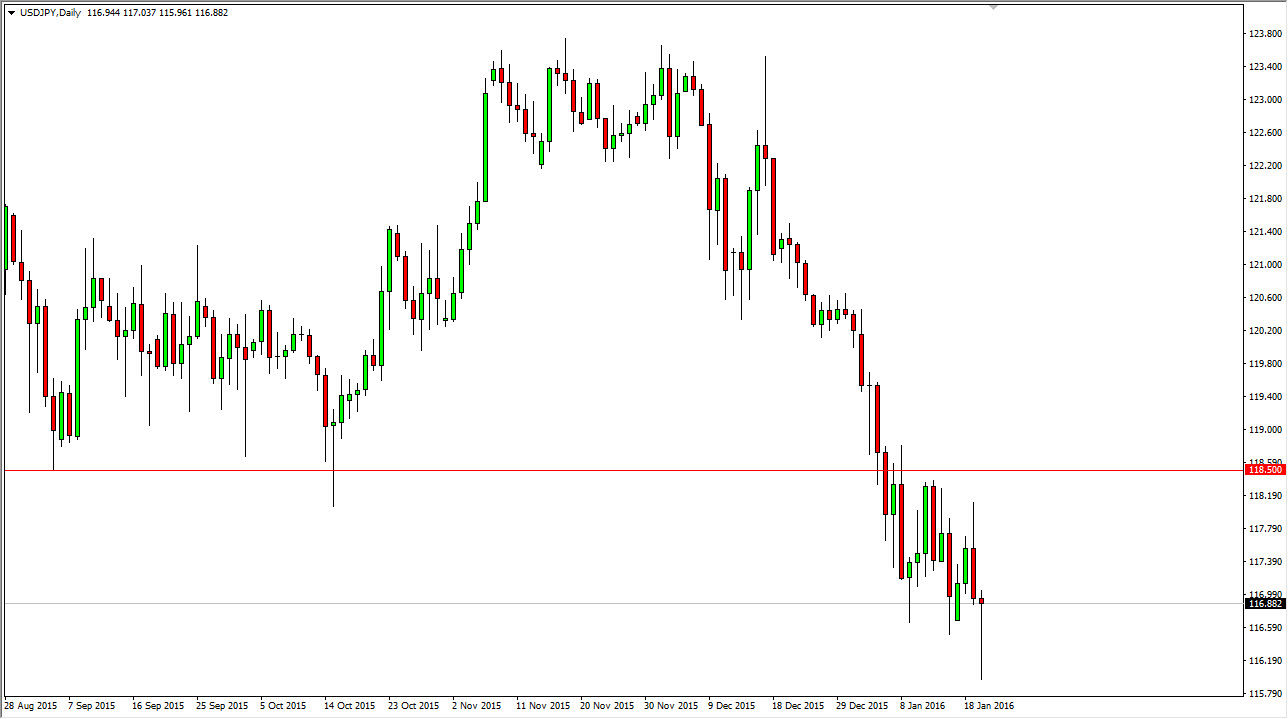

USD/JPY

The USD/JPY pair fell rather significantly during the course of the day on Wednesday, but turned back around as the 116 level below offered quite a bit of support. By doing so, we ended up forming a nice-looking hammer, which is of course significant, as it shows that the buyers are stepping back into this marketplace to pick up perceived value in the US dollar.

Having said that, I believe that the 118.50 level above is essentially the “ceiling”, so given enough time I think it’s enough to keep this market consolidating. I believe that a break above the top of the hammer for the session could be a short-term buying opportunity, but nothing more than that. It is not until we clear the 119 handle that I feel comfortable buying and holding onto this market. A break down below the bottom of a hammer would be catastrophic.

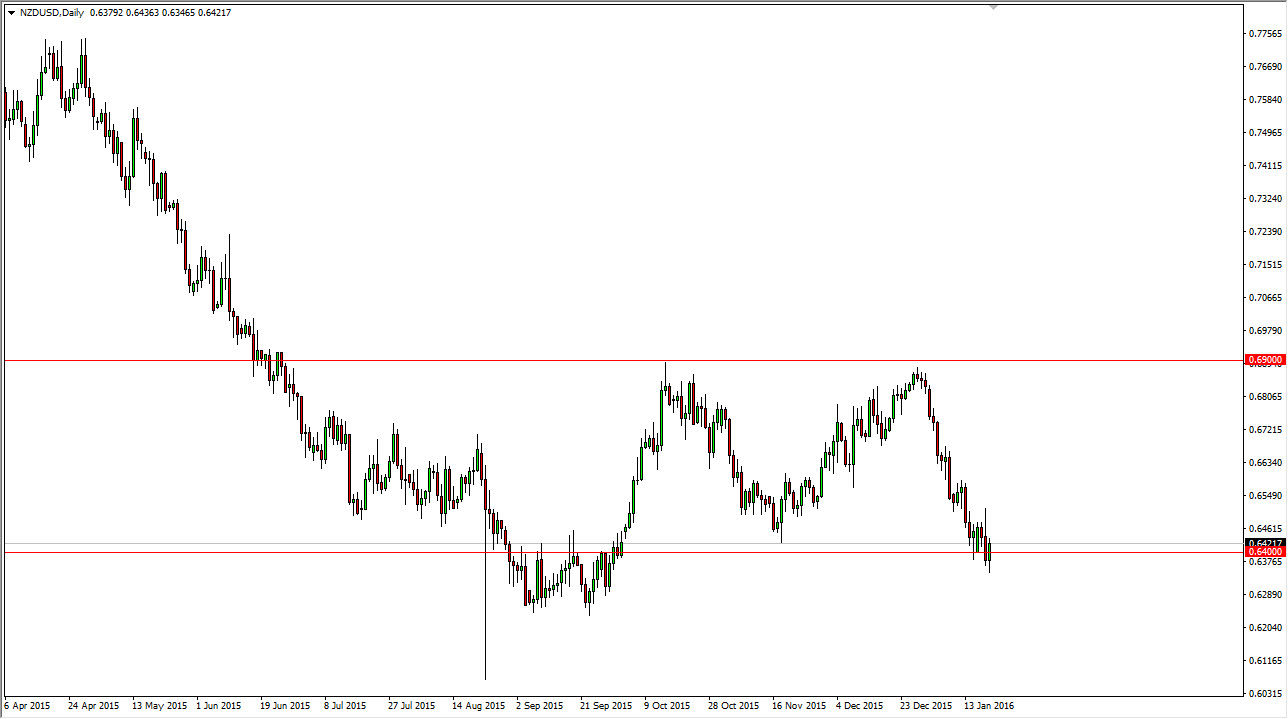

NZD/USD

The NZD/USD pair initially tried to fall during the course of the session on Wednesday, but found enough support below to turn things back around and jump back over the 0.64 handle. This is significant as there is quite a bit of support in the region of the 0.64 level, and that could lead the market to test the 0.65 handle again. If we can break above there, then I believe we could bounce a bit, perhaps a handle or two.

In the meantime, I would anticipate that this market will be very volatile simply because the New Zealand dollar is so highly leveraged to the commodity markets overall. I do not believe that the market will continue to go higher for any real length of time, and at best we are looking for the 0.69 level above. At this point in time though, you have to keep in mind that there is a lot of risk aversion out there, so it’s only going to take a couple of negative headlines to scare people away from the New Zealand dollar in my opinion.