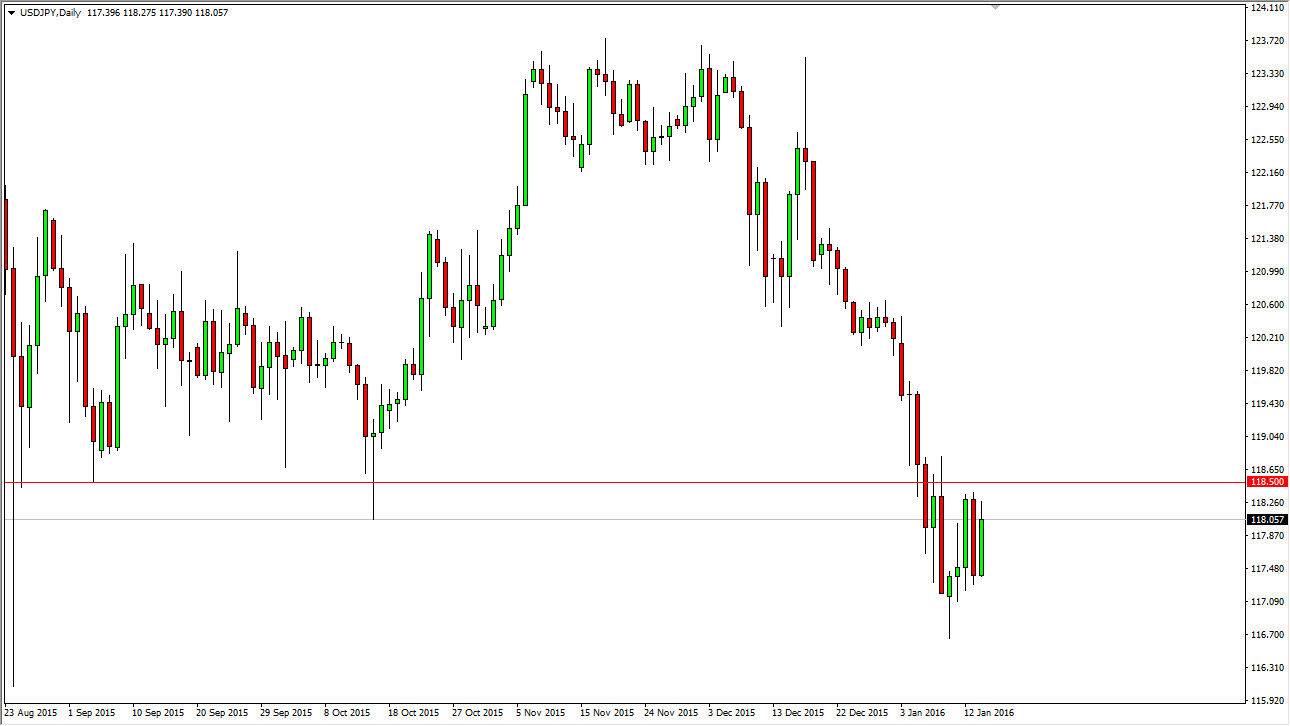

USD/JPY

The USD/JPY pair rallied during the session on Thursday, as we try to break above the 118.50 level. This was an area that was a significant support level that the market had followed for some time, and now should be massively resistive. Any type of resistive candle in this area should be a selling opportunity as the market can simply continue to grind away sideways overall.

If we do break down below the bottom of the hammer at the bottom, the market should continue to go towards the 115 level. Given enough time though, I do believe that this market will rally but right now it’s pretty difficult to imagine any real signs of strength as there is more than enough fear out there to keep this pair lower. However, if we can get above the 119 level I will start buying without hesitation as it would show a significant amount of momentum building.

NZD/USD

The NZD/USD pair fell during the day on Thursday, but found the 0.64 level supportive enough to keep the market afloat. After all, we ended up forming a hammer and that of course is a very bullish sign. I believe that this is the opportunity that those of you who are bullish of the New Zealand dollar happen waiting for. If we can break above the top of the hammer, and more importantly the 0.65 level, I believe that this market will probably try to grind its way back towards the 0.69 level which is the top of the overall consolidation that this market has been in since late September.

If we managed to break down below the 0.64 level, I feel that the market will then reach towards the 0.6250 level, and then possibly the 0.60 level after that. Keep in mind that the New Zealand dollar is highly sensitive to the overall attitude of commodity markets in general, and as a result we need to pay attention to those.