USD/CHF Signal Update

Yesterday’s signals were not triggered as the bearish price action occurred above 1.0091.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time.

Protect any open trades before 6:30pm.

Long Trade 1

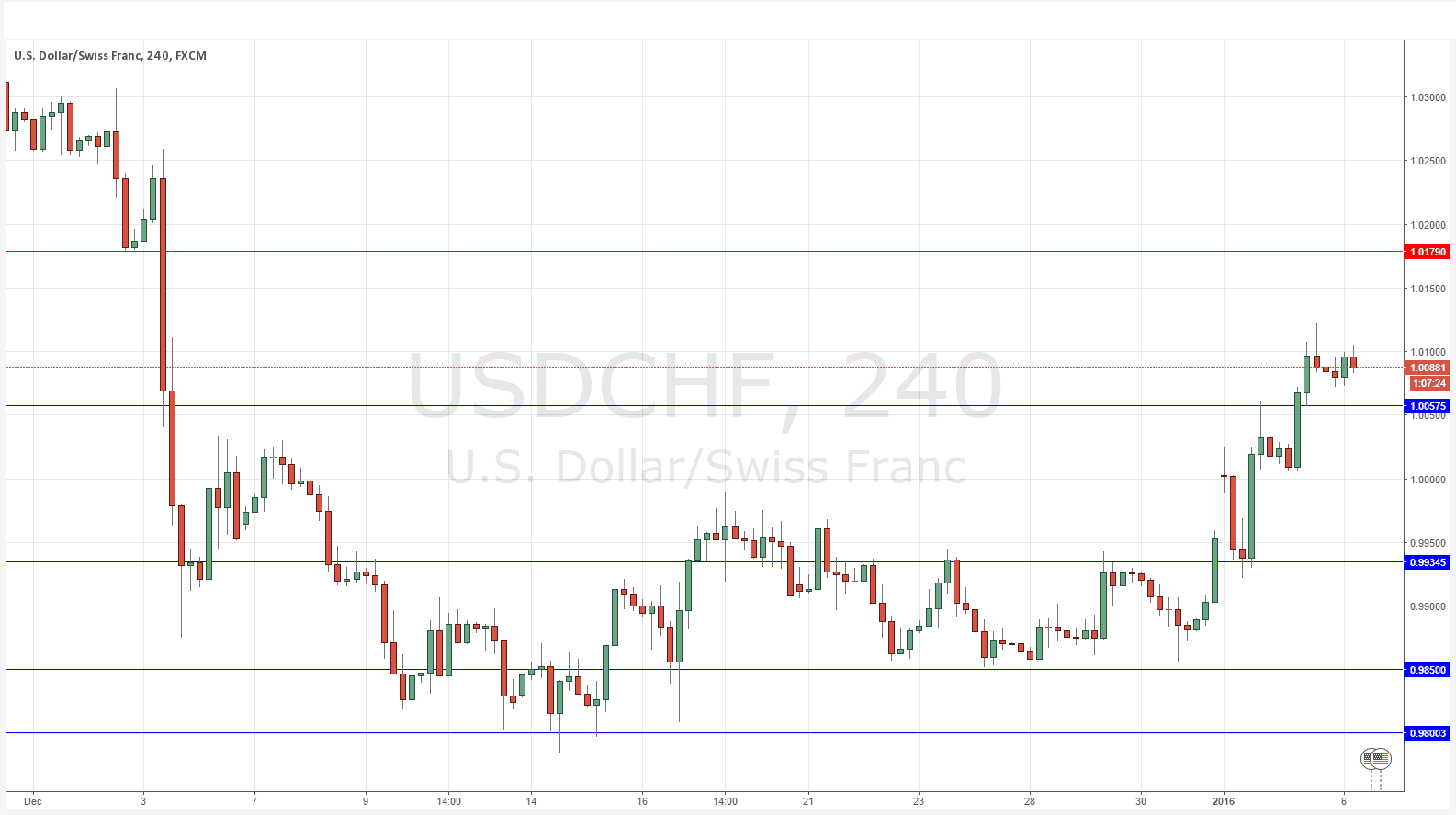

* Go long after bullish price action on the H1 time frame following a first touch of 1.0057.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 1.0179.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I forecasted yesterday that we were going to reach 1.0091 and I would want to see that rejected convincingly before looking to take any short trades. This turned out to be correct and the right course of action as the USD continues to strengthen. It looks like we are probably a little over-extended now as we approach the FOMC Meeting Minutes release, so the move might slow down considerably over the remainder of the London session and the early part of the New York session. However I do see the area at around 1.0057 as having shown some pivotal properties so a pull back to that price and a bullish bounce could be a good opportunity to get long. We are very unlikely to reach 1.1079 before the London Close but if we do it should be resistant.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of the ADP Non-Farm Employment change at 1:15pm London time, followed by Trade Balance data at 1:30pm and ISM Non-Manufacturing PMI data at 3pm. Finally there will be a release of the FOMC Meeting Minutes at 7pm.