USD/CHF Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

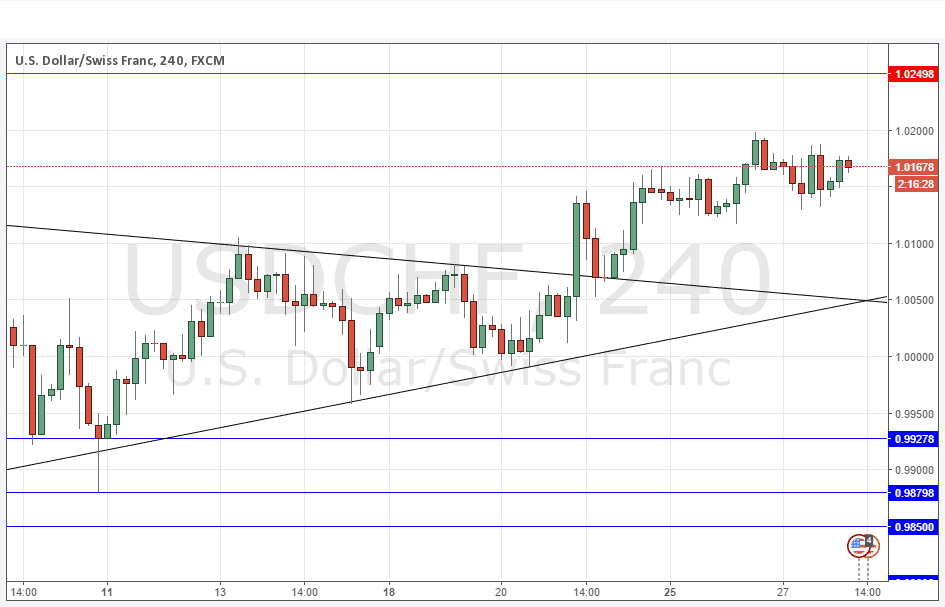

* Long entry after bullish price action on the H1 time frame following a first touch of the bullish trend line currently sitting at around 1.0055.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following a touch of 1.0250.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair is somewhat bullish and is in a long-term bullish trend but it is finding it difficult to really go anywhere at the moment. Additionally, there are no clear support or resistance levels anywhere near the price at the moment, with the exception of possible minor resistance at 1.0200, but the big level would seem to be at 1.0250. Below, there is no obvious support for more than 100 pips. The action overall is rather restrained with not a lot of movement. Nevertheless, this pair can surprise with sudden strong moves and that might happen here. Otherwise, it is looking very hard to trade at the moment, although it would make sense to maintain a bullish bias for the time being.

Concerning the USD, there will be releases of Core Durable Goods Orders and Unemployment Claims data at 1:30pm London time. There is nothing due regarding the CHF.